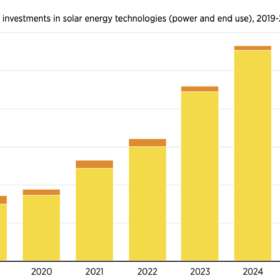

IRENA says $554 billion invested in solar technologies in 2024

The International Renewable Energy Agency (IRENA) says solar is the only renewable energy technology where current investment levels are approaching the annual average needed through to 2030 to align with its 1.5 C pathway.

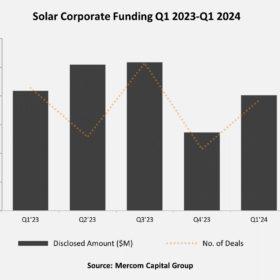

Mercom, WoodMac note challenging PV investment climate in Q1

Mercom Capital Group says that total corporate solar funding, global venture capital funding, public market financing, and PV mergers and acquisitions all fell year on year in the first quarter of 2024. The sector is still grappling with high interest rates, which Wood Mackenzie says is disproportionately affecting renewables projects.

Weekend Read: Famine to feast – China’s solar market in 2023

China’s solar industry rebounded in 2023 after years of pandemic-related sluggishness. As the year draws to a close, pv magazine looks back at key highlights of 2023 and considers the prospects for 2024.

Time for an upgrade?

While people rush to embrace every new generation of smartphones, we are often content to rely on aging solar projects to carry the energy transition. Tomaso Charlemont, product manager for PV repowering and revamping at German developer BayWa re, asks why.

Will Africa be left behind in the scramble for renewables?

Buoyant predictions about a rosy future for African photovoltaics, based on the continent’s abundant solar resources, continue to overlook the difficulties of securing investment, as Empower New Energy co-founder and CEO Terje Osmundsen explains, referring to a report published by the Africa Solar Industry Association at the World Future Energy Summit in Abu Dhabi today.

Finance floods in as global investors expand Australian solar portfolios

Australia’s bounteous land and sun, combined with its new energy-transition-focused government, make it attractive for international renewables investors. Two such players are Greek industrial conglomerate Mytilineos and Philippines-based energy company ACEN Corp., both of which have recently announced further large-scale investment to expand their Australian solar portfolios.

Weekend read: Solar tops the bill

The US Inflation Reduction Act of 2022 sets aside $369 billion to decarbonize the economy and respond to climate change. pv magazine USA’s Anne Fischer and Ryan Kennedy report on the boost the landmark legislation is expected to provide to solar and battery deployment and manufacturing.

Clean power prices leap on back of tightening gas supply

Developers are making hay as far as PPA prices are concerned thanks to eye-watering wholesale electricity prices which mean they can just sell their solar and wind power on the open market.

New poly fabs could head off first-half solar project slowdown

Norwegian analyst Rystad Energy has warned the solar industry could suffer the same effects of rising input prices as onshore wind developers grappling with ever more costly steel, with much hinging on how much solar panel raw material polysilicon can be manufactured.

Solar could hold advantage in post-pandemic global energy sector

The International Energy Agency has acknowledged dramatic falls in energy investment caused by the Covid-19 crisis but said renewables, including PV, offered an attractive proposition to investors as the dust settled, given their enticing economics and short turnaround times.