From pv magazine USA

Renewable energy contracting slowed sharply in 2025 despite record-high levels of battery storage deployment, according to market intelligence firm Pexapark’s 2026 “Renewables Market Outlook.”

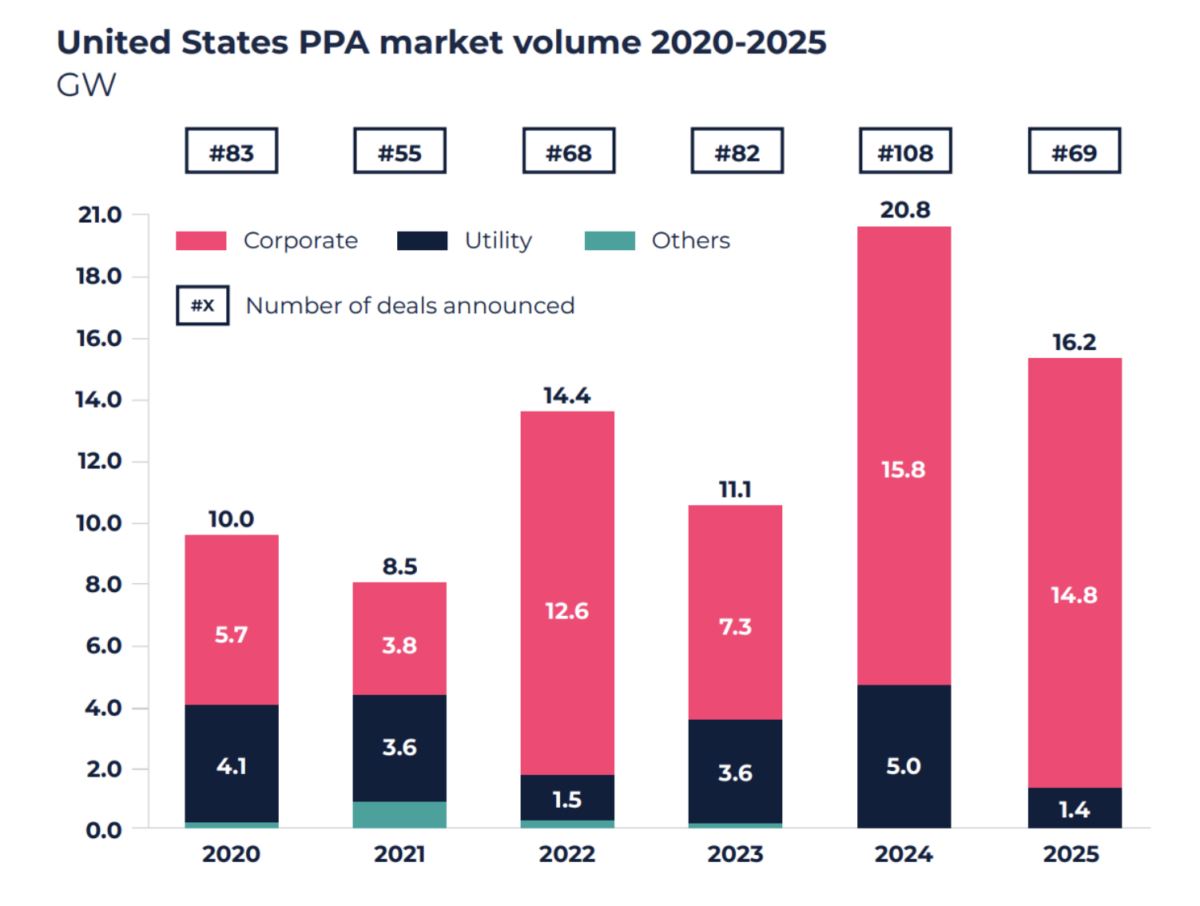

Despite continued demand for PPAs, total contracted PPA volumes and deal counts fell 22% year-over-year due to policy uncertainty in the wake of the July 2025 One Big Beautiful Bill Act (OBBBA), though not necessarily for lack of interest.

The slowdown stemmed largely from the OBBBA. Pexapark estimates the policy could cut cumulative U.S. solar and wind buildout by 41 GW by the end of the decade. In response, many developers paused early-stage projects and replaced fixed-price PPAs with more complex structures, including shared downside mechanisms, as buyers rushed to secure projects before their tax credit eligibility expired.

The report explained that buyers showed a “greater willingness to accept higher prices, looser structures and increased risk-sharing” in the latter half of 2025. The market remained “firmly seller-led” as price expectations rose due to inflation and higher costs of financing and equipment. As tax-eligible projects became scarcer, the report explains, developers earned more leverage over pricing. In practice, the combination caused prices to swing upward despite a drop-off in overall activity.

Hyperscalers, corporates and utilities competed for an increasingly small number of seemingly bankable projects. Meta alone contracted roughly 6 GW of PPAs in 2025, far exceeding other buyers, while Amazon followed with just over 2 GW. Still, their growing appetite didn’t translate into higher aggregate volumes.

Instead, contracted volumes fell, in a reflection of what the report calls a “softer enforcement” of environmental-social-governance (ESG) targets in the current political environment. The authors noted that this downward revision in renewable buildout pushed prices even higher, with solar PPA fair values rising by 8% last year.

Battery storage trod a different path, with BESS tolling prices falling year-over-year across most regions last year. CAISO and ERCOT, however, grew increasingly saturated and that growth marked mounting strains on the markets.

The report said battery cannibalization reduced the value of merchant arbitrage and changed storage’s risk profile. In ERCOT, the ancillary market became crowded, with merchant arbitrage values falling to about $7.50/kW month. That made wholesale arbitrage a larger part of the equation, exposing projects to higher risk.

“While near-term revenues weakened, long-term valuations signaled growing confidence in storage as a core reliability asset within the Texas system,” said the report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.