From pv magazine USA

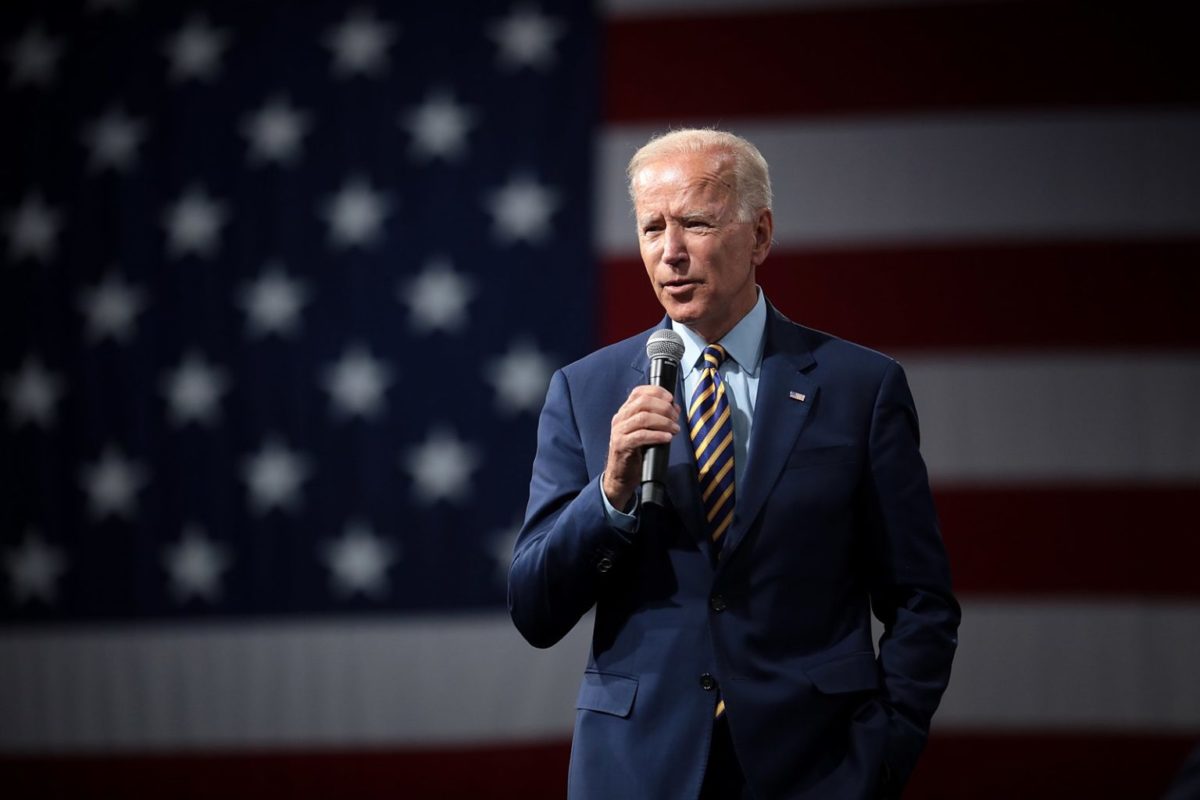

The Biden administration is preparing to announce a 24-month tariff exemption on solar modules manufactured in Cambodia, Malaysia, Thailand and Vietnam, according to reports first announced by Reuters.

The move comes as a direct response to the industry-wide uncertainty that has unfolded since the Department of Commerce’s (DOC) March 28 announcement that it would act on a petition filed by California-based solar module manufacturer Auxin Solar requesting that DOC review solar panel imports from Chinese companies working in Cambodia, Malaysia, Thailand and Vietnam, announcing that it is launching an antidumping investigation into those companies.

According to reports, alongside the moratorium on new tariffs, President Biden will invoke the Defense Production Act as a means to accelerate American manufacturing across the solar supply chain and alleviate overall dependency on imported PV hardware and materials. Reports indicate that the goal of invoking the act is to raise domestic solar manufacturing capacity to 22.5 GW by 2024.

