From pv magazine USA

Suniva has announced plans to restart solar cell manufacturing, after years of lobbying to restrict global solar panel imports into the United States.

Remarkably, it did not resume production even after succeeding in securing tariffs in February 2018. Nor did it make any moves during the record-breaking years of 2020 and 2021 for solar deployment. But in 2023, the company finally broke its silence.

“The Inflation Reduction Act [IRA] and its domestic content provisions, as issued, provide a strong foundation for continued solar cell technology development and manufacturing in the United States,” Suniva CEO Cristiano Amoruso said in a press release.

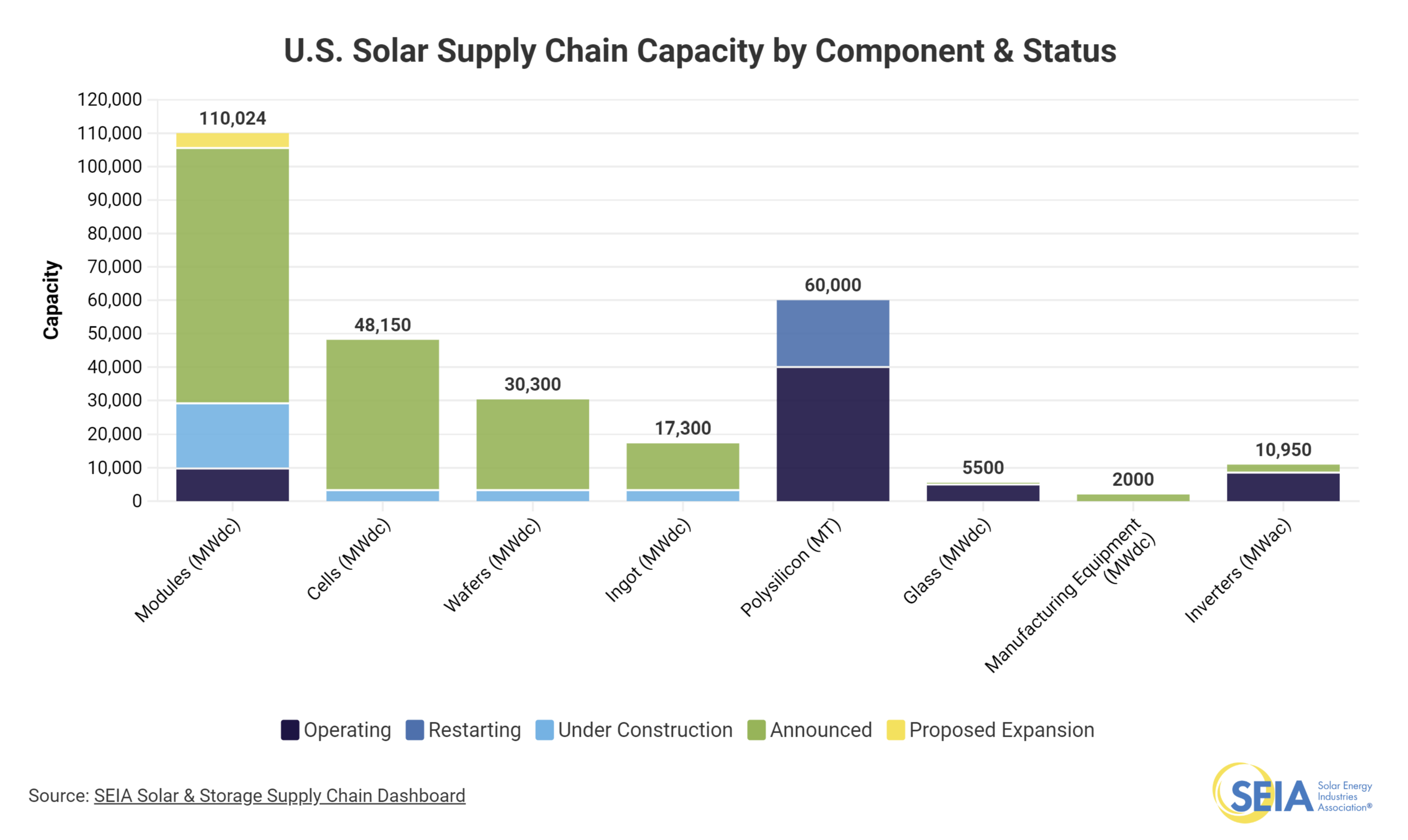

Suniva plans to reactivate and expand its facility in Norcross, Georgia. It aims to kick off production by spring 2024 with a 1 GW capacity, eventually scaling up to 2.5 GW per year. Earlier this year, Suniva secured $110 million in financing from Orion Infrastructure Capital, which also partnered with Heliene for a $170 million manufacturing expansion.

