From pv magazine France

Amid mounting market volatility and increasingly frequent low or negative price episodes, understanding the actual value captured by a photovoltaic plant has become critical. In France, producers are compensated, either through aggregators or under feed-in tariff schemes, based on a monthly average price known as M0. While this benchmark offers a useful reference point for the sector, it does not reflect the real-world performance of individual assets.

The French Energy Regulatory Commission (CRE) itself describes M0 as an “average sector indicator,” noting that its calculation can smooth out important market signals. In practice, two PV plants with different production profiles do not capture the same market value, yet both are paid using the same monthly reference price. That gap between the average price and the price a plant actually captures defines a significant share of a photovoltaic asset’s economic value.

Real performance

At kiloWattsol, analysts quantify this gap by calculating the historical capture price of each project. The method uses real-world climate data to reconstruct a project’s hourly or sub-hourly production profile and applies historical market prices at a 15-minute resolution when needed to reflect short-term price dynamics.

The goal is not to model an uncertain future, but to determine how a project would have performed had it been operational in recent years. Given the relative stability of solar generation patterns across France, this historical analysis highlights a project’s structural predisposition for value capture. An asset that aligns with periods of high prices continues to remain at the upper end of the market.

A project that outperforms the M0 is not simply fortunate. It is one whose production profile aligns with periods when prices rise above the average, typically when demand peaks. Tracker-equipped plants delay the afternoon drop in output and slightly advance the morning ramp-up. These production shifts often coincide with time slots valued more highly by the electricity system. As a result, such projects naturally capture more value than the monthly M0 benchmark.

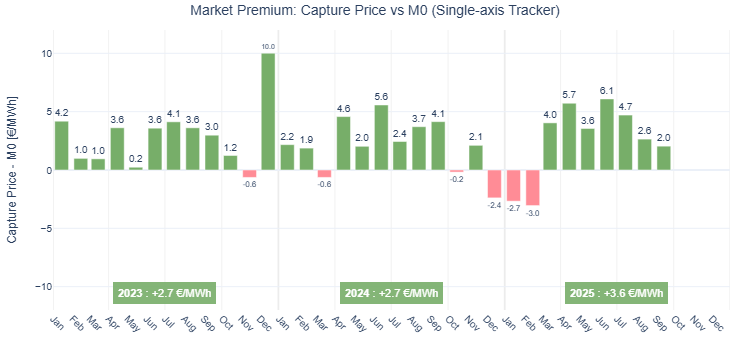

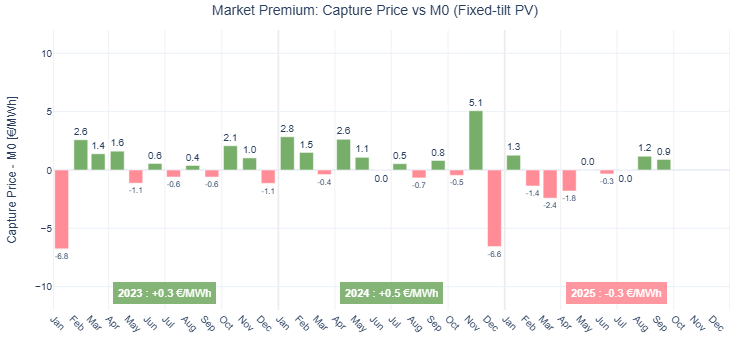

The two graphs below illustrate this dynamic:

In each case, the analysis compares the monthly capture price of the power plant to the corresponding M0. The trend is clear. The fixed-tilt plant remains close to M0 with a slightly positive but moderate performance. The tracker plant outperformed almost throughout the year.

The annual difference summarizes this dynamic: +€2.70 ($3.12)/MWh, +€2.70/MWh, and +€3.60/MWh over three years for the tracker plant, compared with +€0.30/MWh, +€0.5/MWh, and then a slight underperformance in 2025 for the fixed-tilt plant.

Strategic challenge

These discrepancies are not marginal. For a large-scale asset, they can amount to tens of thousands of euros annually and directly affect the project’s resilience to structurally low prices, market-share performance under a contract-for-difference (CfD) regime, portfolio valuation during due diligence or refinancing, and the suitability of a given design or technology in specific regions.

As conversations around negative prices, cannibalization, and hourly efficiency increase, capture-price analysis has become indispensable. Not all PV projects deliver the same value to an aggregator, yet this differentiation often remains unquantified. The M0 offers a baseline, but it obscures the diversity of project behaviors. The capture price, by contrast, brings that diversity into focus.

In a market where value is defined in 15-minute increments, comparing a plant’s performance to the M0 is no longer theoretical. It is a strategic variable for asset owners, investors, and aggregators. One conclusion stands out: PV assets should not be valued uniformly. The challenge is understanding and demonstrating why.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.