The supply of indium for the production of copper, indium, gallium and selenium (CIGS) thin-film solar cells and modules in Europe could be provided exclusively by an EU supply chain and would not pose environmental issues, according to a white paper that was recently published by a group of researchers specializing in the development of this thin-film PV technology.

The association says the European Union recognized the beneficial impact indium can have in a list of critical raw materials that was published last year. The organization considered its use in PV cells and batteries to enable low-carbon energy solutions in the EU economy.

Indium is not a limiting factor for large-scale deployment of CIGS technology, Daniel Lincot and Ayodhya Tiwari, the spokespeople for the research group, told pv magazine.

“The value and actor chains for CIGS are very favorable for this, in particular in Europe,” said Lincot. “Indium production is sufficient for more than 100 GW per year PV production with the potential to meet terawatt challenges in a cost-effective manner.”

Tiwari is also the head of the Laboratory for Thin Films and Photovoltaics at Switzerland’s Federal Laboratories for Materials Science and Technology (EMPA) and the founder of Switzerland-based thin-film module manufacturer Flisom. Lincot is the research director at the French National Centre for Scientific Research and the former scientific director of the L'Institut Photovoltaique d'Ile-de-France (IPVF).

Efficiency gains

The researchers said the indium content per gigawatt of modules, currently about 15 tons, can be reduced to several hundred kilograms, or even lower.

“The case of indium is an excellent example of the wrong perception of abundance or criticality concepts when applied to a given technology, which could destroy its development if not used properly,” Lincot explained. “In fact, an element can shift from rare to ‘sufficiently' abundant, depending on the quantities which are used for producing the same amount of energy.”

In his view, with 15 tons of indium per gigawatt, up to 20 GW of indium can be produced per year throughout the world, with only 30% of available refinery production.

“The rise toward 100 GW and more would be possible with extracting systematically indium from zinc refining, going to thinner films or tandems, as described in the white paper,” he said. “Moreover, there are many routes available for even further reducing the indium content in the modules, by reducing the thickness, increasing further the efficiency, going to tandems and also to concentration with microcells.”

He said that the issue of abundance and the criticality of elements should be examined based on facts. He added that it is important to ramp up R&D support for CIGS photovoltaics to further capitalize on the potential of the technology to support net-zero carbon emission targets via applications in buildings, transport, and other areas.

“In this context, lightweight flexible CIGS modules offer great opportunities,” Lincot said.

The authors of the white paper claim that current prospects for CIGS technology are high.

“The technology has experienced a continuous improvement of the efficiency,” said Lincot, in reference to the 23.35% record efficiency rating achieved by Japanese manufacturer Solar Frontier for a CIGS solar cell and the recent 19.64% efficiency level recorded for a CIGS module by German thin-film module maker Avancis.

These and other recent signs of progress are made by new processes, like alkali addition, and also by alloying the absorber layer. “So, the current prospects for CIGS at the efficiency level are high with expectations to reach 25% in the coming years,” Lincot said. “Bandgap tunability, from over 2 electron volts (eV) with sulfur alloying to a low value of 1 eV with pure selenide, with this class of materials opens unique opportunities for more than 30% efficiency tandem solar modules in coming years and several labs are working in this direction.”

CdTe comparison

To date, it remains unclear whether CIGS will be able to follow the same path of cadmium-telluride (CdTe) thin-film PV technology, which has seen the creation of a gigawatt-scale industry over the past two decades.

“In the case of CdTe, there is one dominant player, First Solar, which has a strong strategy and has been able to successfully integrate the signs of progress at the research level into the production plant and solve very strong problems as the back contact stability and gained efficiency improvements with optimized device composition,” Tiwari explained. “By this way, it succeeded to reach 19% record module while commercial large area modules are at 18.2%, with production up to 6.2 GW in 2020 from 2.6 GW in 2018.”

High efficiency levels for large-scale production, he said, are key to allowing successful competition in the mainstream market for glass substrates with low costs and specific advantages like better efficiency in hot and humid climates, due to a higher bandgap.

