Tipping point for African C&I solar

With installers who cater to African businesses making the headlines this year, Jasper Graf von Hardenberg – whose C&I solar business was recently bought by Shell – explains here how the story of the continent’s commercial and industrial (C&I) solar segment was far from an overnight success.

Nigerian state to install 600 MW of C&I solar in pursuit of 1 GW goal

The Nigerian state of Lagos and the World Bank have announced plans for 1 GW of rooftop PV by 2030.

France announces results of commercial and industrial PV tender

The French government has allocated 324 MW in its latest procurement exercise. Average prices were €76.66/MWh for large power plants (500 kWp-8 MWp) and €87.25/MWh for projects below 500 kWp.

Solar Solutions marks return of PV trade shows to Europe

The Dutch event has attracted bumper crowds this week as the Dutch solar PV market continues to defy skeptics with its tremendous growth.

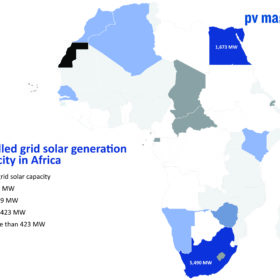

A wave of big African solar is set to break

The Africa Solar Industry Association has recorded almost 2 GW of large scale project announcements since the start of last month with 18 countries planning new clean power infrastructure and including energy storage in the plants.

Malaysia’s commercial and industrial PV segment is thriving

The Malaysian Photovoltaic Industry Association (MPIA) has urged the country’s government to allocate more capacity under the metering scheme, as all installed power for commercial and industrial PV was already assigned a few months after the scheme’s launch.

C&I sector in Sub-Saharan Africa embraces captive solar solutions

The Commercial and Industrial (C&I) solar sector currently accounts for 75% of power demand in Sub-Saharan Africa. However, due to the unreliable nature of energy supply from the grid, consumers under this segment have been forced to invest in alternative sources of energy, which they consider to be more reliable and less expensive, such as the use of captive solar solutions.

Australia’s largest energy provider acquires solar installers

AGL has revealed plans to acquire Epho and Solgen Energy Group, which will make it Australia’s largest climate polluter and its largest commercial solar provider.

Hybrid operational strategy to use lithium-ion storage in commercial PV arrays

Lithium-ion batteries can not only improve self-consumption in commercial PV systems but are also able to efficiently perform peak shaving and price arbitrage, according to an international research group which has proposed a new strategy to calculate the best system configuration in terms of costs and revenue. The scientists specified, however, that the novel strategy may become effective only if storage system prices will drop under $250/kWh.

Storage and PAYG critical to deployment of African off-grid renewables

The former need not necessarily relate to conventional lithium-ion batteries, however, as a recent webinar staged by Solarpower Europe and EU body GET.invest discovered.