Amorphous silicon solar cells still niche market

In the second interview of a series, Arvind Shah, a professor at École polytechnique fédérale de Lausanne, told pv magazine about the challenges facing amorphous silicon cells. He said the tech could be used in some window applications and greenhouses, but not in rooftop projects, as the stabilized efficiency of these cells is too low.

Focus of off-grid funding shifts in Africa

West Africa hogged more than twice as much investment as the east in a year which saw stock market backing plunge an ‘alarming’ 46%, leaving donor grant funding and debt to pick up the slack during a Covid-hit year, according to off-grid industry body GOGLA.

Solar and silver price hikes

The PV industry has experienced several rounds of price increases since the second half of 2020, from polysilicon to materials such as PV glass and films. Between July 2020 and February 2021, prices quoted for 3.2 mm and 2 mm glass surged by more than 60% per square meter. Prices for EVA and POE encapsulant films skyrocketed by more than 40% and 10%, respectively. Prices for silver paste also rose 7%, and have since remained stubbornly high. PV InfoLink Chief Analyst Corrine Lin examines the impact of silver’s recent price turbulence on PV cell manufacturing.

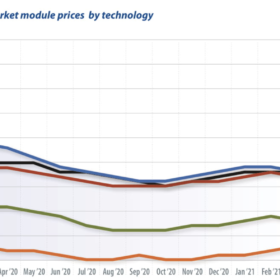

PV module price index: New dimensions, new problems

The speed at which manufacturers are introducing changes from one product generation to the next is accelerating – currently, formats are scarcely available for more than a few months before another revised product is launched. But occasionally new module dimensions also bring new problems, be it in handling, plant design, or logistics. Ever-shorter product cycles and hastily launched record-breaking modules with capacities of 500 W, 600 W, or even 700 W are not always welcomed with open arms – especially by those who have to work with them, writes Martin Schachinger of pvXchange.com.

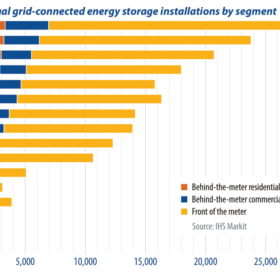

Strong growth ahead for battery storage

Annual battery storage installations will exceed 10 GW/28 GWh in 2021, following a particularly strong year in 2020, despite the challenges created by the global pandemic, writes IHS Markit analyst Mike Longson. Combined solar and storage will be a core focus for new deployment in 2021, as the front-of-the-meter and behind-the-meter energy storage markets are both expected to grow significantly in the months ahead.

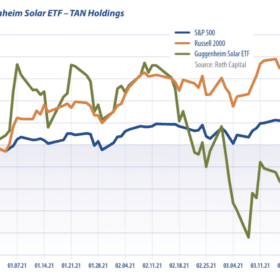

Guggenheim Solar Index: PV industry facing headwinds

The solar industry faced headwinds in March, writes Jesse Pichel of Roth Capital Partners, thanks to rising interest rates and, in California, concerns over increasing grid access fees. Despite this, the recent earnings season reveals strong fundamentals and a healthy outlook for most players.

The Hydrogen Stream: EU launches call for low-carbon hydrogen tech, Netherlands unveils €338m plan

Furthermore, Michelin said it wants to become a world leader in hydrogen fuel cell systems and ScottishPower aims to build a green hydrogen plant at a wind power complex. Moreover, a study led by scientists at the U.S. Department of Energy’s (DOE) Argonne National Laboratory suggested new strategies to design perovskite materials to speed up the oxygen evolution reaction (OER), a process that frees up molecular oxygen from water and is key for hydrogen production.

Solar may cover 75% of global electricity demand by 2050

A new study from the Lappeenranta University of Technology predicts solar may even achieve a 69% share for total primary energy supply by the end of the first half of the century. In terms of price, solar PV is expected to achieve a capex of €246/kW-installed for utility scale projects, and of €537/kW for residential arrays by 2050. The levelized cost of energy (LCOE), however, is expected to remain constant over the next three decades, as the energy transition will also be implemented with storage technologies, increased flexibility and the production of synthetic fuels.

Solar power has to be about quality as well as quantity

Greater dispatchability will be required from solar as it becomes increasingly mainstream worldwide, or investors could experience diminishing returns as a victim of the technology’s success at bearing down on electricity prices.

The weekend read: Should solar developers take notice of ESG criteria?

Something is brewing in the financial world. “Sustainable finance” and the growth of ESG funds have been taking the market by storm in recent years. Since most major PV projects end up needing investors from the capital market, it is only a matter of time before they will have to adapt. The beginning of March 2021 saw a milestone reached in this process.