Even with duties, Chinese PV modules will be competitive in India

Despite safeguard tariffs against certain imports of solar PV products into India, Chinese manufactured modules will remain competitive, says TrendForce. It further anticipates PV demand falling 30% in fiscal year 2018 in India, while cost pressures will mount for EPCs and project developers.

BREAKING: Trump calls for 25% tariffs on Chinese inverters, other products

U.S. President Donald Trump has asked trade officials to consider increasing import duties from 10% to 25% on a list of products from China, including inverters, AC modules and non-lithium batteries.

Chinese shadow over latest IEA world energy report

The International Energy Agency’s latest study of global energy investment paints another rosy picture for solar – even as the authors warn of missed sustainable growth targets – but the report covers last year, and notes China’s policy about-turn could blow a cold wind through PV.

SolarEdge extends patent infringement lawsuit against Huawei

Following the claim filed in June, SolarEdge now alleges Huawei has infringed two more of its patents. With its HD-wave inverter topology the subject of the first lawsuit, the Israeli manufacturer now says its Chinese rival also copied its power optimizer technology.

India imposes 25% safeguard duty on solar imports

The Indian government has imposed a safeguard duty of 25% on solar imports from China and Malaysia for two years. The Ministry of Finance (Department of Revenue) levied the duty based on the final recommendations proposed by the Directorate General of Trade Remedies (DGTR). While most industry players are dismayed, believing project costs could “immediately” go up by 15%, others are more optimistic.

SunPower to shift IBC solar production to new technology

The PV maker plans to shift its 800 MW of E-Series production to its new NGT technology, as it records a massive loss on depreciation of its old equipment. The move was revealed in second-quarter figures featuring plenty of red ink.

Total looks to Chinese EV market

Oil and gas company Total has announced it will work alongside Shanghai-based NIO – the world’s inaugural Formula E champion – to develop products for a potentially huge electric vehicle marketplace in the populous Asian nation.

India’s trade war will have global repercussions

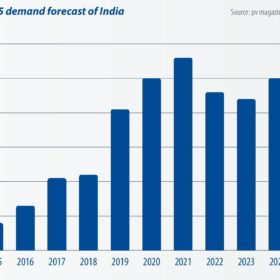

India is currently the second largest market in the world for PV module demand. With China’s domestic demand frozen since the 31/5 notification, the country’s total module demand in 2018 will likely only achieve 32-34 GW. This will allow India, which may surpass 10 GW in annual demand, to reach 13% of global PV demand this year. As a result, the future of India’s trade war has become an influential factor in the global PV industry.

The figures for China’s booming PV industry will be seen with a tinge of regret

In what analysts worldwide are sure to look back on as the last golden period for global solar – at least for the immediate future – China saw more impressive figures for PV manufacturing in the first half of the year. Then the government stepped in.

Top 10 crystalline PV module manufacturer ranking

With production and capacity figures provided by industry analyst IHS Markit, pv magazine provides a rundown of the top 10 crystalline silicon module manufacturers based on 2017 production data, followed by a look at the market forces and technology trends that have shaped the supply landscape.