Going back as far as 2018, PV manufacturers began to explore wafer formats larger than the standard 156 mm as a route to optimizing production and lowering project costs. This brought about a big jump in module power ratings, but left behind uncertainty as to the optimal design. Today the market is split between two sizes, 182 mm and 210 mm.

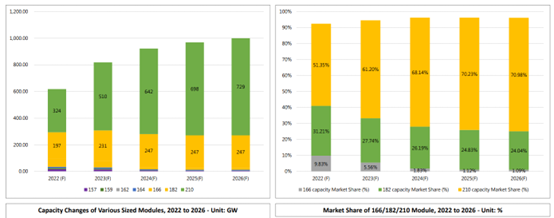

Most major module producers have already chosen one or the other, and both formats will likely be widely available for the next few years at least. Promoters of both formats have claimed advantages in performance, durability, ease of installation, and other areas. For now it is not clear whether one or the other will pull away in terms of market share, though analysts including TrendForce expect the larger 210mm products gradually increase their share, representing more than 70% of the market by 2026.

Alongside this shift, in 2023 manufacturers are also moving from p-type to n-type cell designs, with tunnel oxide passivated contact (TOPCon) cells expected to take a sizeable chunk of the market away from the p-type passivated emitter rear cell (PERC) designs that currently dominate. Trina Solar emerged as an early backer of the 210 mm format, and is also working on converting most of its production capacity to make TOPCon products.

N-type advantage

In a new whitepaper, Trina demonstrates that benefits it had previously shown for the 210mm format in p-type products also broadly apply to TOPCon modules. Data from a demonstration project in China shows that n-type products achieve a higher energy yield, while calculations for projects in Latin America and the Middle East show that the 210mm cell promises lower project costs compared to n-type modules using the 182 mm cell size.

Trina says it brought its n-type demonstration project online in 2016, a 5 MW installation in China’s Jiangsu province. N-type modules at the site have consistently outperformed p-type modules installed for comparison, with annual data showing the n-type products generated 3.79% more energy per kilowatt-peak in 2020, and 3.12% more in 2021.

The paper also demonstrates how Trina’s 210mm, TOPCon products add up to savings in project cost. Taking a distributed project located in Dubai as an example, Trina presents calculations showing that the 210mm modules reach the same capacity of 4 MW (ac) with fewer strings, fewer modules and fewer tracker units. This adds up to a 2.84% reduction in balance-of-system costs compared to a 182 mm n-type module. Trina also references a 100 MW project in Brazil, where it’s modules pencil out to a 2.44% reduction in project investment cost, and a 2.97% reduction in levelized cost of electricity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.