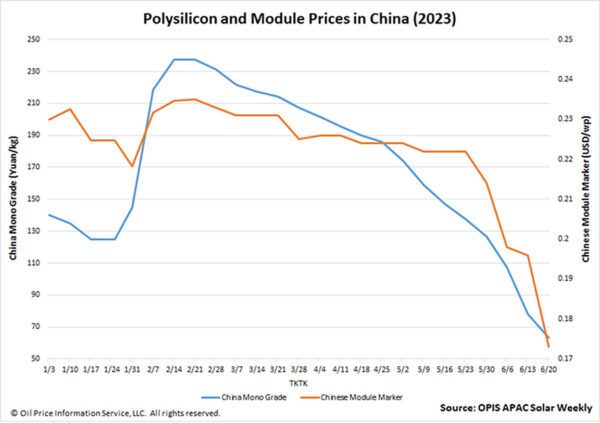

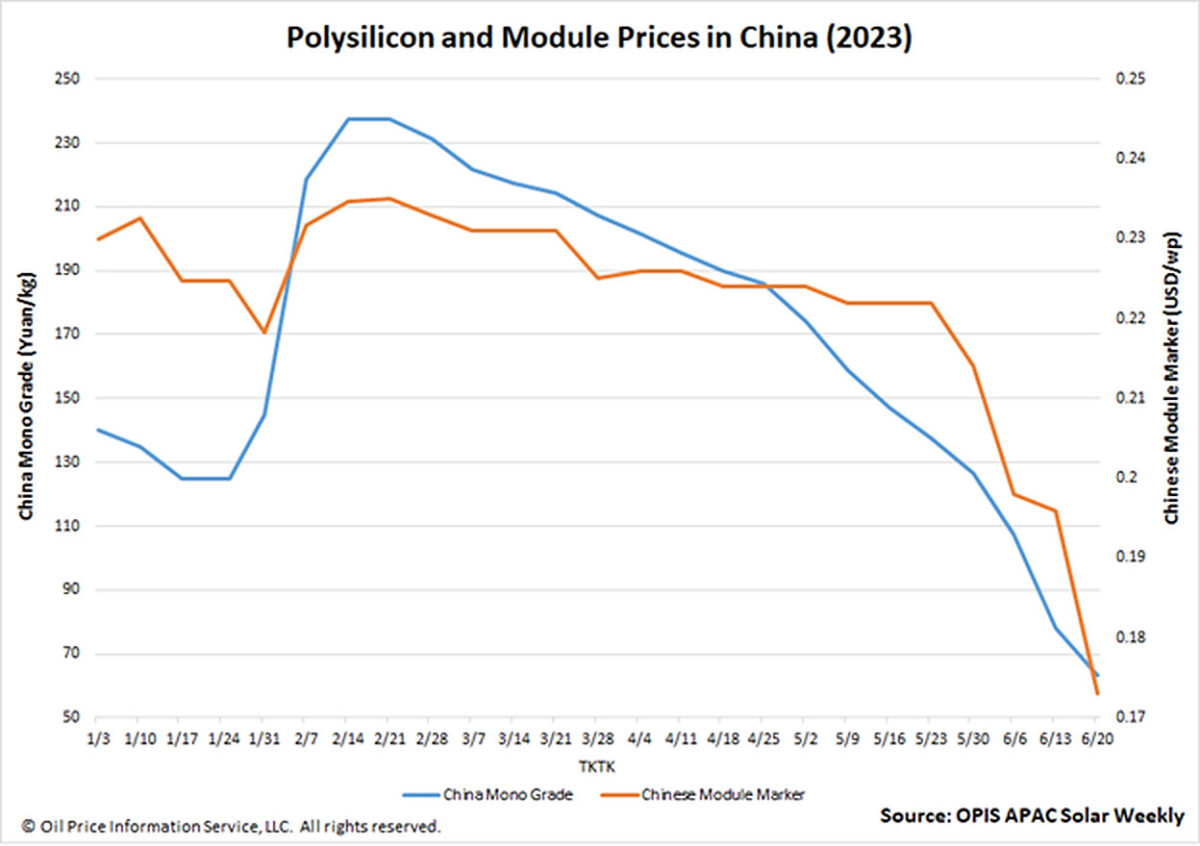

The Chinese Module Marker (CMM), OPIS’ benchmark assessment for modules from China, dived to $0.173 per W, falling for a fourth week running to its lowest value ever according to OPIS data. In the aftermath of Intersolar Europe, the market must reckon with clear signals that the region is oversupplied with modules, as well as how China polysilicon prices upstream are very close to their floor.

The 11.73% week-on-week plunge is also record-breaking in being CMM’s largest percentage drop ever.

It comes as OPIS contacts, during and since Intersolar, have almost unanimously highlighted that prices are falling fast and hard. The majority saw prices in the $0.170-0.175/W range, with numbers as low as $0.150/W heard. Some did not share prices as they assessed the degree of the drop.

With a similar unanimity, market players also lamented the overstocked state of Europe’s module inventories, which face falling values and which curtail further shipments. Europe installed a record 46.1 GW of solar power in 2022, according to a SolarPower Europe report. But around 85 GW of modules were shipped there last year, with the remainder ending up in warehouses owned by Chinese companies across Europe, according to a veteran market observer.

Given these modules represent 2022’s much-higher-than-present prices, it is better to get them sold now, before prices fall further and companies risk losing even more, the veteran added.

A continent away from Europe, China polysilicon prices have plummeted to CNY63.5 ($8.84)/kg, on the threshold of the CNY60/kg figure OPIS contacts generally consider the material’s cost figure. It is a “common consensus” that this market now faces overcapacity, said one source, who added that China’s tier-1 manufacturers alone have more than 100,000 MT of polysilicon stockpiled.

Looking ahead and in light of these bearish factors, module prices are expected to keep sliding, with one source expecting them to stabilize in the next quarter after the polysilicon and wafer segments have hit their cash cost.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Thanks for writing this!