From pv magazine 06/2021

It is estimated that by the end of 2021 there will be around 400 GW of mono PERC capacity, doubling the 2020 volume. There will be at least 280 GW of cell capacity, calculating 182 mm and 210 mm cells only. Amid the serious capacity surplus, Tier-1 cell manufacturers could only keep slim profits in the first quarter, with only 1-3% of profit left for mono PERC cells.

Demand growth

PV manufacturers have not changed their target markets. Chinese n-type TOPCon manufacturers mainly target utility-scale projects, but the power output of modules assembled with large p-PERC cells has reached beyond 500 W, outshining n-type, despite its efficiency advantage.Silver prices remain high, hindering the development of HJT cells with higher silver paste consumption. This means slower demand for n-type products.

Non-China n-type module manufacturers, on the other hand, focus on residential and C&I rooftop projects. Outside China, Panasonic withdrew from solar and Maxeon announced PERC cell capacity expansion plans. In a competitive cell market, foreign manufacturers also began to develop strategies for the future. Mature markets including Europe, the U.S., and Japan, where demand is rather stable, will remain the major overseas markets.

The large-scale capacity expansion and economies of scale of p-PERC makes it difficult for n-type to compete. With the rising cost of raw materials and sluggish demand, n-type cell production declines to around 6 GW, and market share slips from 5% in 2020 to 4% this year.

| Comparison of current technologies | |||

| P-type PERC Module | N-type TOPCon Module | N-type HJT Module | |

| Capex ($/1 GW) | CNY 160-220 million ($22 million- 30 million)/1 GW | CNY 250-300 million ($34-41 million)/1 GW | CNY 450 million ($61 million)/1 GW |

| Cell Efficiency | 22.4%-22.8%+ | 23,50% | 24% |

| Mainstream Module Power Output (72 pcs) | 440-445 W(166 mm) | 415-420 W (158.75 mm) | 420-425 W (158.75 mm) |

| 535-540 W (182 mm) | 450-455 W (166 mm) | 465-470 W (166 mm) | |

| Module Price | $0.22-0.24/W | $0.23-0.245/W | $0.25-0.26/W |

| Source: PV InfoLink | |||

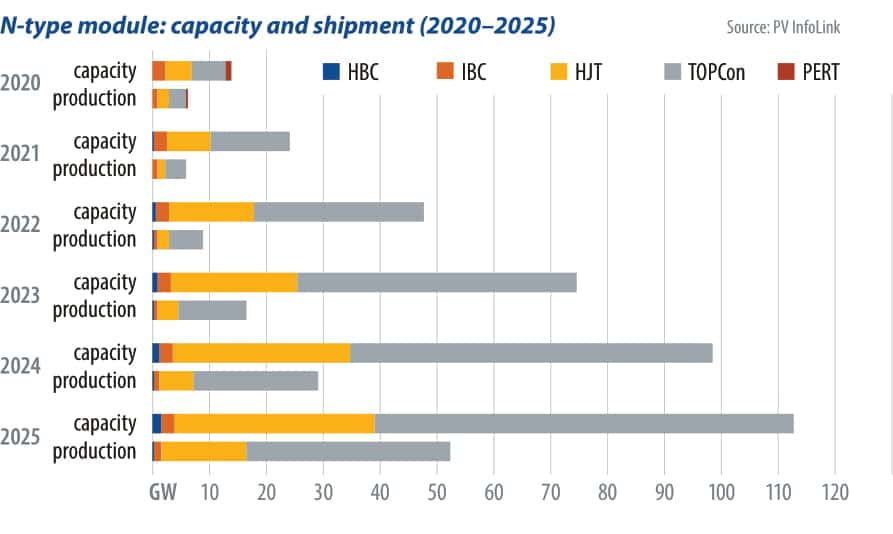

N-type capacity

Orders for n-type products remain low. Manufacturers mainly gear up for n-type technology this year, with capacity significantly higher than production. Having expanded, mono PERC now sees signs of decrease in profitability. Several manufacturers revealed that they will stop adding PERC capacity, as it’s already in surplus. Projects for the second half of the year are mostly n-type technology roadmaps or high-end technology research. It will take a while for n-type technology to reach large-scale commercial production.

Progress by larger manufacturers in 2021 will determine whether n-type can achieve mass production. The industry is watching whether Longi’s TOPCon and Tongwei’s 1 GW HJT capacity expansion projects materialize by early 2022, bringing costs down. Eyes are also on the yield rate of TOPCon and the selection of equipment for these processes.

Equipment capex for TOPCon dropped in 2020 to a level slightly higher than PERC. Taking into account equipment compatibility and the ability to increase cell efficiencies after switching from PERC to TOPCon, many new PERC production lines have been earmarked for upgrade to TOPCon. If TOPCon process can help increase efficiencies of existing cells and stabilize yield rate, real TOPCon capacity and production will exceed HJT. Technically, manufacturers are still choosing between LPCVD and PECVD, and the issue of wraparound polysilicon layer remains to be solved.

HJT processing is simpler and has advantages on yield rate and efficiencies. After introducing light-soaking last year, overall cell efficiencies increased to more than 24%. However, cost reduction remains a bottleneck. With the emergence of Chinese HJT equipment suppliers and their continued optimization, the capex for a 1 GW HJT cell production line has declined to CNY 450 million ($61 million)/GW. In addition to cost reduction through decreased equipment capex, adopting multi-busbars or smart wire interconnection can drive efficiencies up and silver paste consumption down. Meanwhile, R&D in silver pastes continues, hoping for a technical breakthrough with different materials.

High costs put most manufacturers in wait-and-see mode. Except for Tongwei and HuaSun, most capacity expansion projects this year are at pilot scale. Future development depends on whether HJT expansion in the second half can bring down the cost per watt. The depreciation of equipment brings limited cost reduction, after equipment costs declined from an annual CNY 800 million/1 GW last year to this year’s CNY 450 million/ 1 GW. Further cost reduction can only depend on the advancement of silver paste technology, as well as economies of scale. For HJT capacity and production to grow in the long term, HJT must narrow the gap of costs with p-type.

Continuous progress

TOPCon and HJT both see continuous progress in cost control and efficiencies. The two are projected to see expansion in capacity and production in the next one to three years. However, TOPCon has advantages over HJT in order volume and capacity expansion, as it is easier to be upgraded from PERC. As a result, TOPCon will outpace HJT in terms of capacity and production in the short term. If costs for equipment and silver paste can decrease continuously while production volume increases, HJT will have more room for cost reduction for each high-cost material. Moreover, as HJT cell efficiencies continue to improve, its capacity and production will grow long term.

TOPCon and HJT face challenges in the large wafer transition. While 182 mm and 210 mm will become the mainstream format for p-type in the second half of the year, it remains a barrier for n-type to overcome stability issues using large wafers. If n-type cells made with large wafers can go into mass production in the next two years, costs will fall immediately.

Mono PERC is showing signs of decline after large-scale expansion, so it becomes increasingly important to prepare for next-generation technologies. But as it will take time for n-type to reach commercial production, large manufacturers’ materialization of capacity expansion projects, the degree of cost reduction, mass production efficiency, as well as yield rate control, 2021 and 2022 will be a key period for the evaluation of manufacturers.

About the author

Amy Fang focuses on research and analysis of the solar cell segment of the supply chain. She supports PV InfoLink in producing market trend analysis and works across price forecast and production capacity data services. Fang continues to contribute to solar cell technology research efforts, analysis of market trends, and timely market information.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.