Solar sector to add 552 GW by 2027 led by China

The leading trio – China, the United States and India – will comprise 70% of the projected 552 GW of solar capacity, which will be added between end-2017 and 2027, finds Fitch Solutions, which has revised down its original forecast for solar capacity growth in China. The curbed growth in China, due to subsidy cuts and restricted access to the United States and India, is expected to squeeze domestic solar equipment manufacturers, but also lead to access to cheaper solar panels in other smaller markets.

US: Democrats control the House. Now what?

The new Democratic majority in the U.S. House of Representatives will still need to deal with a Republican Senate and president, and is unlikely to take bold action.

The Netherlands installed 658 MW of PV in the first half of this year

New solar installations in the country reached the milestone in six months, according to Dutch New Energy Research, which publishes its first Dutch Solar Quarterly report today.

Indian PV procurement leapt to 3 GW in October figures

Developers gave short shrift to warnings about depreciation, protectionism and tax headwinds as tendering and auction figures soared, but shied away from tough price caps set for the Solar Energy Corporation of India’s procurement exercises.

Germany concludes draft detailing drastic cutbacks for PV systems 40 kW and over

In addition to solar subsidy cutbacks of around 20%, planned for the start of 2019, the German Federal Ministry of Economics’ draft Energy Sources Act includes special tenders for PV and onshore wind. While many say the cuts cause great uncertainty for large-scale project developers, politician Peter Altmaier sees it differently: the energy transition is becoming safer and more affordable, he says. The decision to adopt or change the act now lies with the Federal Parliament.

Renewables overtake fossil fuels in UK installed capacity

A report published today by U.K.-headquartered energy company Drax says that, for the first time ever, total generation capacity available from renewables has overtaken that of fossil fuels on Britain’s electric grid.

Further Indian sites considered to host large-scale floating solar

With the Solar Energy Corporation of India having already proposed 10 GW of solar be located on artificial bodies of water over the next three years, one of its directors has mooted ambitious plans at four more locations.

Chinese manufacturer prepares to raise $434m through bonds

The polysilicon, PV wafer and module and inverter maker has arranged a second EGM of 2018 to seek permission for two bond issues, as its peers scramble to raise their manufacturing capacities.

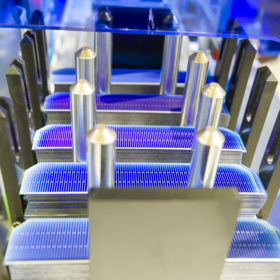

Singulus signals 300 MW production equipment order as Chinese dragon roars again

Predictions of the imminent demise of Chinese solar demand due to the reining in of subsidies have not stopped manufacturers ramping up production capacities. German equipment maker Singulus is among the suppliers to benefit from a renewed confidence in the Far East.

India’s 10 GW solar tender amended again – but deterrents remain

While the timelines for PV plant execution and completion of the manufacturing facilities required by the tender are now more realistic, production obligations – especially related to capacity utilization – need to be revisited.