China’s emission-reduction action squeezes PV production

Industrial shutdowns and reduced factory production capacity levels indicate the companies producing the raw materials used by solar manufacturers are being afflicted by electricity consumption measures just as other sectors are. It is not clear whether the solar industry will be afforded any favors by Beijing, as analyst Frank Haugwitz explains.

Re-Source 2021 Recap

Re-Source 2021 took place in Amsterdam at the end of last week, and pv magazine was there to cover the event where the suppliers and sellers of renewable power purchase agreements (PPAs) meet the (largely corporate) buyers, though encouraging PPA uptake among small and medium-sized enterprises (SMEs) was among the major talking points, including ‘additionality’, de-risking renewable PPAs and 24/7 matching.

Canadian fund Omers plans to acquire 49% of FRV Australia

Fotowatio Renewable Ventures’ (FRV) Australian platform includes 637 MW (DC) in projects already operational or under construction, and a pipeline comprising 7 GW of solar projects and 1.3 GWh of battery storage.

AIIB accused of backing Bangladeshi fossil fuels instead of renewables

Despite investing US$605 million in Bangladesh’s energy sector during the last five years, the Asian Infrastructure Investment Bank has reportedly not supported a single renewable energy project, according to experts and environmental activists.

UK renewables industry calls for action on rising energy bills

Industry body the Renewable Energy Association (REA) is calling on the U.K. government to reduce tax on various clean energy technologies and energy efficiency measures in the residential sector, with particular emphasis on battery installations. The association sees this as one of the most effective ways to protect consumers from volatile energy prices, as well as for the country to meet its stated decarbonization goals.

RatedPower raises $6 million in financing round led by Seaya Ventures

The financing round will be used to drive the Spanish PV software specialist’s international growth in markets such as the United States, Europe, Latin America, and Asia-Pacific, accelerate product development and improve customer experience.

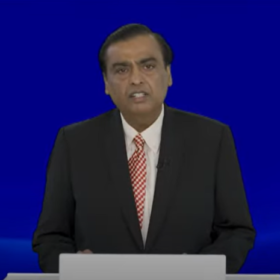

Reliance Industries to invest $29 million in Nexwafe

Reliance New Energy Solar, a subsidiary of Reliance Industries led by billionaire Mukesh Ambani, which is planning a huge manufacturing venture in Gujarat, India, has led a series C financing round in German wafer manufacturer NexWafe with an investment of EUR 25 million ($29 million). This marks the third major investment in renewables announced by the Indian multinational this week.

Austria’s CCE Solar Invest nails financing for 600 MW in Italy

CCE Solar Invest GmbH has secured financing to build 600 MW of PV capacity in Italy.

10 GW Desert to Power PV initiative picks up $150 million in funding

The Green Climate Fund has announced it will provide US$150 million in funding to the Desert to Power initiative – a project led by the African Development Bank and spanning several countries that aims to build 10 GW of PV generation capacity in various projects across the Sahel region to the south of the Sahara Desert.

Reliance Industries acquires 100% stake in REC Group, plans new manufacturing bases

India headquartered multinational Reliance Industries, through its subsidiary Reliance New Energy Solar Limited, yesterday announced the acquisition of Norway headquartered module manufacturer REC Group. The move comes as Reliance pushes forward with its US$10 billion plan to move in on the renewable energy industry, having also this week announced acquisition of a 40% share in EPC provider Sterling & Wilson.