Special trade zones can help Africa’s energy transition

With investors often put off by a lack of supportive policy for renewables on the continent, the exceptions made to attract money to its economic trade zones might also prove more friendly to clean power infrastructure spending.

U.K. takes another tiny step to smart energy system

Energy regulator Ofgem has announced it aims to bring in market-wide half-hourly settlement across the retail electricity market – from October 2025. The long timescale reflects a sluggish attitude at an inconsistent regulator which appears to be planning an unpredictable route to net zero.

Add electric vehicles, not bulk transmission, for a low-cost, clean grid: UC Berkeley study

A 90% clean grid with a transition to EVs would achieve lower electricity costs than one without, the study shows. Transmission investments would mainly be spur lines to new renewable generation.

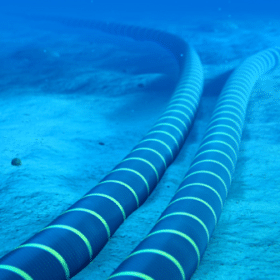

Submarine cable to connect 10.5 GW wind-solar complex in Morocco to the UK grid

UK-based Xlinks is planning to build 10.5 GW of wind and solar in Morocco and sell the power generated by the huge plant in the UK. This should be made possible by a 3,800 km high voltage direct current (HVDC) transmission line that would be connected to locations in Wales and Devon. The company’s CEO, Simon Morrish, spoke with pv magazine about the ambitious project, and on how it should become feasible.

Australian regulator proposes rewards for new, ultra-fast services in the electricity market

The Australian Energy Market Commission has released proposals to reward fast frequency services in the National Electricity Market for the first time.

No bifacial solar in West Africa? That’s likely to change soon

A technology-focused event held by the Africa Solar Industry Association has heard development pipelines across the continent are swiftly changing to accommodate double-sided PV panels, and that’s good news for solar tracker providers too.

Model agreement to make solar and wind share same connection point in the Netherlands

The model agreement was outlined by Dutch consultancy Ventolines B.V. and follows the introduction of new provisions for the sharing of the same connection point issued by the country’s government last year.

Italy should embrace solar, not gas to hit raised climate ambition

Instead of splurging €11 billion of EU cash on uneconomic new generation capacity, the Italian authorities–and electricity bill payers–would be better served investing in a mix of current clean power technologies which would include almost 17 GW more solar capacity.

Solar changing shape of electricity prices in Northern Europe

Rising volumes of photovoltaic project capacity are increasing the incidence of negative price periods for electricity–and changing the times of day when they occur.

Solar power has to be about quality as well as quantity

Greater dispatchability will be required from solar as it becomes increasingly mainstream worldwide, or investors could experience diminishing returns as a victim of the technology’s success at bearing down on electricity prices.