Enacted in 1950, the Defense Production Act allows the President to direct private companies to prioritize orders from the federal government and allocate materials, services, and facilities for the purpose of national defense. The order has been invoked twice since the beginning of 2020, once by then-President Donald Trump and again by Biden, in response to the Covid-19 pandemic.

Invoking the Act will not end the DOC investigation, which is expected to continue, meaning that tariffs could still be imposed after the moratorium, depending on DOC’s ruling. However, according to Reuter’s unnamed source, the impending action would eliminate the possible imposition of retroactive tariff collection, which could have gone as far back as the date of Auxin Solar’s initial petition filing.

Immediate impact

In the months that followed the announcement of the investigation, the Solar Energy Industries Association (SEIA) lowered its solar installation forecasts for 2022 and 2023 by 46%, predicting that the case would result in a drop of 24 GW of planned solar capacity over the next two years, more solar than the industry installed in all of 2021.

Developers across the U.S. have already felt the sting of the investigation, which has frozen module imports and left solar projects in development and construction limbo, with some partially-constructed projects sitting idle in the field, waiting for modules.

According to the most recent publication of SEIA’s investigation impact survey, with over 700 responses current to April 26, 83% of respondents who purchase or use modules reported cancellations or delays in their module supply agreements. 13 states had 100% of respondents share that they were experiencing delayed or canceled module supply.

Based on voluntary reporting, responses have outlined to SEIA that a total of 318 utility scale projects accounting for 51 GW of solar capacity and 6 GWh of attached battery storage are being canceled or delayed. What’s more is that a large percentage of delayed projects could move into the realm of cancelation, as developers don’t know when they might be able to get modules and some delays may drag on to the point of project failure.

Popular content

With respondent data from 39 states, all but two of those states are reporting utility-scale project cancellations and delays above 100 MW in capacity. SEIA shares that these figures also likely only represent a fraction of the investigation’s true impacts. Across the US as a whole, 42% of the known utility scale solar development pipeline has been disrupted. Indiana and Idaho both reported 100% of each state’s known pipeline being disrupted.

With such capacity lost, SEIA estimated that the United States would emit an additional 364 million metric tons of carbon by 2035, missing the opportunity to effectively take 78 million internal combustion-engine vehicles off the road.

Those predictions are based on assumptions of an affirmative decision on the investigation, with tariffs imposed in the 50% to 250% range; sharply restricted module import supply from countries named in the investigation, with manufacturers in non-named countries needing time to pick up the slack; and the updated results of the impact survey.

Cambodia, Malaysia, Thailand and Vietnam currently account for roughly 80% of U.S. module imports.

External pressure

Since the announcement of the investigation, the Biden Administration has been stuck between a rock and a hard place, pitting Biden’s goals of decarbonizing the U.S. power grid by 2035 and cutting national greenhouse gas emissions by 50% to 52% by 2030, versus 2005 levels, against existing political pressure to stand against Chinese economic practices and product dependance.

Both DOC and the Biden admin have been flooded with pleas from renewable energy advocates and politicians alike to abandon the probe. So far, 22 Senators and 19 state governors have officially called on DOC to deliver an expedited and negative preliminary decision.

On the other end of the spectrum, on May 26, US Senators Sherrod Brown (D-OH) and Bob Casey (D-PA), along with US Representative Marcy Kaptur (D-OH-9), sent a letter to President Biden expressing their support for the continued investigation.

The investigation was also expected to lead to the loss of 100,000 jobs across the solar industry, according to SEIA president and CEO Abigail Ross Hopper. It’s important to clarify that the figure of 100,000 jobs lost also includes new jobs not added, though SEIA asserts that the vast majority would be layoffs of existing workers. 16,000 to 18,000 solar manufacturing jobs would be not realized between 2022-2023 due to the imposition of tariffs, the majority of which would be layoffs. For context, roughly 31,000 people were employed in solar manufacturing in 2020, the most recent year for which survey data is available.

pv magazine will continue to update this story as it develops.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I’m so glad I came upon this in my research on the subject.