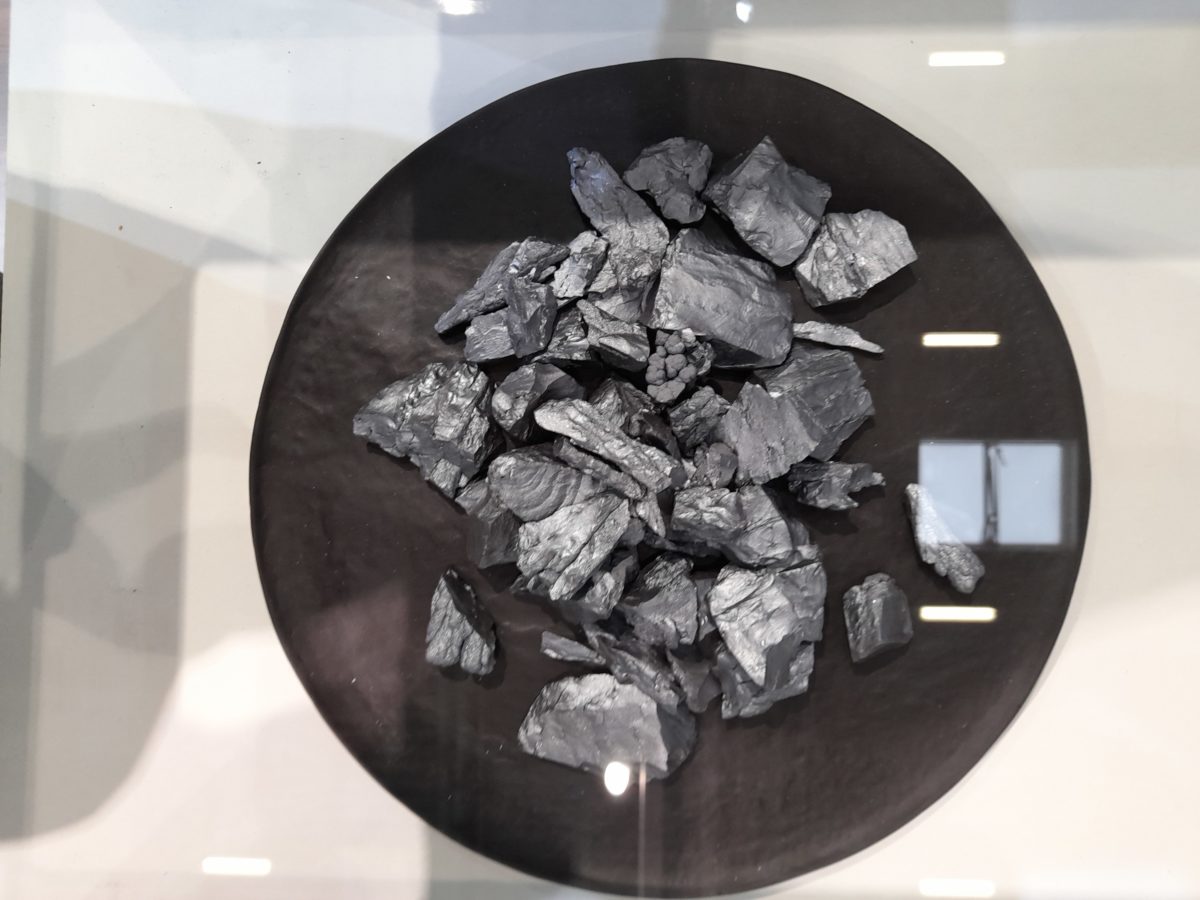

The CSRC has authorized the trading of industrial silicon futures on the Guangzhou Futures Exchange. It said it aims to improve the pricing mechanism for industrial silicon, and claimed that the move would improve the risk-management capabilities of various market entities.

Johannes Bernreuter, a polysilicon analyst, said that the introduction of industrial silicon future appears to be a reaction to the surge in silicon metal prices in the third quarter of 2021.

“Probably, this will give polysilicon manufacturers the opportunity to hedge against fluctuating silicon metal prices,” Bernreuter told pv magazine.

However, he noted that polysilicon prices have already stabilized at high levels.

“This will only be the usual seasonal drop at year end,” he said. “As to forecasts of a stronger decrease, we remain cautious for the first half of 2023.”

In late November, PV InfoLink said that polysilicon prices are on a “distinctive downward” trend, following months of high prices. It said it expects prices to fall significantly from the end of November into early December.

“Unhealthy inventory will persist in the polysilicon sector until the end of the month,” said the consulting firm, noting that it expects to see the first decline in polysilicon inventory in two years.

In October, PV InfoLink predicted that prices would fall from around CNY 300 ($41.85)/kg, excluding VAT, and to less than CNY 150/kg by the end of 2023.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.