Africa is on the verge of a solar energy revolution, according to the International Energy Association's (IEA) “Renewables 2022” report, with the continent's 7 GW of solar generation capacity set to hit 25 GW in 2027.

So much for the good news. Unfortunately, the IEA cannot substantiate its buoyant projection. Is the prediction credible, or is the continent at risk of becoming the world’s fossil fuel outlier?

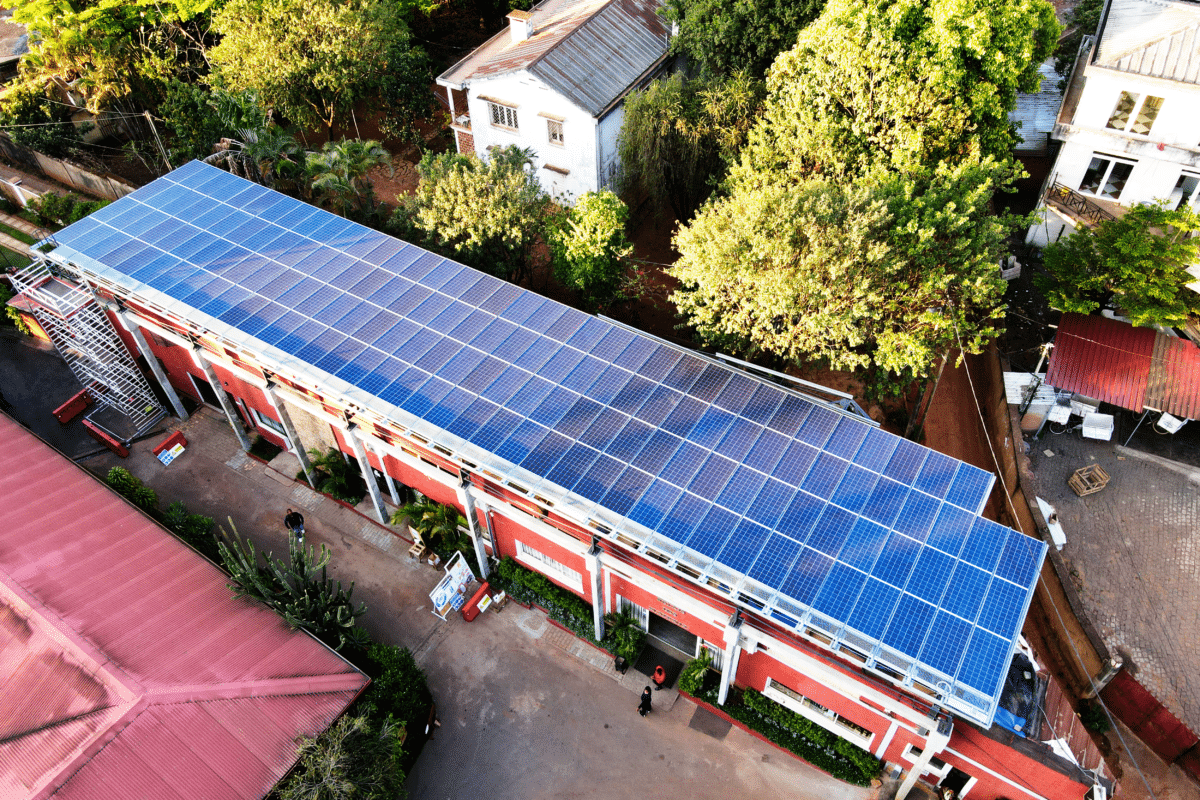

Image: Empower New Energy

The global energy organization estimates Africa installed between 1.9 GW and 3.3 GW of solar last year, around 0.9% of a global figure estimated to have been between 210 GW and 240 GW. If true, that would represent a landmark year for Africa, but how reliable is the IEA estimate?

Trade body the Africa Solar Industry Association (AFSIA) estimates the 1.8 GW of solar added in the continent in 2019 fell to just 700 MW in 2021 with the latter number representing around 0.41% of the 168 GW installed worldwide two years ago. AFSIA expects Africa to have added 900 MW of solar last year, less than half the volume announced by the IEA and less than 0.4% of the global figure.

The EU, by comparison, is reported to have installed more than 41 GW of solar last year, almost 50 times more than AFSIA's Africa estimate.

These figures fall into an alarming wider pattern highlighted by Bloomberg New Energy in its “Scaling-Up Renewable Energy in Africa” report. While the world posted an all-time high $434 billion worth of renewables investment in 2021, Africa attracted no more than $2.6 billion – less than 0.6% of the total and slipping 35%, year on year, to the lowest level since 2011. Africa reportedly boasts around 60% of the world's solar resource – plus abundant hydro, wind, and bio energy potential – and 17% of the global population.

