Navigating Romania’s PV boom

A latecomer to the European PV party, Romania’s embrace of clean energy means it is perfectly placed to ride the wave of urgently ramped grid investment being rolled out by the European Union.

Mitsubishi HC Capital acquires 20% stake in European Energy A/S

Mitsubishi HC Capital, a Japanese investment firm, has become the second-largest shareholder in Danish renewable energy developer European Energy A/S by acquiring the equivalent of 75 million shares. Knud Erik Andersen, the CEO of European Energy, says the transaction more than triples the company’s equity.

Solar canopies as a central pillar of IRA-driven energy transition

With so much of the space in United States cities allocated for parking, the dual pronged approach of the Inflation Reduction Act (IRA) – production tax credits to drive investment in domestic manufacturing and investment tax credits to attract consumer-side investment – means solar canopies can make a huge contribution to the net zero drive.

Tibo Energy secures funds to expand sales of cloud-based software supporting C&I assets

Netherlands-based Tibo Energy has raised €3 million from European early stage investors. Its software is used by businesses to manage and optimize their renewable energy assets and grid usage.

The Hydrogen Stream: Ceres secures license agreement for SOEC stack production

As electrolysis is gaining traction in the markets, European and US companies announce new hydrogen projects in the heavy mobility sector. Meanwhile, UK-based solid oxide electrolysis cell (SOEC) tech developer Ceres Power signed a global long-term agreement with Delta Electronics.

Tiamat secures funding for sodium-ion gigafactory in France

French sodium-ion battery maker Tiamat has raised €30 million ($32.6 million) in equity and debt financing. It will use the funds to launch the construction of a 5 GWh production plant in the Hauts-de-France region.

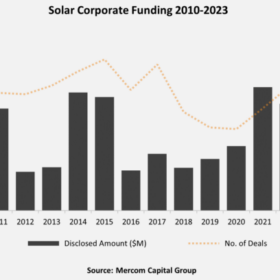

Solar corporate funding hits decade-long high in 2023

PV funding activity increased by 42% year-on-year in 2023, driven by strong growth in private market financing and debt financing, despite a decrease in the total number of deals, according to Mercom Capital Group.

Chinese PV Industry Brief: Jinchen to raise funds for production equipment

Jinchen says it aims to raise CNY 1 billion ($140 million) through a private placement of shares.

Northvolt secures $5 billion for Europe’s first circular gigafactory

Europe’s leading battery maker, Northvolt, has signed a $5 billion non-recourse project financing arrangement to enable the expansion of Northvolt Ett in northern Sweden. The deal represents the largest green loan raised in Europe to date.

German companies unite to bring virtual power plants to mid-sized businesses

Germany’s Electrofleet has invested in its virtual power plant technology partner Dieenergiekoppler. The two collaborate to enable mid-sized businesses to use self-produced renewable energy based on fixed price contracts. Dieenergiekoppler’s latest financing round solidified the collaboration.