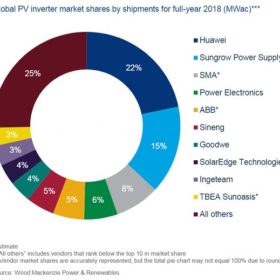

Huawei remained world’s largest inverter provider in 2018

The Chinese string inverter giant was the world’s biggest supplier for the fourth year in a row, in spite of having lost 4% in global market shares, according to analyst Wood Mackenzie. Asia-Pacific was again the largest inverter market last year, accounting for 64% of global shipments. Sungrow and SMA were, respectively, the second and third largest providers.

Bringing battery knowhow in house

Back in October 2018, SolarEdge announced its acquisition of Korean battery maker Kokam. Executives from both companies will be featuring as a part of discussions at pv magazine’s Future PV Roundtable during Intersolar 2019 and Lior Handelsman, Founder and VP for marketing and product strategy for SolarEdge spoke to pv magazine about the acquisition and strategy.

EnergySage report suggests Panasonic, LG gains in US rooftop solar

EnergySage’s quarterly intel report also showed Enphase winning back U.S. market share from SolarEdge, falling costs and bigger rooftop PV systems.

Smart Energy Week in Tokyo: Self-consumption, storage and a plentiful pipeline for now

Though we’re unlikely to see a return to the days of double-figure GW annual installation levels, Japan will stay at the top table of solar. Last week, pv magazine visited PV Expo Japan, part of Tokyo’s World Smart Energy Week, and found plenty of market developments to discuss, along with healthy interest from major players.

The weekend read: Just look who is closing ranks!

Owners of residential PV systems increasingly want more features. Virtual power plants, smart EV charging and self-consumption measured by ever higher percentages of self-sufficiency have been buzzwords in the industry. The result has been a new breed of smart bidirectional inverters, sometimes dubbed hybrid inverters. And with utilities having found business models that also work out in their favor, could a new dawn of residential installations rise over the world of suburbia?

Bullish SolarEdge posts $100 million rise in gross profits and predicts strong start to 2019

Unimpressed by last year’s China policy-related shenanigans, the inverter maker continued to grow at a rapid pace as it acquired storage, uninterruptable power supply (UPS) and e-mobility related businesses. Its full-year results place SolarEdge in a good position going into a more promising year, with solar installations expected to hit double-digit growth figures in many markets and reach 120 GW globally.

Inverter maker SolarEdge to acquire Italian EV company

Israeli company will offer $77m – made of up cash and shares – for a controlling stake in electric vehicle power train manufacturer SMRE with the aim of then making the Italian company a wholly-owned subsidiary as the Italian government plans a big EV push.

SolarEdge’s latest quarterly results show robust growth

The inverter maker took number one spot in the US from SMA this year, and acquired majority stakes and IP in uninterrupted power supply company Gamatronic and storage system provider Kokam. While other companies have consolidated, SolarEdge managed to report robust results.

Inverter maker and battery giant charge into US market

German inverter maker SMA has joined forces with China’s BYD after losing US market share to Solaredge, which this year linked up with Kostal to optimize communication interfaces between inverters and storage applications.

Solaredge charges into storage market, acquiring Kokam

The inverter maker will buy 75% of Kokam’s shares for $88 million, with an intent to acquire the remainder shortly after, on the open market. Strategic company acquisitions and close partnerships are characterizing this year’s inverter market, as companies seek to diversify and integrate storage systems and other technologies.