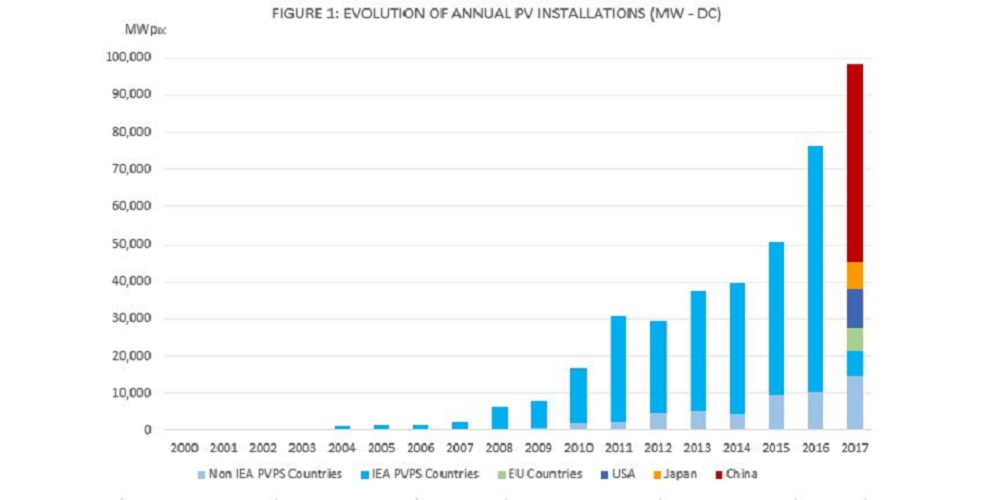

The International Energy Agency's Photovoltaic Power Systems program (IEA PVPS) took stock of the global solar market this week in its report, “Snapshot of Global Photovoltaic Markets.” According to this, the global cumulative installed PV capacity reached 402 GW at the end of 2017, while newly installed PV power for last year was around 98 GW, which is in line with other analyst calculations. In 2016, new additions totaled around 76 GW.

The European market is gradually recovering – with an increase of 6.5 GW, up slightly from 6 GW in 2016. In Europe, Germany remained in poll position, with 1.8 GW of new installations, followed by the U.K. (950 MW), France (875 MW) and the Netherlands (853 MW). Turkey, which grew by a remarkable 2.6 GW last year, was included by the IEA PVPS in the Middle East region. SolarPower Europe, in contrast, recently bundled it together with the European market.

Overall, the IEA states that global solar market growth is still relatively low. The authors of the report point out in particular, the rapid development in China, with an increase of 53 GW, India with 9.1 GW, and other emerging countries. China thus accounted for over half of the global market last year.

After 2011, the market for decentralized PV systems has again grown significantly worldwide for the first time, from a cumulative capacity of 19 GW in 2016, to 38 GW in 2017. But here, too, the main growth was from China.

Excluding China, the global solar PV market grew by just 4 GW to 45 GW in 2017. According to the IEA PVPS, this low global growth outside of China paints a less positive picture of the global PV landscape. For example, the U.S. market fell by 28% to 10.6 GW.

Markets, such as Australia (1.25 GW), South Korea (1.2 GW), Pakistan (800 MW), Taiwan (523 MW) and Thailand (251 MW) are now established, and this is could also also happen for countries like Malaysia, the Philippines, Vietnam and Indonesia in the coming years, continued the authors.

The IEA has persistently issued conservative renewables forecasts, also with regard to solar PV. However, IEA PVPS is aware of the potential of this technology, not only in terms of annual cost reductions.

“The speed of their development is based on their unique ability to cover most market segments – from the very small individual systems for rural electrification to utility-scale power plants,” wrote the report's authors. And indeed, no technology has grown as fast as solar PV in the past year. In the future, declining battery prices and increasing electromobility could further accelerate this development, they said.

Despite the recent massive expansion in China, the potential there remains huge. According to the report, the country currently only covers 3% of its electricity needs with solar. Topping this ranking are Honduras with over 13%, Germany with 7.5%, Greece with 7.3%, and Italy with 7.11%.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

And if China’s installations had been double what they were, installations would have been faster.

What a said excuse for not being able to do their job correctly (or at least close to correctly).