Solar corporate funding rises 15% YoY with $5.3 billion in H1 2018 – Mercom

Despite the uncertainty caused by U.S. solar panel import tariffs, deteriorating trade relations between the U.S. and China, and the looming consequences of China’s PV policy change, the solar industry saw a 15% YoY increase in corporate funding in the first half of 2018, on the back of a Q2 rebound, finds the latest Mercom Capital report.

Mexican utility CFE retires protection measures against solar net metering

Without the threat of a hostile attitude from the state-owned power provider, the Mexican distributed generation (DG) market may now continue to be a strong driver of growth in the northern American country.

Q4 could be a ‘hot market’ for solar contract negotiations following China’s changes – BNEF Q&A

In a Q&A with Bloomberg NEF (BNEF), two solar analysts tell pv magazine they see no PV module price rebound, continuing oversupply, and falling utilization rates. They expect Q4 could be a “hot market” for contract negotiations, while Chinese developers will start overseas construction earlier than planned for two key reasons.

Complete ecosystem needed to ensure India’s solar success – UL India interview

The Indian Government must create a complete ecosystem to ensure the effective on-ground execution of its ambitious solar program, says Chakradhar Byreddy, Director–Renewable Energy, UL, Asia Pacific, during an interview with pv magazine. This includes investing in laboratory infrastructure, and skills for technical due diligence, energy yield assessment and forecasting.

Global EV market growing sturdily despite trade dispute setbacks

EnergyTrend recognizes recent tariffs developments will hit the electric vehicle (EV) industry. Despite this, environmental regulations, as well as costs and technological advancement, will prevail and continue to drive EV sales globally.

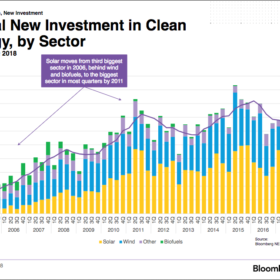

Global solar investment drops due to low project costs, China policy change

While overall global investment in clean energy saw a decrease of just 1% YoY in the first half of 2018, solar’s share dropped 19% following changes to China’s PV policy and lower project costs, says Bloomberg NEF (BNEF). It forecasts this trend to continue throughout the year.

Italian government challenges Sicily’s moratorium on solar parks

The Italian Council of Ministers said that Sicily’s temporary suspension of all approvals for large-scale wind and solar project is unconstitutional.

Turkey authorizes foreign-currency loans for already approved unlicensed PV projects

The measure is intended to reduce domestic foreign exchange exposure for investors and developers of PV projects up to 1 MW (and solar parks consisting of several 1 MW units). Prior to these new rules, only licensed PV projects exceeding 1 MW in size were granted this kind of financing.

Belgium: Flanders to allow direct lines for solar, RE starting from 2019

A new amendment to the region’s energy law allows enterprises to sell power to one other through the so-called direct line model, starting from 2019.

Lower module pricing will bolster PV deployment in India

More than 80% of India’s solar equipment requirements are met through imports from China. Against this backdrop, industry analysts see the predicted 30% lower module pricing, following China’s revised policy, as a good news for Indian PV projects.