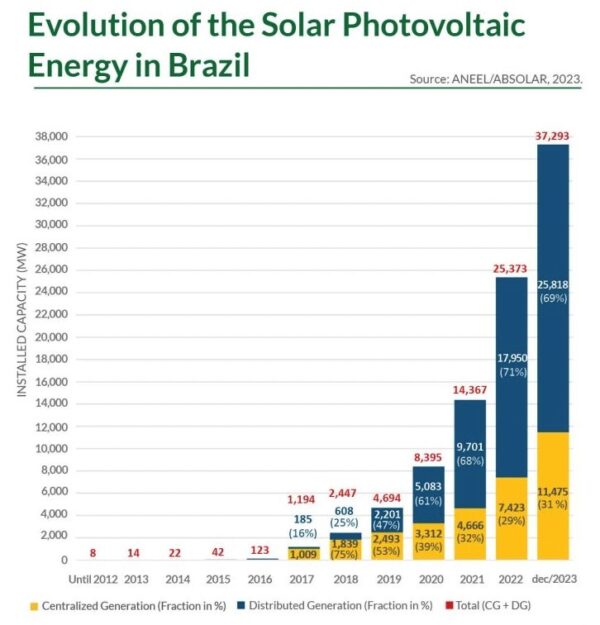

In 2023, PV uptake in Brazil grew at a rate of more than 1 GW per month (70% of that rooftop PV), and the cumulative installed PV capacity reached over 37 GW. The deployment rate is 60 W per person per year and is fast enough to double the installed capacity every two years.

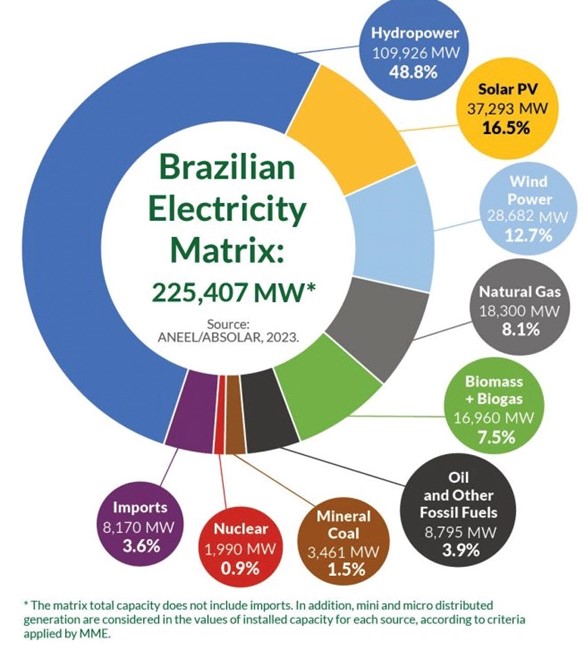

Favorable net metering legislation, rising conventional electricity tariffs, and consistent and strong downward trends in photovoltaic equipment prices in recent years have led PV to become the second largest contributor to Brazil’s electricity generation mix. Figure 1 shows that hydroelectricity still dominates the generation market with almost 110 GW installed (49% of the country’s electricity generation capacity), but solar PV moved from fifth to second place last year, with 37 GW (17%), followed by onshore wind (29 GW = 13%). Biomass (mainly sugarcane bagasse and biogas) added another 17 GW (8%) to the electricity mix, totaling more than 85% of the country’s electricity generation capacity (225 GW).

Solar PV and wind are now the lowest-cost power generation technologies. As Figure 2 shows, the price development of PV in the national energy auctions of the regulated electricity market evolved from over $100/MWh in 2013 to $32/MWh in 2022, after a low in 2019 that reached just over $20/MWh.

Electrification of transport, heating and industry, together with green hydrogen production is expected to expand demand for large-scale PV in coming years, and because of its well-structured energy market, high solar and wind resource availability, and relative proximity to export markets in Europe, Brazil is expected to produce one of the lowest-cost H2 and NH3 worldwide.

For distributed generation, solar PV is by far the most cost-competitive technology, with a levelized cost of electricity (LCOE) well below distribution utility tariffs everywhere in the country, leading to payback times ranging between three and five years for residential rooftop PV, depending on the local solar radiation resource availability and the local distribution utility’s retail tariff.

There are 93 million consumer units (potential rooftops) in the country, and so far, fewer than 2.5% of them have a rooftop PV system installed. Through favorable legislation that allows remote self-consumption, there are 3.6 million consumer units enjoying the energy credits produced by these 2.3 million net-metered rooftop PV installations. This favorable legislation has made PV the most democratic choice of electricity production, since residents of even multi-family, multi-story buildings can benefit from PV electricity generated elsewhere under the same distribution utility concession area.

Popular content

In 2012, when PV was first allowed to be connected to the public utility grid by national legislation and a net-metering scheme, distributed generation rooftop PV started from a very small base, as shown in Figure 3 (blue bars = DG). In 2020 it surpassed the installation of large-scale PV power plants (yellow bars = CG). Rooftop PV accounts for around 70% of the installed PV capacity in Brazil, and as the information about the widening price difference between solar electricity and retail electricity tariffs spreads, more and more residential consumers embark on the rooftop PV option. Soon, as Li-ion batteries and electric vehicle prices decline, the shift away from fossil-fueled vehicles will bring new electricity demands, and rooftop solar PV will lead to the least-cost per km alternative.

Author: Prof. Ricardo Rüther (UFSC).

ISES, the International Solar Energy Society is a UN-accredited membership NGO founded in 1954 working towards a world with 100% renewable energy for all, used efficiently and wisely.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.