Solar PV to grow 65-fold by 2050, 2°C target will be missed by a long shot – report

DNV GL has issued its annual Energy Transition Outlook. It reports that global electricity demand is set to grow by a factor of 2.5. Over half of this demand is expected to be met with renewable energy by 2050, while storage will play a key role. It adds that grid infrastructure expenditures are less related to variable renewable energy assets than to increasing energy demand. In the current scenario, meanwhile, global warming is likely to reach 2.6°C.

Banks turn their back on coal amid emissions concerns

While global coal mining companies are enjoying the highest prices in years on the back of boosted Asian demand, banks and financiers are increasingly ending their support for coal power. London-based Standard Chartered the latest to stop financing new coal-fired stations.

EU-Japan trade deal first to include Paris Agreement provision

The EU alleges in its statement that the deal makes up for 28% of the global GDP and that the two blocks will focus on the development of clean energy innovations. This February, the EU Commission stated that future EU trade deals are contingent on Paris Agreement membership and have to include provisions regarding the fulfillment of the agreement.

EU and China to co-operate on clean energy technology and emissions trading

High-ranking officials from China and the EU have signed a joint statement to foster technological and political co-operation in clean energy. The regions will also develop emissions trading systems further, with officials seeing such schemes as a policy tool to foster innovation for a low-carbon economy.

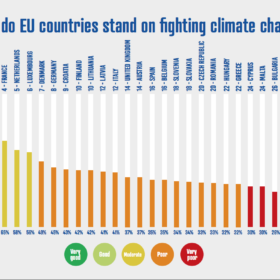

Most EU countries fail to work towards climate goals – CAN Europe

According to a new report released by Climate Action Network (CAN) Europe, no single EU country is performing sufficiently in both showing ambition and making progress in reducing carbon emissions, thus casting a long shadow over the Paris Agreement objectives. Sweden is leading the charge in fighting climate change, followed by Portugal and France.

PV leading the charge to low-emission future says IEA

With 34 of the 38 key technologies needed to hit the Paris Agreement’s best-case scenario falling short, PV and electric vehicles are keeping hopes alive

IRENA: Renewables can account for up to two-thirds of total energy use, and 85% of power generation by 2050

In the latest edition of its long-term renewable energy outlook, IRENA calls for at least six-fold deployment of renewables by 2050, compared to the levels set out in current plans. Investment in low-carbon technologies needs to grow by around 30% to US$120 trillion to enable the energy transition and avoid escalating stranded assets, the report finds.

IEA leads governments off the Paris Agreement track, report states

In a new report out today, Oil Change International and the Institute for Energy Economics and Financial Analysis (IEEFA) have taken the International Energy Agency (IEA) to task for misleading governments on climate policy through its energy forecasts.

Macron climate summit draws big announcements, but they still fall short

A number of parties used the One Planet Summit in France yesterday to either reaffirm clean financing commitments, or unveil new ones. However, the figures still fall short of the US$6.3 trillion the OECD has calculated is needed annually.

BNP Paribas to cease funding shale/tar sands, and increase financing for renewables

French banking group BNP Paribas has announced a series of measures to support the energy transition, including a pledge to cease all business with companies primarily involved in shale gas, tar sands oil and Arctic exploration for oil. The group also plans to increase its total financing for renewable energy projects to €15 billion by 2020.