The global solar sector is “experiencing peak uncertainty and a challenging investment climate,” said Mercom Capital Group CEO Raj Prabhu in the consultancy's new report on funding and merger and acquisitions (M&A) in the first quarter of 2024.

Mercom said total corporate funding into the solar sector stood at $8.1 billion in the first three months of the year. The figure includes 41 deals, marking a 4% year-on-year decline. However, the figure is a 47% quarter-over-quarter increase over the $5.5 billion raised in the fourth quarter of 2023.

Elsewhere, global venture-capital funding in the solar sector in the first quarter of 2024 hit $406 million across 13 deals, down 81% year on year. Public market financing reached $1.4 billion across six deals the first three months of 2024, down 39% year on year. Debt financing rose 59% year on year across 22 deals, according to Mercom.

“The solar sector is experiencing peak uncertainty and a challenging investment climate,” said Prabhu. “The sector is grappling with multiple hurdles, including the likelihood of prolonged high-interest rates, higher labor and construction costs due to inflation, and supply chain issues, coupled with trade disputes and tariffs.”

Mercom recorded a total of 21 solar M&A transactions in the first quarter, unchanged from the fourth quarter of 2023, but down from the 27 solar M&A deals recorded in the first quarter of 2023.

“Although a crash in Chinese module prices has spurred demand, it has made investments in manufacturing projects unattractive, even with incentives. VC investments were down, and M&A activity continues to be subdued,” Prabhu added. “Given the current market conditions, it wouldn't be surprising if the recovery is delayed further in conjunction with rate cuts.”

Meanwhile, Wood Mackenzie said in a separate report that if high interest rates persist, the transition to a net-zero global economy will be “even harder and more costly.”

In the consultancy’s latest report, ‘Conflicts of interest: the cost of investing in the energy transition in a high interest-rate era’, it said that the higher cost of borrowing negatively affects renewables and nascent technologies compared to oil and gas and metals and mining sectors, putting future renewables projects at risk.

Popular content

“Interest rates, which have risen sharply in the past two years, may not come down as far or as quickly as markets anticipate,” said Peter Martin, Wood Mackenzie’s head of economics. “This increased cost of capital has profound implications for the energy and natural resource industries, particularly the cost and pace of the transition to low-carbon technologies.”

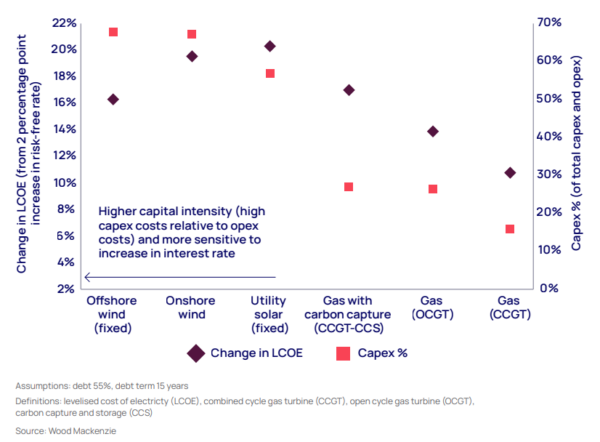

WoodMac said that in the United States, a 2% increase in the risk-free interest rate could push up the levelized cost of electricity (LCOE) by as much as 20% for renewables. The comparative increase in LCOE for a combined-cycle gas turbine plant is 11%.

The research firm said that solar and wind have an economic advantage over hydrocarbon generation sources, but higher interest rates are eroding it.

“While power and renewables companies have higher gearing, they do compare favourably with other peer groups on a cost-of-debt basis. But this is precisely what makes them more sensitive to interest rates,” Martin said. “Mechanisms to reduce price and offtake risk enable power and renewables companies to obtain debt more cheaply than the relatively risky oil and gas and metals and mining sectors. The recent rise in interest rates, therefore, has a larger proportional impact on their cost of debt.”

pv magazine print edition

The April edition of pv magazine considers a $9 billion subsidy package for Indian rooftop solar, examines energy community movements in the US and Italy – as well as renewables pushback in Australia – and ranges as far afield as Egypt, Central Asia, and the Middle East. All that plus a special section previewing this year’s smarter E Europe energy exhibition.

WoodMac said that policymakers should focus on bolstering carbon markets, maximizing subsidy efficiency and mobilizing green finance to offset headwinds, he added.

“The good news is that there are actions policymakers can take now to help offset or at least mitigate the burden of higher interest rates,” Martin explained. “Policymakers need to remove obstacles such as slow permitting and project approval as well as offering clear, consistent, and sustained incentives, to support the uptake of low-carbon energy and nascent green technologies.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.