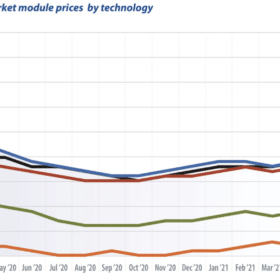

EU spot market module prices: Is sustainable market development possible?

Module manufacturers have once again adjusted their prices upwards. This is already the third or fourth price increase in the last six months, and there is no end in sight, writes Martin Schachinger of pvXchange. But why is it so hard to achieve long-term, sustainable development in the global solar market, at least on the part of manufacturers? Few other industries are so turbulent, with constant swings between excess supply and bottlenecks, between price collapses and price rises – and always to the breaking point of the market. Yet again, planning security is out the window.

Green hydrogen supply chain concerns

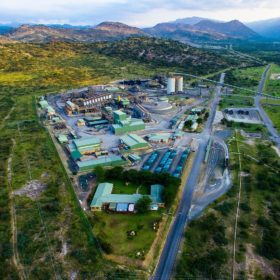

With South Africa holding 63,000 of the world’s estimated 69,000 metric tons of platinum reserves – according to the Statista.com website – and Russia and Zimbabwe a further 5,100 between them, the European Commission has cited the metal as an example of a potential supply chain bottleneck that could handicap its grand plans for renewables-powered hydrogen production.

Eurostat figures confirm rise of renewables during Covid-hit 2020

While solar, wind and hydro generated 80 TWh more electricity last year than in 2019, coal and oil use fell in every EU member state, and Greek energy emissions fell almost 19%.

South African bank secures continent’s ‘first green loan’

The private-sector arm of the World Bank says it will lend up to $150 million to Johannesburg-based Absa Bank for green project funding.

Botswana tops list of world’s ‘super abundant’ renewables nations

A Carbon Tracker report estimates 60% of the world’s technical solar potential – enough to produce 3.5 exawatt-hours of clean electricity per year – would already be cheaper than fossil fuel if installed. Of the remainder, most would be in sub-Saharan Africa, a region which has the potential to be a global solar and wind powerhouse.

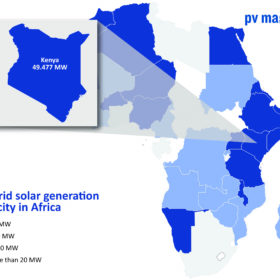

A case study in African solar policy problems

Dutch off-grid solar organization GOGLA has focused on the negative effect of the reimposition of VAT and import duties on solar lighting systems in Kenya as emblematic of the lack of legislative support for clean energy across the continent.

China mandates energy storage as it sets 16.5% solar and wind target for 2025

The National Energy Administration has ordered grid companies to supply enough network connection points for all the solar and wind projects registered in 2019 and 2020, and said variable renewables should be supplying 11% of the nation’s electricity by the end of the year.

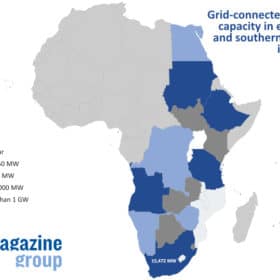

Solar and wind could provide half of 2040 power mix across 22 African nations

The International Renewable Energy Agency has combined energy infrastructure commitments across a huge swathe of the continent with hundreds of regional sites which offer rich solar and onshore wind potential, to determine what could be possible.

Special trade zones can help Africa’s energy transition

With investors often put off by a lack of supportive policy for renewables on the continent, the exceptions made to attract money to its economic trade zones might also prove more friendly to clean power infrastructure spending.

China’s Covid recovery saw green bond issuance rebound in second half of 2020

The $18bn worth of sustainable finance instruments floated in the nation last year marked a retreat from previous highs but, with most of the bonds issued from July onwards, the recovery is under way, according to the IFC, which is anticipating a more-than-$100 billion sector in emerging markets over the next three years.