“For CIGS the competitiveness of modules on glass is more difficult since the commercial module efficiencies of the leader company are still lower, while demonstrating successfully the GW production scale capability,” Lincot said. “For the other companies with smaller volumes, at the level of tens to several hundreds of megawatts, the cost issue is even more pronounced since they do no benefit from scale effect.”

However, this impact may be triggered by the record module efficiency of 19.6% achieved by Avancis. Thiw could open up new perspectives if it or other companies are able to translate this value for commercial modules.

Nevertheless, the competition with silicon technologies for glass substrates is difficult, according to both experts. The opportunity for the CIGS is raising for high efficiency flexible and lightweight modules, as crystalline silicon, CdTe and organic PV are not strong competitors in this segment.

“Low production volume remains a concern for increasing the competitiveness in the mainstream market while plenty of niche markets are available for flexible lightweight modules,” Lincot said.

Record efficiencies of up to 20.8% achieved by EMPA for flexible cells and 17% in commercial modules from U.S.-based Miasolé on steel foils are presently opening this avenue.

On top of the scale effect and efficiency improvements at the module level, some simplification of manufacturing processes is expected to take place in the future.

“The cost prospect for CIGS as a thin film industry has inherent advantages in terms of cost as compared to slicing and assembling wafers,” Tiwari said. “First solar is already demonstrating the competitiveness of thin films at this regard.”

