Chinese PV Industry Brief: construction begins on world’s largest PV project

State-owned power generation company China Huadian Corporation has begun work on a 3.3GW solar site in Sichuan province. The project is one of nine renewable energy plants listed in China’s latest national five-year plan.

Solar supply chain trouble to ease this year, according to analyst

Wood Mackenzie has predicted solar equipment cost increases will ease back after last year saw the average cost of solar electricity rise for the first time in the Asia-Pacific region.

Korea Zinc invests in gravity storage developer Energy Vault

Korea Zinc, non-ferrous metal smelting company, has agreed to invest $50 million in Energy Vault, a Switzerland-based gravity storage specialist, in order to use its tech to decarbonize its refining and smelting operations in Australia.

Silicon Ranch raises $775 million

Silicon Ranch, a Shell-backed utility-scale solar developer in the United States, has raised funds from new and existing investors.

Shunfeng set to sell off another 130MW of solar farms

The developer is aiming to resume trading in its stock tomorrow ahead of a shareholder vote this month which could remove more than half of the $220 million it owes creditors in overdue payments.

EU to gut the principle of sustainable taxonomy with inclusion of nuclear and gas

The EU’s Sustainable Taxonomy was intended to complement the Green Deal, provide investors with certainty about the sustainability of their investments, and help channel billions into sustainable, low-carbon processes and technologies. Despite input from experts and NGOs, the inclusion of gas and nuclear power just proposed by the Commission suggests that, once again, politics is trumping science.

Chinese solar developer suspends trading in stock

Heavily-indebted Shunfeng International could be set for another big sell off of solar assets as it tries to pay down a near-$300 million overdue debt pile.

Stepping UP in 2021: #3 Sustainable electricity and corporates’ critical solar role

Despite the global Covid-19 pandemic and recession, corporate purchases of clean energy are booming. Several factors are driving this trend, including falling costs, a heightened appetite for sustainability among consumers and investors, and increased political will for net-zero development. In recognition of this, the UP Initiative spent Q3 2021 investigating sustainable electricity supply. How are PPA models evolving? What are the critical issues around residual energy? And how can greenwashing be avoided? Read on to discover more.

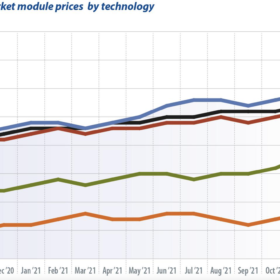

PV module price index: The price spiral winds up

The title of Martin Schachinger’s October market commentary was “Module prices set to rocket back to 2019 levels.” This month, he writes that prices have already reached December 2018 levels and notes that there is no reversal in sight. Prices for all module technologies have once again risen by an average of 3 percentage points since last month.

Guggenheim Solar Index: Two sides to PV import tariffs

Solar stocks underperformed the broader markets in November, writes Jesse Pichel of ROTH Capital Partners. This is in large part thanks to uncertainty coming from the United States, where the Court of International Trade reinstated an exemption from import tariffs for bifacial modules – a decision that will likely see an appeal.