With Chinese solar project developer and PV glassmaker Xinyi having this week moved to add battery storage to its solar generation portfolio, its prediction storage would be mandated under the nation's latest five-year plan has been borne out by the National Energy Administration (NEA).

In stipulating to its subsidiaries and major state-owned enterprises that the proportion taken up by solar and wind power in the national power generation mix must rise to 11% this year, the NEA also ordered the use of energy storage for the first time.

The NEA has told grid companies to provide sufficient network connection points for new solar and wind generation projects, starting with facilities registered in 2019 and 2020. Project capacity planned from this year onwards must include a certain proportion of energy storage capacity, the NEA stated in a notification, following similar moves by some provincial authorities concerned about a lack of grid connection capacity.

Popular content

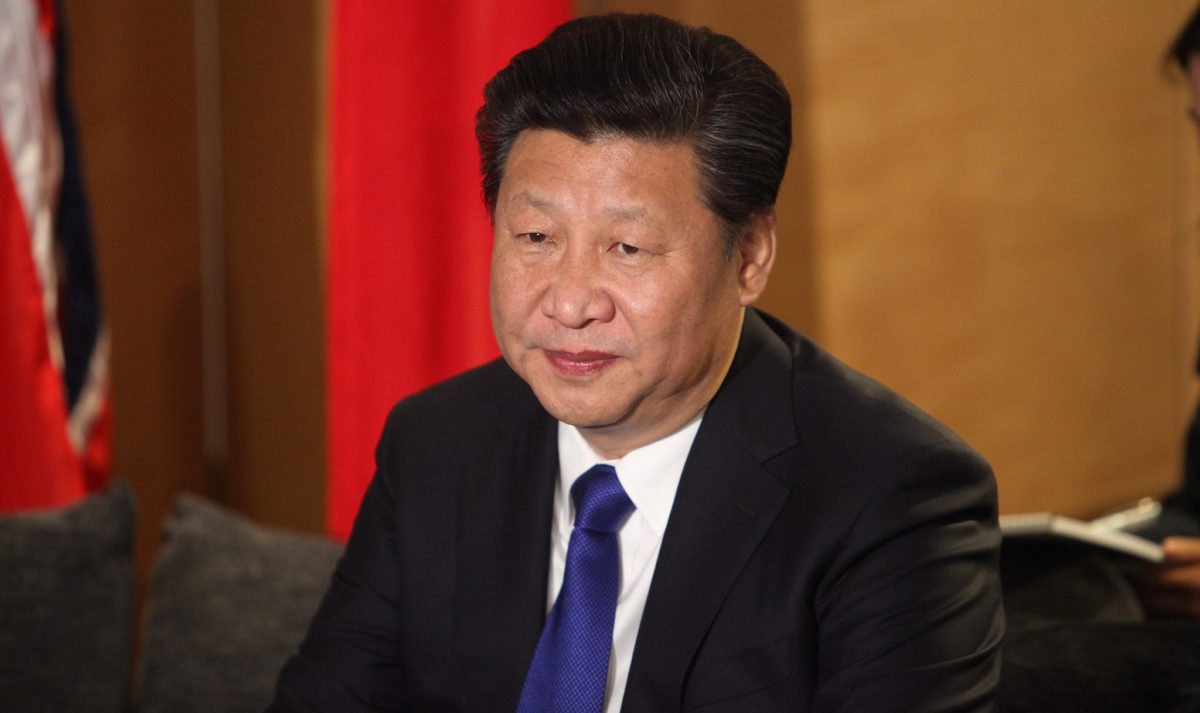

The NEA notice setting the 11% renewables target, up from 9.7% last year, requires the proportion of solar and wind in the national power mix to rise gradually to 16.5% in 2025, as part of plans, announced by president Xi Jinping, for China's carbon emissions to peak this decade and for the country to hit carbon neutrality by 2060.

The state entity also instructed its provincial offices to draw up plans for the consumption of renewable electricity and to work to drive inter-regional power flows.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The pathway is unlikely to be as smooth and dignified as this scenario suggests. Indian and American experience suggests that the next big thing will be a financial crisis for coal generators. For current operations, it doesn’t matter what the relative LCOEs of coal and renewables were when built, it’s only the short-run operating costs that count. For these, the renewables always win hands down. Chinese coal plants face the same future as their American and Indian counterparts: capacity factors dropping below the breakeven rate, mounting losses, and increasingly desperate calls for bailouts. The differences are partly the colossal scale of the still continuing Chinese coal overbuild, and a Leninist-plutocratic government more likely to pony up the handouts.