From pv magazine 03/2021

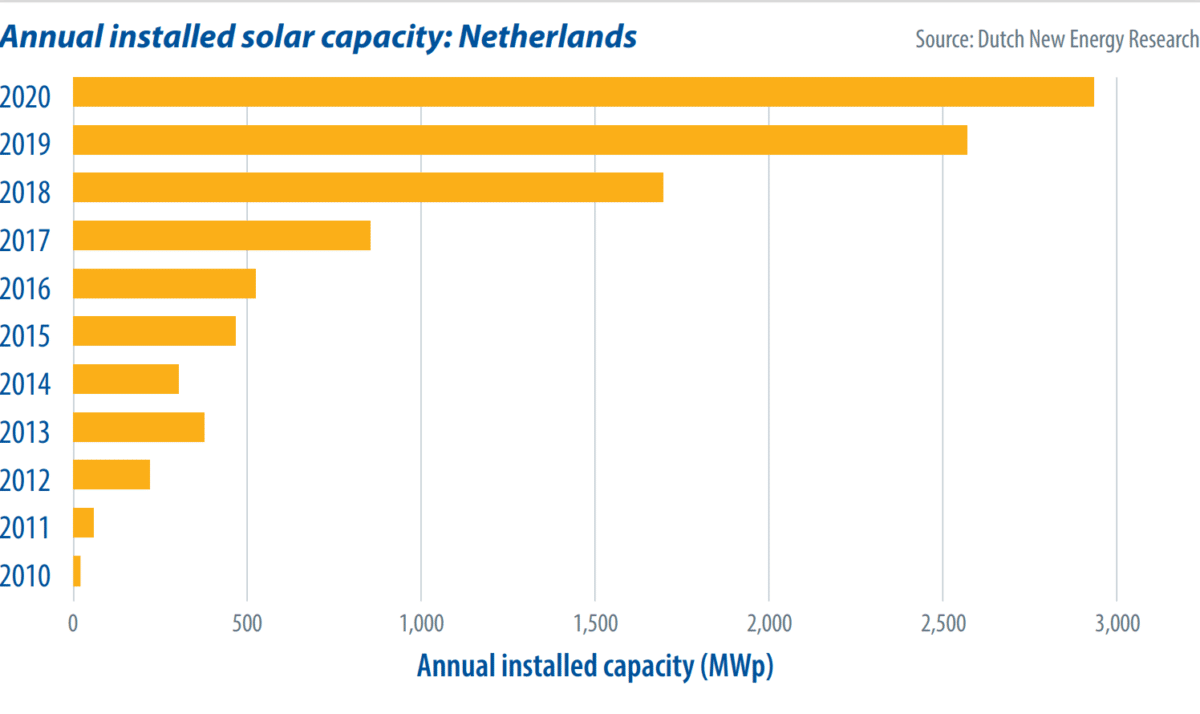

So how is it possible then, that this small country is close to surpassing Germany’s annual solar installations of 4.88 GW in 2020, and is even approaching a second milestone of installed PV capacity relative to its number of inhabitants? Even during the Covid-19 pandemic, the Dutch solar market grew by 14%. In 2019, almost 2.6 GW were installed and in 2020 just short of 3 GW were added – bringing total installed capacity in the Netherlands to 10 GW.

10 GW solar capacity in the Netherlands makes its annual share in the nation’s electricity mix 6.6%, but during the long summer days, solar’s share can come close to 100%.

Residential segment

The Netherlands is one of the few strong residential markets in Europe. Although many countries have favorable policies in place for the residential segment, Holland can be considered a forerunner, passing the threshold of 1 GW of new capacity last year, and has shown year on year growth of more than 20%.

This strong residential market is primarily due to the country’s net-metering scheme. The program and tariff levels have kept the payback period around the seven-year mark in recent years.

Net metering has resulted in over one million households, or one in eight, with PV panels installed on their roof. The successful net-metering system was planned to be phased-out between 2023 and 2031. However, in February 2020 the Dutch parliament declared that the phasing-out of net-metering was “controversial”, which means the law will not be brought to a vote until after the elections this month.

As a result of this delay, its implementation in 2023 may not occur. Several organizations continue to lobbyat various levels with an aim to keep the unlimited net-metering system in place over a longer timeframe. For now, this means residential PV is highly likely to continue its growth in coming years.

C&I and utility scale

An astonishing volume of almost 11 GW of unrealized PV-capacity is allocated in the SDE+(+)-feed-in subsidy scheme. Following a revision of this scheme in 2020, it now allows annual applications for an available budget of €5 billion.

With the revision of the scheme, the focus is directed more towards CO2 emissions reduction instead of merely electricity production, and more technologies, like CCS and hydrogen, can apply.

Since 2017 most projects, and between one quarter to half of the available budget, has gone to solar. Under current policy, the SDE++ scheme is expected to fund new capacity for renewable generation until 2025.

Image: Baywa r.e.

In the wake of the pandemic, realization deadlines were postponed for projects funded through the SDE-scheme by twelve months. This gives developers and EPCs somewhat more leeway in their planning and in securing project financing. Despite challenging conditions for project realization, 1.8 GW of new capacity was installed in the commercial sector, and more to come in the upcoming years.

Aside from Covid-19, there are other challenges for large scale projects, which lie in their ability to innovate with regard to grid congestion problems. If companies can uphold their business case by increasing flexibility with, for example, curtailment, demand-response and storage, this will increase a project’s prospects for the future expansion of its PV capacity.

Overall, prospects for the Dutch market are sunny. Firstly, increasing the share of renewable sources in electricity supply are safeguarded by legislation under the climate agreement. Secondly, there is increasing attention to electrification of transport and heating along with backup capacity to ensure demand rising along with the renewable energy supply. Thirdly, increasing focus on interconnectedness suggests a tendency to solve challenges of the energy transition on a European level.

The Netherlands is one of only a few countries in Europe that has thriving and mature markets for both residential and non-residential solar. Although it will probably not surpass Germany this year, it will surely surpass the 3 GW threshold by a wide margin, and with luck may be crowned Europe’s solar champion.

About the author

Rolf Heynen is CEO of Dutch New Energy Research and CTO of Solar Solutions International. DNE Research produces the annual Dutch Solar Trendreport, the Dutch Solar Quarterly market report and the upcoming market reports on Europe: Europe Whitepaper and the Europe Solar Quarterly. Heynen holds degrees in both electrical engineering and political science.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.