Brookfield Renewable acquires Standard Solar, Scout Clean Energy

Brookfield Renewable is set to invest up to $2 billion in Standard Solar and Scout Clean Energy, bringing its development portfolio to 60 GW.

Blackstone Capital move for mounting system company under scrutiny

The European Commission’s merger and acquisitions body is running the rule over a plan by New York-based Blackstone Capital to take joint ownership of expansionary Esdec Solar, alongside private equity group Rivean.

Solar energy tax credits are a boon to blockchain technology solutions

The Inflation Reduction Act (IRA), signed into law by US President Joe Biden, represents the single largest investment in clean energy, GHG emissions reduction, and climate resilience in the country’s history by providing around US$370 billion for green energy tax credits and other incentives to spur large-scale development of solar energy technologies to electrify the US’s digitization.

AfDB announces cheap loans to back off-grid solar in Africa

The African Development Bank has announced that European and US donors will provide $20 million of concessional loans to support pay-as-you-go solar companies in sub-Saharan Africa.

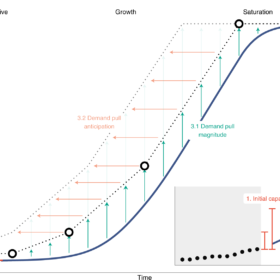

Short-term scarcity, long-term uncertainty weighing on green hydrogen

Historic analogues suggest that emergency-like policy measures could foster high growth rates, expediting a breakthrough and increasing the likelihood of future hydrogen availability. However, EU targets require unprecedented growth rates, according to a group of German and US researchers.

KKR, Hero Group to invest $450 million in Hero Future Energies

The investment will support Hero Future Energies in expanding its renewable energy capacity. The Indian independent power producer has a diversified portfolio of 1.6 GW of operating solar and wind projects.

In Asean nations it’s all about the solar

Indonesia will have to get to work installing more than 24 GW of solar this year – and every year – if the region is to achieve the 2.1 TW to 2.4 TW of photovoltaics Irena has estimated it will require to achieve a net zero carbon energy system by 2050.

Pakistani regulator clarifies net metering proposal

A consultation about raising the level of payments made for excess household electricity injected into the grid appears to have prompted fears it could raise solar power prices across the board.

The weekend read: Mining for gold in legacy PPAs

As the pace of solar installations quickens, developers are racing to find the best remaining sites and optimize their position in interconnection queues. But what if the best investment opportunity is hidden in a site built a decade or more ago? Time gets the better of us all, and many early solar sites no longer perform as expected. Yet those sites generally sell power at prices today’s developers can only dream of. Chris Chappell and Stephen Shirey of Clean Energy Associates examine what can be done to unlock the value in these legacy sites.

Goldman Sachs, Cleanhill Partners acquire majority stake in US inverter maker EPC Power

With clean energy installations projected to skyrocket, the two financial powerhouses value EPC Power’s position in the evolution of the industry.