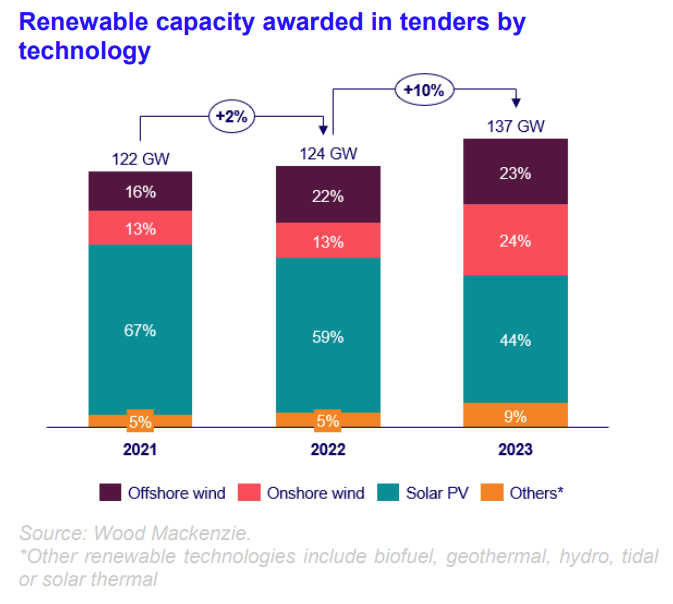

Research firm Wood Mackeznie says renewable capacity reached 137 GW through government tenders in 2023.

A 10% increase year on year, Wood Mackenzie says the growth came “despite sector cost headwinds, logistics tensions, and the energy crisis” in 2023.

PV capacity was the most awarded form of renewable energy through government tenders last year. The Asia-Pacific region received two-thirds of government contracts worldwide, at approximately 90 GW. This was buoyed by China, where more than 55 GW were allocated through 49 renewable energy tenders. India awarded 20 GW over 55 tenders, while Germany was the largest player in Europe, with 19 GW awarded through 11 rounds.

Wood Mackenzie is now predicting government tenders will drive at least 102 GW of global renewable capacity in 2024, including at least 60 GW of offshore wind. It anticipates that the overall volume will grow as the year progresses, eventually matching 2023 levels.

“Tenders have increased each year, and Wood Mackenzie expects to see some big rewards in 2024 – the EMEA region will hold more than 50% of expected tenders, mostly for offshore wind capacity,” said Ana Fernandez Garcia, a senior research analyst at the firm. “Individual major markets, such as China, will continue to dominate.”

Popular content

WoodMac’s analysis says renewable energy tenders are currently experiencing two opposing trends. It explains that while the offshore wind energy sector has witnessed “intense competition,” resulting in subsidy-free tenders and negative bids, onshore and solar energy tenders have gone undersubscribed.

The research firm says the lack of interested bidders left 30% of the tendered volume unallocated in 2023. It adds that zero bidding has led to canceling contracts later in the developing phase of projects.

Fernandez Garcia says both situations put renewables deployment at risk and illustrate the need for tender design reform. She adds that Wood Mackenzie expects an increase in ceiling prices and non-price criteria to play a prominent role in the year ahead.

Wood Mackenzie’s latest analysis follows recent research on the levelized cost of electricity (LCOE) in the Asia-Pacific region, and predictions for annual PV growth through 2032, both published earlier this year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.