Norwegian wafer maker and US mounting system supplier join the solar gold rush

It is not just the big beasts of Chinese solar that are investing in aggressive expansion as high-efficiency wafer maker NorSun and tracker supplier GameChange Solar make big announcements. The New York company, however, may fall foul of President Trump’s America First trade mantra by opening production lines in the Far East.

Joining the high-efficiency gang

In a conversation with pv magazine, REC vice-president for sales in the EMEA region Ivano Zanni describes the new strategy of the Norwegian manufacturer following the launch of its high-efficiency, half-cut mono n-type heterojunction module. REC expects annual production capacity for the panels at its factory in Singapore to increase to 600 MW by the end of next year, and that the company’s total capacity will reach 2 GW.

Bifacial module demand continues to grow

Module technologies such as bifacial, half-cut, multi-busbar (MBB), and shingled are maturing after two years of improvement. Comparing module technologies, we see that half cut has a high degree of maturity in production equipment, high yield rates, and output climbing since the beginning of 2018. From late 2018 to 2019, most companies have expanded or upgraded their portfolios by pairing half-cut technology with MBB technology.

Chinese manufacturer Seraphim’s new 1 GW module fab will produce bifacial, half-cut modules

The Changzhou-based company, which has established the Shanxi facility with state-owned rival Shanxi Lu’An Photovoltaics Technology, has not revealed what proportion of the factory’s output will feature the high efficiency technology.

Longi’s 5 GW high-efficiency mono PERC factory will be at full capacity ‘soon’

The Chinese panel maker is already producing bifacial half cut modules at its new Anhui fab after the completion of an initial 2.5 GW phase of operations. And the company president confirmed Longi is on track for 45 GW of mono wafer and ingot production capacity next year.

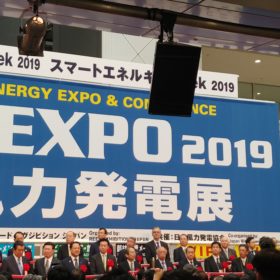

Smart Energy Week in Tokyo: Self-consumption, storage and a plentiful pipeline for now

Though we’re unlikely to see a return to the days of double-figure GW annual installation levels, Japan will stay at the top table of solar. Last week, pv magazine visited PV Expo Japan, part of Tokyo’s World Smart Energy Week, and found plenty of market developments to discuss, along with healthy interest from major players.

PI Berlin findings say little about module quality in Europe

PI Berlin analysis has suggested the quality of modules is particularly high in Asian factories with a large throughput. However, just 2% of the 67 GW of production capacity audited for the study originated in Europe. The audits for the white paper were mostly carried out by Solarbuyer between 2012 and 2018.

Seraphim expands South African solar cell fab plans to 500 MW

Chinese solar manufacturer Seraphim has announced plans for a 500 MW cell factory in Port Elizabeth, South Africa. The company also plans to expand an existing 300 MW module factory in South Africa’s Eastern Cape region by 200 MW.

The China effect: Decreasing PV utilization rates, serious oversupply and future strategies

Independent energy analyst, Corinne Lin discusses the fallout of China’s recent solar PV policy decision, including decreasing utilization rates and serious oversupply; and a focus on equipment upgrades, particularly for PERC, SE, half cut and bifiacial technologies. The industry will bounce back in 2019, she concludes.

REC Group launches new half-cell solar module

At last week’s Intersolar Europe show in Munich, Norwegian headquartered manufacturer REC Group unveiled its latest module innovation, the N-peak series. The new solar PV modules will be the first to combine n-type, mono-cSi and half-cut cell technologies.