From pv magazine India

Premier Energies has filed the draft red herring prospectus (DRHP) with capital markets regulator SEBI to raise more than INR 1,500 crore ($180 million) through an IPO.

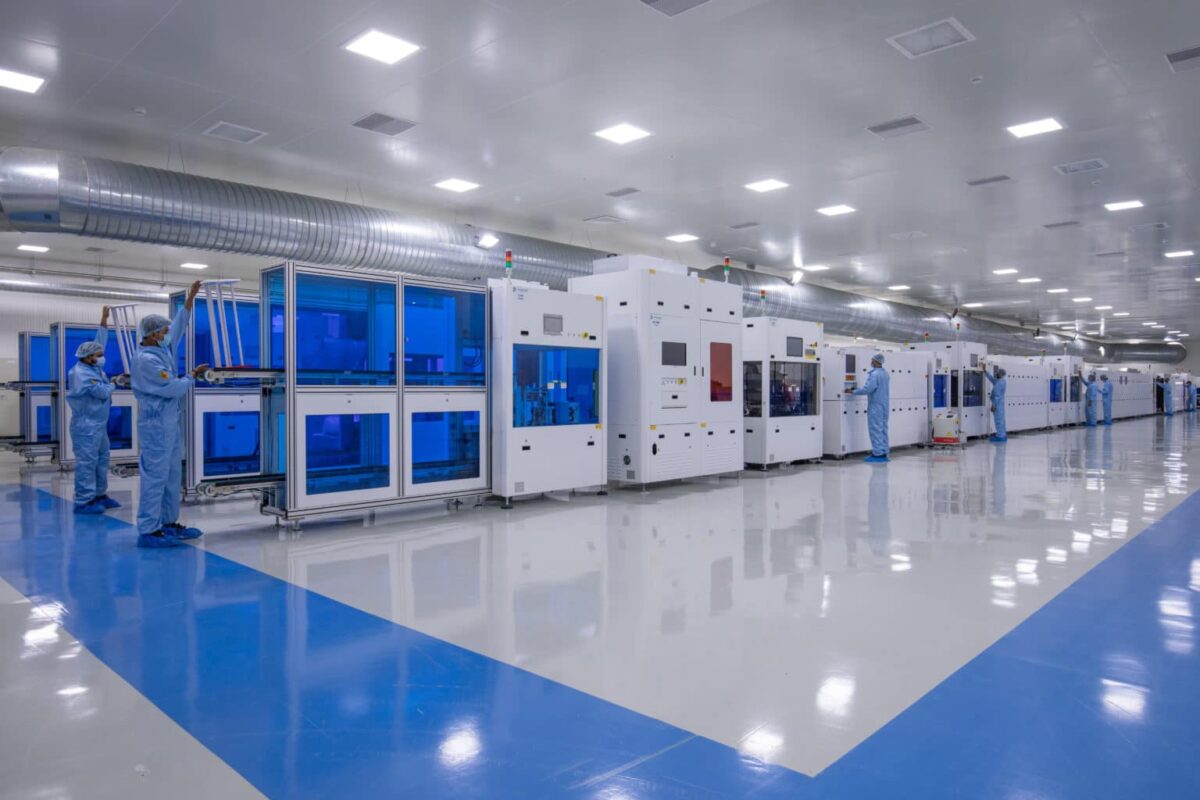

The company proposes to utilize the net proceeds of the fresh issue toward INR 1,168 crore of investment in its arm, Premier Energies Global Environment, for part-financing the establishment of a 4 GW TOPCon solar cell and 4 GW TOPCon solar module manufacturing facility in Hyderabad, Telangana, and the rest for general corporate purposes.

Premier Energies is India’s second largest integrated solar cell and solar module manufacturer, with an annual installed capacity of 2 GW and 3.36 GW, respectively, as of March 31, 2024, according to Frost & Sullivan. The company was established in 1995 by Surender Pal Singh Saluja, chairman and whole-time director.

Popular content

The company’s revenue from operations increased at a compounded annual growth rate (CAGR) of 42.71% from fiscal 2021 to fiscal 2023.

Kotak Mahindra Capital Co. Ltd, J.P. Morgan India and ICICI Securities Ltd are the book running lead managers for the issuance. The equity shares are to be listed on the BSE and the National Stock Exchange of India.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.