Polish solar manufacturers unite to compete with imports

Businesses, supported by the government, will join forces to strengthen their industry and contribute to the European Green Deal through made-in-EU products.

European consortium bid to bring 25.4%-efficient heterojunction-IBC solar cell into mass production

The EU-funded Nextbase project aims to manufacture heterojunction, interdigitated back-contact solar modules for less than €0.275/W. Solar panels featuring the Nextbase cell tech are expected to have a conversion efficiency of 23.2%, according to the European Commission.

Chinese PV Industry Brief: a 15 GW factory, new standards and solar glass output

Risen Solar has unveiled plans for a 15 GW cell and module fab in Yiwu City, Zhejiang province and China South Glass is fundraising for a PV glass factory in Anhui province. Such growth, however, may be slowed by the introduction of new standards by the government.

Chinese PV Industry Brief: new listing plans and more POE encapsulant capacity

Daqo revealed it will list its main production unit in Shanghai, while Goodwe secured approval for its own plans to list shares. Cybrid Technologies, meanwhile, said it will ramp up production of polyolefin elastomer (POE) encapsulant films.

Chinese PV Industry Brief: 3.95 GW of new PV in Q1, new 500 W-plus modules, and a panel with 23.2% efficiency

China’s cumulative installed PV capacity topped 208 GW at the end of March, thanks to 3.95 GW of new projects completed in the first quarter. JinkoSolar and Longi both joined the 500 W-plus module race, with their new panels offering 580 W and 530 W of output, respectively. Ginlong, meanwhile, has revealed plans to raise funds to increase its annual inverter production capacity to 20 GW, and Xi’An Solar has claimed a 23.2% efficiency rate for its N-type TOPCon modules in mass production.

Hard times for German PV equipment providers

German engineering association the VDMA expects a difficult year because of the Covid-19 crisis. Sales had already dropped considerably last year and the current order intake level offers no glimpse of hope. However, the public health crisis may offer business in new markets determined to break a dependence on Chinese panels.

A gigawatt solar factory in Europe? Why it must be in France

With Swiss solar equipment company Meyer Burger laying plans for a module fab in North Rhine-Westphalia and Norwegian panel maker REC Group mulling a fab in Sarreguemines, northeastern France, Xavier Daval – from French renewables association the SER – says it is time Europe resumes its path to a stable solar manufacturing industry, not least because of the rising proportion of solar module costs accounted for by shipping.

Chinese PV Industry Brief: New capacity expansion plans and 100 MW of PV for a poverty-alleviation project

Three major Chinese PV manufacturers have announced capacity expansion plans over the past week. Chint also released its 2019 financial results, while Kstar unveiled a new inverter supply deal.

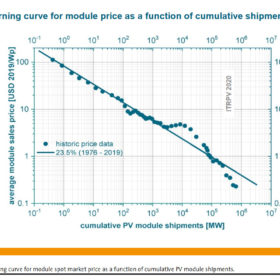

Solar costs set to continue falling according to ITRPV roadmap

The 11th edition of the German document which tracks solar price falls and efficiency improvements has considered the role bigger wafers are playing in cost reduction.

Ministry representative says Polish solar manufacturers could benefit from Covid-19 disruption to take market share from Chinese rivals

The Polish solar industry is reportedly planning an offensive to claim a bigger slice of the domestic PV market. The idea was apparently floated by the head of a private renewable energy body.