From pv magazine print edition 3/24

The annual SNEC solar exhibition in Shanghai is an exhausting affair. On his return from the 2015 event, seasoned energy storage analyst Sam Wilkinson took a call from a journalist at The Times newspaper. A drained Wilkinson provided what proved to be front-page analysis.

The United Kingdom-based title was after Wilkinson’s take on the new Tesla Powerwall, the American EV maker’s residential battery. The product had been revealed by Elon Musk, with trademark chutzpah, on social media.

“I was literally in a taxi on the way home from Heathrow Airport and the next day I got a call that somehow the story had made the front page,” said Wilkinson, a director of clean energy technology at S&P Global Commodity Insight.

“It showed that there was this level of interest in the idea of energy storage. At the time it was a very nascent, niche, techy thing to do – to have a battery in your house. Fast forward, eight or nine years and it has become a very well understood, common thing.”

The Times was not alone in its enthusiasm for the Powerwall. “Sleek, chic, and unmistakably touched by that Elon Musk magic,” enthused pv magazine when featuring the first iteration of the Tesla Powerwall on its June 2015 cover (see left). The battery came at a price point far below rival products. Musk said the 10 kWh Powerwall would retail for $3,500, with the 7 kWh model going for $3,000.

The Times was not alone in its enthusiasm for the Powerwall. “Sleek, chic, and unmistakably touched by that Elon Musk magic,” enthused pv magazine when featuring the first iteration of the Tesla Powerwall on its June 2015 cover (see left). The battery came at a price point far below rival products. Musk said the 10 kWh Powerwall would retail for $3,500, with the 7 kWh model going for $3,000.

“At the time I noted the price of Tesla batteries was significantly cheaper than what we’ve seen in the market, which would bring competition among other suppliers and push prices down,” said Wilkinson. “Which turned out to be relatively true, in the end.” By setting such an aggressively low price, Tesla blew open a previously nascent market segment.

Next generation

At the time, Tesla embodied the cutting edge in EVs and uber-geek cool. Powerwall 3, launched in 2024, will be the most powerful iteration – offering backup power even to large homes. It became available to installers in the United States on Feb. 16, with the move announced on X (formerly known as Twitter), Musk’s social media platform.

The Powerwall 3 was unveiled in Las Vegas at the RE+ trade show, on Sept. 12, 2023. While it has the same storage capacity as the Powerwall 2 – 13.5 kWh – a key differentiator is that it can provide more than 50% more power, at 11.5 kW of continuous power. It is a hybrid battery with the solar and battery inverter fully integrated.

At RE+, Tesla engineers highlighted that the Powerwall 3 offers installers quicker installation through a series of innovations. The new battery is smaller and lighter, albeit slightly deeper. It is 110 cm long, 61 cm wide, and 19.3 cm deep and its inverter, battery cells, and battery management system weigh in at 130 kg.

To lighten the load, Tesla has also worked with partners to develop a “dolly” – to help installers to lift the hybrid battery up and onto walls for mounting. That may seem like a minor detail but, crucially, it allows a single installer to fix the battery in place.

At $11,500, the Powerwall 3 is not looking to shake up the residential market based on price, as its predecessor did. However, the Tesla team at RE+ were keen to impress that quicker installation will enable installers to carry out more jobs, bringing down their labor costs.

Integrated system

Tesla’s in-house engineers developed the solar inverter inside the Powerwall 3 – displaying the company’s growing technical proficiency. The product deploys six maximum power point trackers (MPPTs), to optimize rooftop PV output.

“That has been an evolution of the [energy storage] space in general,” said Wilkinson. “We call them ‘integrated systems,’ with batteries and inverters combined together. The integrated product is obviously looking to provide a lot of other functionality and slightly more futuristic things, like VPPs [virtual power plants] and systems that can respond to things like electricity prices.”

The integrated approach precludes retrofit applications in homes with existing rooftop arrays, which Tesla says it will continue to serve with the Powerwall 2.

“It is all about the Tesla brand and they have that unique position of being the place you can go to get solar, storage, and an EV – and no-one else offers that full ecosystem,” said Wilkinson.

In the United States, Tesla is planning to sell the Powerwall 3 in a bespoke offering for homeowners. The company’s sales team provides integrated solar-plus-storage quotes based on a home’s size and power consumption. For even larger homes, up to four Powerwalls can be installed in series, offering a whopping 40 kW of power.

“It is not completely unheard of to have three or four Powerwalls, in the States,” Wilkinson said. “It is not an economic decision, it is purely a backup power play. And people will pay for backup in the US because grid outages are relatively common, compared to Europe.”

Thunder Down Under

Sydney-based PV and battery retailer Natural Solar sold the world’s first Powerwall in January 2016. The company’s founder, Chris Williams, said that while the first Powerwall was largely for early adopters, the Powerwall 2 opened up more of a mass market, with some 500,000 units sold globally. He said the latest version represents the next phase of the product’s evolution – which he described as an “interesting and exciting” one.

“It is tackling a new market as a solar inverter and a battery,” said Williams. “Having that all in one ecosystem, with data flowing from the Tesla app – and you can add an EV charger – I think is the next stage of ecosystem, from a customer perspective.”

Australia is a significant market for Tesla, for its utility scale and distributed batteries and its EVs and chargers. With a vast and growing rooftop solar fleet, and power outages increasingly common as a result of extreme weather events, there is a growing appreciation of backup power provision through residential solar-plus-storage.

Around 600,000 homes in the state of Victoria lost power on Feb. 13, some for days, after a storm downed a major transmission line.

EUPD Research monitors EV charging and solar-plus-storage installers in Australia and Europe. EUPD analyst Finn Bee said that the Tesla residential EV charger has consistently had the highest installer satisfaction rating of any brand. When it comes to batteries in Europe, however, there is more of a mixed picture.

“Our installer monitor, for which we survey more than 1,600 installers in selected markets across Europe and Australia, shows that Tesla has lost some market penetration but is still one of the best-known brands in many countries,” said Bee. “They are doing particularly well in Australia and Italy, two of the strongest markets for storage but are lagging in Germany, for example.”

Future outlook

While Tesla helped to create the residential energy storage market segment in 2015, the dynamic in 2024 is one of oversupply. The residential segment in the United States is depressed on the back of net metering reforms in key solar states. In Europe, inventories remain high.

“The market has cooled off in 2023,” said Wilkinson. “We’ve now got a pretty grim situation, especially in Europe. Every company, especially the newer Chinese entrants, was shipping, into Europe, crazy volumes when the energy-crisis boom was under way.”

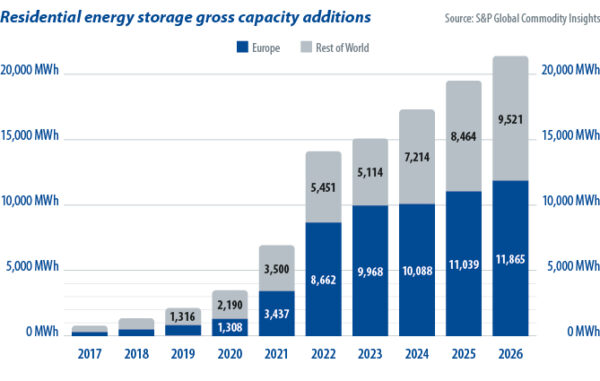

S&P Global forecasts incremental residential energy storage growth in the coming years, with slightly more than 17 GWh of installations expected globally in 2024.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.