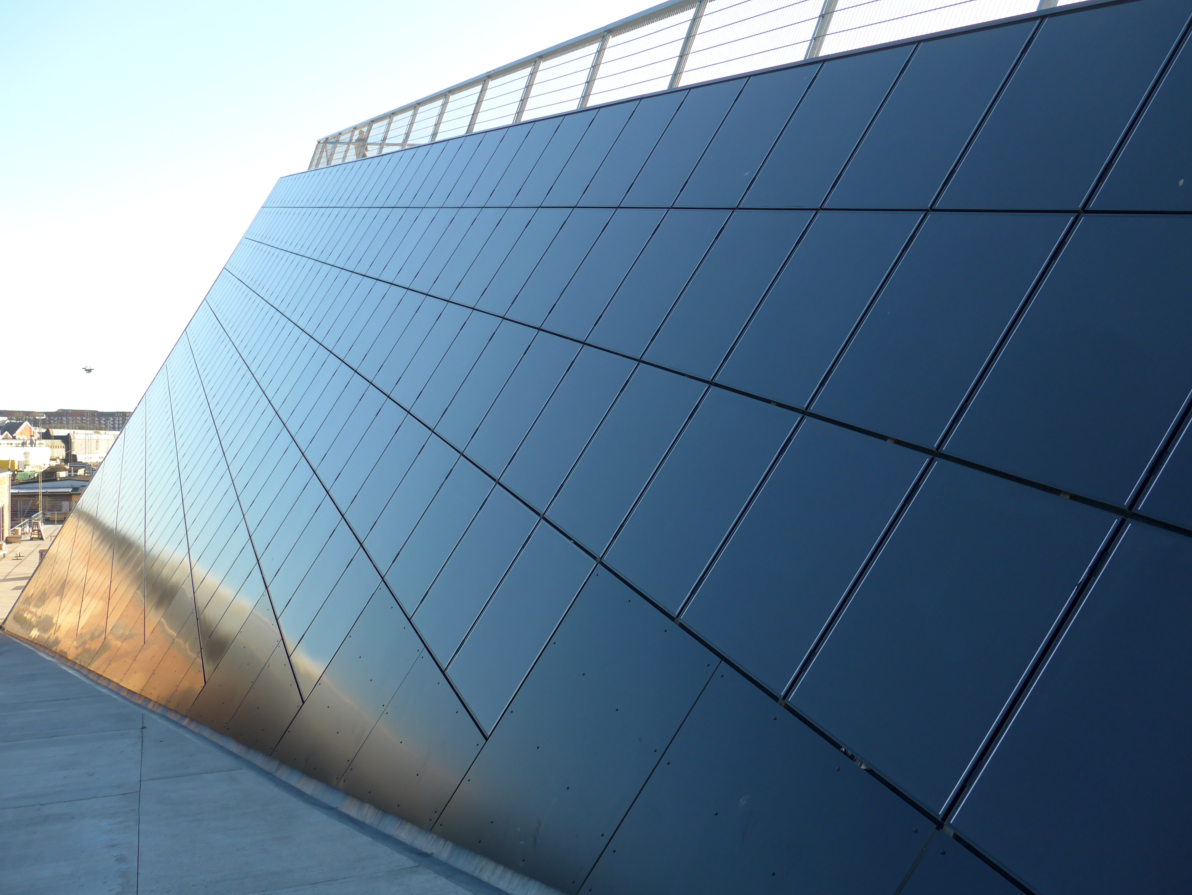

He said CIGS technology can follow the same trends for lower costs with advancements in manufacturing equipment and higher production volume, especially for building-integrated photovoltaics (BIPV). This market could reach 20 GW per year over the next few years and raise to hundreds of gigawatts in the by 2030.

“The need for lightweight high-efficiency modules is important for fragile roofs and facades,” Lincot explained. “However the CIGS markets are much broader, beyond BIPV, in particular for agrivoltaics, floating PV, autonomous PV and also seasonal PV with retractable units which can cover temporarily the land during summer.”

CIGS solar cells, on the other hand, can also be used for tandem applications in mainstream markets, for 30% efficiency modules, either with silicon for wide bandgap CIGS as top cell or perovskites as low bandgap bottom cells.

“CIGS technology can thus become a key component of next generations of silicon solar cells,” Lincot said. “This development which was unexpected a few years ago may become a reality within a few years with a key advantage that CIGS and silicon are already commercial technologies.”

On the other hand, CIGS-perovskite tandem cells are opening up possibilities for ultra-high efficiency lightweight flexible modules beyond the excellent results already obtained with CIGS cells alone, he added.

R&D outlook

The research on CIGS is still at a very high level and widely distributed internationally, according to the two scientists. Historically, Europe has been and remains a key actor in CIGS R&D. In view of the new market developments for the CIGS technologies, there is a need to reinforce industrial strength through more R&D.

“For this, we have to extend research studies towards low bandgap CIGS solar cells for bottom cells and toward wide-bandgap for top cells, with silicon in particular, beyond the historical trend to focus on highly performing standard composition with the intermediate bandgap adapted for single-junction optimization,” Tiwari said. “Collaborative R&D and adequate funding support in consistent manner is essential, especially the role of EU programs is extremely important.”

There are many studies about the life cycle assessment (LCA) analysis of CIGS technology. The scientists claim this shows that environmental concerns are very low, as the solar cells are composed of chemical elements with low toxicity

“The only concern is about the presence of a minimal amount of cadmium which is used in the form of a very thin cadmium sulfide (CdS) interfacial buffer layer,” Lincot said. “This is a small amount and modules are well encapsulated and protected which minimizes the risk, allowing their utilization.”

However, alternative cadmium-free buffer layers have already demonstrated high-efficiency devices, including the record solar cell produced by Solar Frontier and all its gigawatt-scale production, making already CIGS a cadmium-free technology. This, according to the two experts, gives CIGS technology a supplementary advantage for its environmental acceptance.

“In view of the potential of the CIGS PV technology for contributing to the zero carbon emission objectives, it was important and timely to address the question of indium availability,” Lincot concluded. “The investigation suggests that it is not a blocking factor as often considered. The aim of this white paper initiative was to assess the potential of CIGS technology and its role in terawatt PV production in the future.”

The signers of the white paper are: Daniel Lincot, CNRS-IPVF (France); Jean-Francois Guillemoles, CNRS-IPVF (France); Ayodhya N. Tiwari, EMPA (Switzerland); Marcus Bär, HZB (Germany); Bart Vermang, IMEC (Belgium); Maïté Le Gleuher, BRGM (France); Roland Scheer, University Halle-Wittenberg (Germany); Vasilis M. Fthenakis, Columbia University (USA); Michael Powalla, ZSW (Germany); Wolfram Witte, ZSW (Germany); Sascha Sadewasser, INL (Portugal); Marika Edoff, Uppsala University (Sweden); Susanne Siebentritt, University of Luxembourg (Luxembourg); Thomas Weiss, University of Luxembourg (Luxembourg); and Hans Werner Schock, formerly at HZB (Germany).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

9 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.