IHS Markit: Trackers to account for a third of PV installations

New analysis predicts more than 150 GW of tracker capacity will be installed in the next five years – around a third of all ground mount projects up to 2024. Rapid growth in Europe, the Middle East and Africa; and the better cost structures possible from combining trackers and bifacial modules are singled out as key trends.

Distributed generation growing in Latin America

In the early years of the 21st century, distributed generation systems in Latin America were mainly installed off-grid in remote rural areas, writes Maria Chea, solar analyst at IHS Markit. As the El Niño phenomenon and high oil prices continued to exacerbate high electricity prices and power shortages, governments began to turn their attention to distributed generation, including PV systems, to assuage strains on their national grid networks.

10 GW of utility-scale PV+storage by 2023

In 2019, the United States will become the world’s largest market for grid-connected battery energy storage, writes IHS Markit’s Camron Barati, as solar-plus-storage and peaking capacity requirements drive increased procurement.

ABB exits solar inverter business

This Swiss giant is following a trend as large multinational high-tech companies see their role as redesigning infrastructure rather than supplying inverters at ever lower margins. Schneider Electric has pulled out of large scale solar, Siemens’ Kaco acquisition and Junelight launch show increasing interest in the C&I and residential markets, and GE is likely to divest its power conversion business due to low profit margins in that sector.

IHS Markit: Global EPC market grew 34% last year

China’s slowdown in installations last year was more than made up for by expansion elsewhere, according to IHS Markit. The news comes amid increasing market fragmentation – with the biggest engineering, procurement and construction business boasting less than 3% market share – and internationalization, with almost half of the top 15 companies operating across more than one region.

Growing interest in energy storage for maritime applications

The Electric and Hybrid Marine World Expo in Amsterdam last week highlighted growing interest in storage technology from the sea vessel industry. Leading global battery manufacturers had their latest charging technologies on display, catering to rising demand for clean, efficient electric and hybrid marine systems.

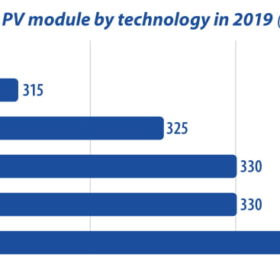

The sun rises on the bifacial module market

With market penetration exceeding expectations in 2018, bifacial technology is set to account for one third of global solar module production by 2022, writes Edurne Zoco, Research Director at IHS Markit. Bifacial and half-cell technologies are rapidly gaining momentum due to their improvements in power output, along with their low implementation barriers and minimal capex requirements

Blue Solutions on why it’s betting on solid-state batteries

While market experts suggest solid-state battery technology will not play a significant role in the storage industry until 2025, one company may be leading the race. Blue Solutions, electrical energy storage award winner at The smarter E Europe in Munich, Germany, says it has developed the only commercialized solid-state lithium battery. pv magazine caught up with the company around the European trade show to discuss its award-winning technology and unique position in the market.

Scatec Solar inks strategic collaboration deal over 485 MW of solar in Vietnam

Scatec wants to expand in Southeast Asia and Vietnam is poised to become a hot market thanks to a generous feed-in tariff and a government that has set tight carbon emission targets.

US energy storage market set to almost double this year

The solar-plus-storage combination is super-charging the deployment of batteries across the country and IHS Markit says the U.S. will become the largest market for grid-tied energy storage this year.