Reality bites

It can be uplifting to read the IEA's prediction Africa's solar fleet will expand 250% within five years, helped by the energy security fears and decarbonization objectives in big economies which are fueling the global clean energy boom. But the reality on the ground is that much needs to be done to attract the $4 billion to $5 billion needed annually to reach that milestone. If governments and other parties do not surmount the barriers deterring investors from the continent, Africa will continue to lag competition for solar investment from the US, Europe, China, and India, just as it did in the last two years.

A glance at the IEA statistics shows Egypt and South Africa host around 60% of Africa's solar generation capacity, thanks largely to the vast Benban Solar Park is Aswan, Egypt; and to South Africa's Renewable Energy Independent Power Producer Procurement Programme (REIPPPP).

Those two nations – plus Morocco, Nigeria, Kenya, and Ethiopia – will raise their current 5 GW of solar to 20 GW in 2027, according to the IEA, with 12 GW expected in Africa's other nations, which currently host only 1.5 GW between them.

Hurdles

Why it is so difficult to increase solar investment in Africa? There are three main obstacles: debt overhang, currency crises, and regulation.

Most of the utility scale solar and wind projects announced in Africa of late remain stalled, waiting for government-backed payment guarantees for the electricity to be generated. Investors and lenders request such assurance because Africa's utilities are wracked with debt but many governments are also in dire straits, ensuring payment guarantees cannot be issued.

The global recession expected as a result of the Covid-19 pandemic has been followed by soaring interest rates on the debt held by deeply leveraged governments; rising energy bills prompted by the war in Ukraine; and a dramatic fall in local currency values against the dollar. Yet again, Africa has been hardest hit. Public debt has doubled in the continent, from making up 32.7% of GDP in 2010 to 65% last year and the World Bank estimates most African nations will suffer a 30% to 40% increase in yearly debt servicing payments. World Bank president David Malpass said, “The increased liquidity pressures go hand in hand with solvency challenges.”

Popular content

Currency

A sharp appreciation of the dollar against African currencies last year has left governments and private energy off-takers in an even worse position. For example, the Egyptian pound and the Ghanaian cedi depreciated around 70% against the dollar last year. In Nigeria, the cost of a dollar may officially be around 450 naira at the moment but the “real” price being paid is around 800 naira, up from 550 naira, or so, at the start of the year.

Richer nations can ride out currency wobbles by turning to local investors but Africa is dependent on foreign cash. International investors are interested only in dollar or euro revenue, otherwise the cost of capital will be prohibitive and unpredictable.

Commercial and industrial solar has the largest untapped potential for African PV but regulation and fossil fuel subsidies are holding it back. In the majority of African nations, businesses are not permitted to buy solar power from non-utility generators, through power purchase agreements, and must instead use less flexible contractual agreements such as equipment-lease terms.

Net-metering

The absence of net-metering arrangements, to pay solar power generators for excess electricity they inject into the grid, is another deterrent to PV investment.

With so many governments continuing to subsidize fossil fuels by providing artificially cheap electricity tariffs, there is another big disincentive to back solar. In Egypt, for instance, diesel costs around EGP 7.20 per liter ($0.24), around 20% of the price it commands in Europe.

Africa clearly has the potential for turbo-charged growth in renewables, as projected by the IEA, but if governments and international partners do not address the barriers holding back investment, the continent will continue to fall behind. This is a risk we cannot take if the world is to reach net zero.

Solutions

So what needs to be done?

Energy reform, debt restructuring, and currency stability are clearly important but it is market-based price incentives for solar and batteries that could make a real difference. This could come in the form of a carbon tax, or tradeable carbon credits for clean power generators, and would help the business case of large energy users and microgrids which currently rely on diesel.

Further ahead, there is the option of carbon offsetting – whereby big polluters are able to offset their carbon footprint with payments to fund decentralized solar in Africa. That sort of measure could unlock a market for African green hydrogen to power microgrids and energy-intensive industry, alongside the use of fuel cells – and that could kick-start a clean-power fueled African economic revival.

About the author: Terje Osmundsen is co-founder and CEO of Oslo-based commercial and industrial solar and storage investor Empower New Energy, which focuses on installing small and medium-sized systems in Africa.

This copy was amended on 18/01/23 to indicate Terje Osmundsen was not presenting at the World Future Energy Summit.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.