Debt-saddled Panda Green and Singyes wait on Chinese state-backed bailouts

With Singyes having already announced a plan to receive a cash injection and restructure its debt, fellow Hong Kong listed solar developer Panda Green today announced plans for a Beijing coal power company to ride to its rescue.

Japanese giants have solar operations on the down-low

Panasonic offloaded some of its PV interests to Chinese HJT cell maker GS-Solar and Kyocera is advertising further savings from its solar operations but neither business unit acted as a significant drag on wider group figures.

China Solar’s latest attempt to relist put off until November

The scandal-hit Hong Kong-based solar manufacturer has had trading in its shares suspended for six years but white knight investor Cheung Shun Lee is hoping to get it back into operation.

SunPower’s slow climb towards the black

The high efficiency solar panel maker pulled off a rare profit in the second quarter due to selling off leases, but expects to report another quarterly loss in its next update.

Wacker’s results affected by low polysilicon prices

The Munich company hopes the PV market will pick up in the second half, driven by demand in China. Wacker Chemie also expects rising prices for polysilicon.

Chinese investment in renewables soars under Belt & Road initiative

A report by Greenpeace has found in the five years since China announced the continent spanning ‘One Belt, One Road’ infrastructure plan, investment in Belt & Road countries has supported 12.6 GW of wind and solar power generation capacity. That compares with just 450 MW which came online in the territories before 2014. The initiative has also supported 68 GW of new coal capacity.

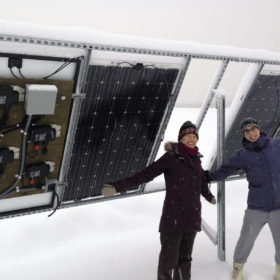

The weekend read: Pursuing a 20% bifacial boost

Research on bifacial solar panel performance has moved performance analysis closer to a standardized practice than ever before. More field tests are underway across the United States, and the first waves of data are expected this year. These tests will help standardize a predictive model for bifacial projects that is bankable.

Hanwha Q-Cells assumes market leadership in Europe

In Germany, the Korean PV manufacturer increased output to 760 MW last year. Despite a highly competitive environment and persistently high pressure on margins, Hanwha says it is looking to the future with optimism. The company has further diversified away from solar module production in recent months.

Chinese solar production figures continue to ramp up

Quasi-governmental body the CPIA has released first-half figures for the world’s biggest solar marketplace which show production volumes for export markets continuing to expand and the domestic picture set to rebound after public solar subsidy levels were published.

No respite for REC Silicon as shutdown dominates Q2 figures

The Norwegian polysilicon supplier – which has most of its manufacturing operations on U.S. soil – cannot give any estimate on when its solar material production lines will return, and has been left entirely dependent on the semiconductor products made by its Montana facility.