Guggenheim Solar Index: Two sides to PV import tariffs

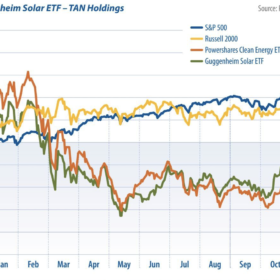

Solar stocks underperformed the broader markets in November, writes Jesse Pichel of ROTH Capital Partners. This is in large part thanks to uncertainty coming from the United States, where the Court of International Trade reinstated an exemption from import tariffs for bifacial modules – a decision that will likely see an appeal.

Guggenheim Solar Index: Solar pricing throughout the whole upstream chain is rising

As of October 22, 2021, the overall solar stock market posted strong performance, with the Invesco Solar ETF leading the pack.

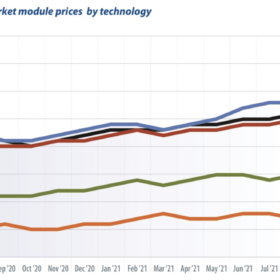

EU spot market module prices: PV prices high today, higher tomorrow

Some time ago, when I lived in the center of Berlin, I was a regular at the farmers’ market to buy fresh fruit and vegetables. One greengrocer advertised his wares with the words “cheap today, expensive tomorrow.” It would almost be desirable if we PV wholesalers could offer our modules with a similar slogan. Unfortunately, no one in the industry can currently claim that solar modules are cheap – quite the opposite. Following a brief respite, prices have climbed again in recent weeks. Since the previous low in September 2020, prices for new, grade-A goods have already risen by an average of 20% to a level not seen since April 2019.

Guggenheim Solar Index: Underperforming solar stocks and significant challenges

In June, solar stocks underperformed, writes Jesse Pichel of ROTH Capital Partners. The U.S. residential market retains a positive outlook, though rising prices and forced labor concerns represent significant challenges.

Guggenheim Solar Index: Supply chain cost increases see underperforming solar stocks

In May, cost increases across the supply chain left solar stocks underperforming in the market, writes Jesse Pichel of ROTH Capital Partners. For the U.S., higher prices for shipping and steel have hit particularly hard.

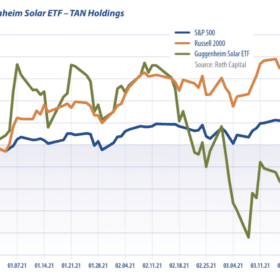

Guggenheim Solar Index: PV stocks slip on short supply

Supply shortages and price increases slowed solar stocks in April, writes Jesse Pichel of ROTH Capital Partners. In the United States, however, new policies promise to foster growth in the second half of the year.

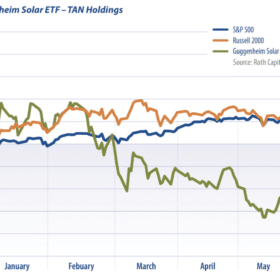

Guggenheim Solar Index: PV industry facing headwinds

The solar industry faced headwinds in March, writes Jesse Pichel of Roth Capital Partners, thanks to rising interest rates and, in California, concerns over increasing grid access fees. Despite this, the recent earnings season reveals strong fundamentals and a healthy outlook for most players.

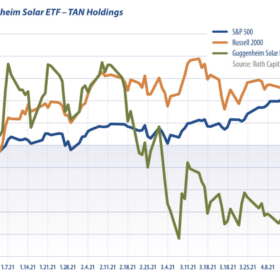

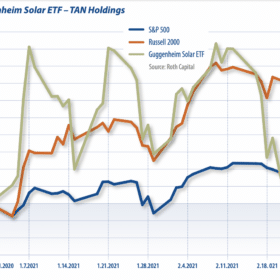

Guggenheim Solar Index: Headwinds, or a healthy correction?

In the month of February, the solar industry witnessed a decline, writes Jesse Pichel of ROTH Capital Partners. Increasing prices throughout the supply chain and forced labor concerns from China spelled headwinds for the solar industry, but the decline can also be viewed as a healthy correction, following historic highs in January.

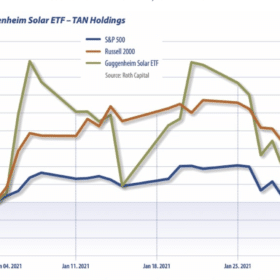

Guggenheim Solar Index: Strong beginnings

Solar stocks enjoyed a good start in 2021, writes Jesse Pichel of ROTH Capital Partners. In the United States, the Biden administration’s focus on climate change and the expectation of further incentives for renewables saw solar stocks rally in January. The global forecast is also positive, with China and others set for big installation numbers.

Guggenheim Solar Index: More to come in ‘21

With the wholesale transformation of the power industry from the inside out and other energy transition mega-trends, capital will continue to flow into renewables from ESG, energy funds, and retail, writes ROTH Capital Analyst Jesse Pichel. Look for a greater mix of unsubsidized economic solar projects to support improving revenue visibility, increasing earnings quality, and multiple expansions.