Heat pump sales in Europe in 2023 fell for the first time in a decade with the slowdown already forcing manufacturers to cut jobs.

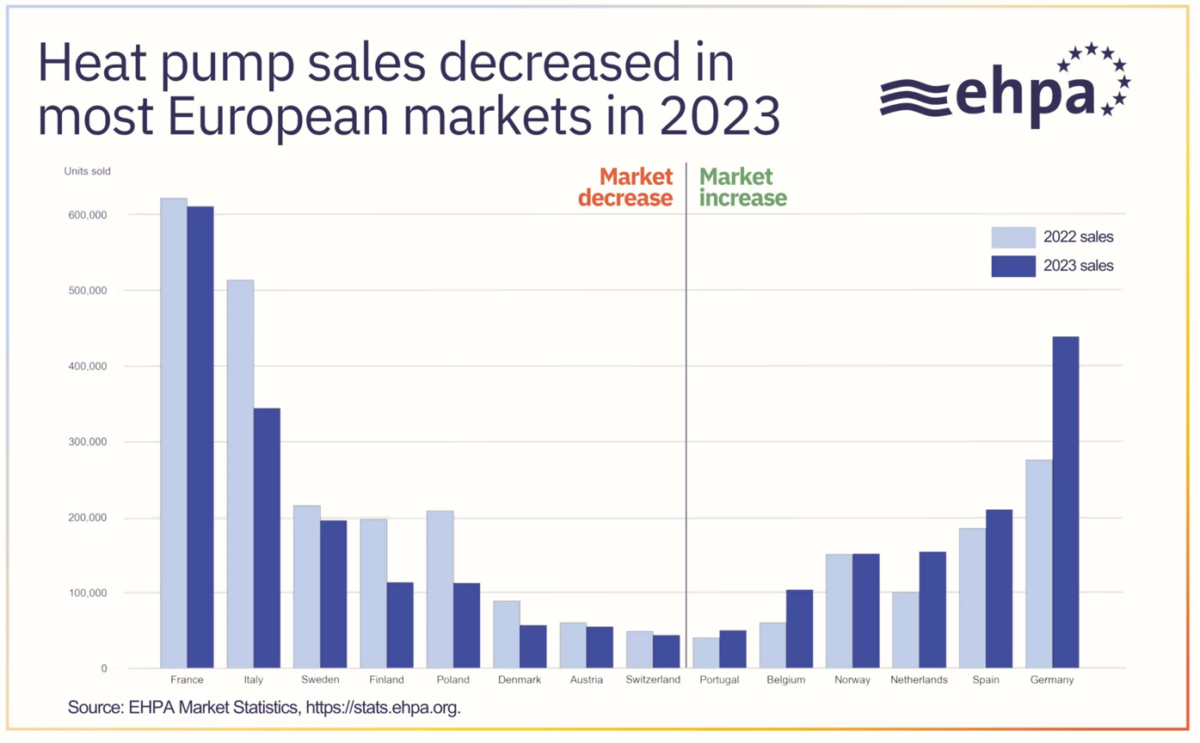

According to the European Heat Pump Association (EHPA), sales across 14 countries, representing 90% of the European market, fell by 5% in 2023 compared to 2022, from 2.77 million to 2.64 million.

The drop in sales was particularly pronounced in Poland (46%), Finland (42%) and Italy (32%). Meanwhile, Germany, which saw sales jump 59%, was also one of six EU countries in which the market grew in 2023 but this was not enough to offset the overall decrease.

In many countries that saw overall growth, quarterly sales declined towards the end of 2023. Market analysts expect this downwards trend to continue way into 2024.

The slowdown is already forcing manufacturers to cut jobs. EHPA calculates that the changes announced so far will impact nearly 3,000 employees.

Heat pump sales in Europe dropped as gas prices fell, interest rates rose, and national policy measures changed. Namely, governments increased support for people investing in heat pumps in 2022 following the energy crisis triggered by the Russian invasion of Ukraine, but much of that support was restricted or removed last year.

On top of that, the EU’s Heat Pump Action Plan, due to be published in early 2024 to support the sector, has been delayed by the European Commission until ‘a time to be decided’.

Popular content

“The heat pump sector is facing stormy weather and needs all hands on deck,” says Thomas Nowak, EHPA secretary general. “Companies have invested in training and manufacturing capacity and consumers are on board. What’s now vital is a compass in the form of the EU Heat Pump Action Plan and subsequent national plans. These will steady the waters.”

In January, 61 CEOs said in a joint letter to Commission president Ursula von der Leyen that delaying the EU Heat Pump Action Plan threatens EUR 7 billion ($7.6 billion) of planned investments in the sector over the 2022-25 period. “This would affect jobs in the sector; there are over 160,000 already today in Europe, and huge growth possibilities,” the industry leaders said in the letter.

The European Commission has recognized the heat pump sector as critical for Europe’s energy independence under REPowerEU and the Green Deal Industrial Plan. However, it said in December that it was postponing the EU Heat Pump Action Plan – which would set out how it planned to achieve its pledge to install 10 million additional heat pumps by 2027 – until after the European Parliament elections in June.

An email sent from the commission to EHPA in December stated that the action plan would not be released in the “very busy Q1 2024,” but most likely in the”autumn or winter 2024-25.”

According to Eurostat data, about 50% of all energy consumed in the European Commission is used for heating and cooling, and more than 70% still comes from fossil fuels (mostly natural gas). In the residential sector, around 80% of the final energy consumption is used for space and water heating.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.