Although the IRA appears to have fueled the current US solar manufacturing boom, it’s not the only factor. Existing tariffs, and import restrictions, have inflated prices in the domestic solar module market. However, historical data provides valuable context.

Despite past tariffs, the US solar market expanded. The tariffs first imposed in 2012 and 2014 by the Obama administration aimed to counter economic espionage by Chinese military hackers against SolarWorld, the theft of monoPERC technology, and the dumping of solar cells.

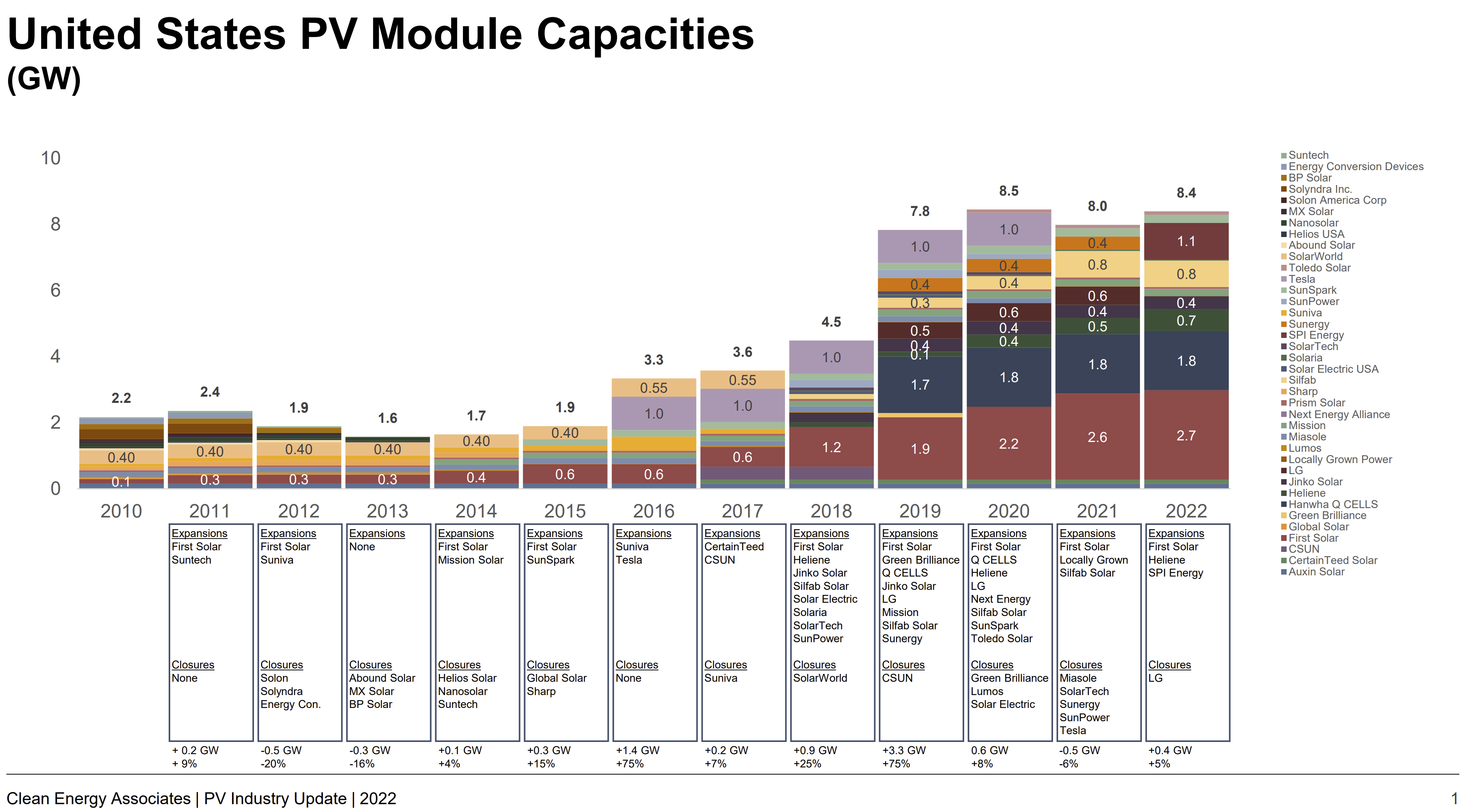

According to data from Clean Energy Associates, US solar manufacturing continued to decline after tariffs were introduced, but saw a modest uptick later. Peaking in 2019, 19.8% of all US solar installations used domestically produced modules, according to the Coalition for a Prosperous America.

In that year, the United States deployed 13.3 GW of solar panels, with about 2.6 GW sourced from domestic manufacturers that had approximately 8 GW of available capacity. However, in the following two years, as the US market rebounded and set annual records, the share of modules manufactured domestically started to decline relative to the total number of modules installed.

To continue reading, please visit our pv magazine USA website.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.