From pv magazine, November edition

On the floor of the 2018 Solar Power International trade show, manufacturers showed off a wide array of new module designs, with half-cut cells, copper wire interconnections, and bifacial modules all over the place, often in combination.

But one thing was consistent: The majority of the modules on display featured monocrystalline silicon, and there was even a module made of half-cut cells with the distinctive absence of grain at the booth of the world’s largest maker of multicrystalline silicon wafers. And the trend to monocrystalline is global.

For years, monocrystalline technology has been reserved largely for residential and other space-constrained installations, and multicrystalline has dominated the utility-scale sector. But market analysts say that more and more large-scale solar plants are using monocrystalline modules, and two different analysts told pv magazine that the global split between mono and multi product sold will be within a few percent of 50/50 in the second half of this year. This is a sea change from the first half of 2016, when modules using monocrystalline cells made up less than 30% of all product sold.

Price dynamics

Price dynamics underlie this market shift. According to IHS Markit, prices for mono wafers fell to $0.133/W in the first half of 2018, making them only 10% more than multicrystalline wafers. This difference is less noticeable as the products are made into cells and then modules, as there is no inherent higher cost for mono cell production or module assembly. By the time we reach system prices, this is often more than compensated for by a balance of systems advantage due to the higher efficiency of monocrystalline silicon.

So how has monocrystalline silicon been able to reduce prices so sharply, and why is it taking over the global market? In order to answer this question, you have to go to the factories.

Diamond wire and PERC

Monocrystalline silicon makers have benefited from two of the big technology trends in solar wafer and cell manufacturing: diamond wire slicing and PERC.

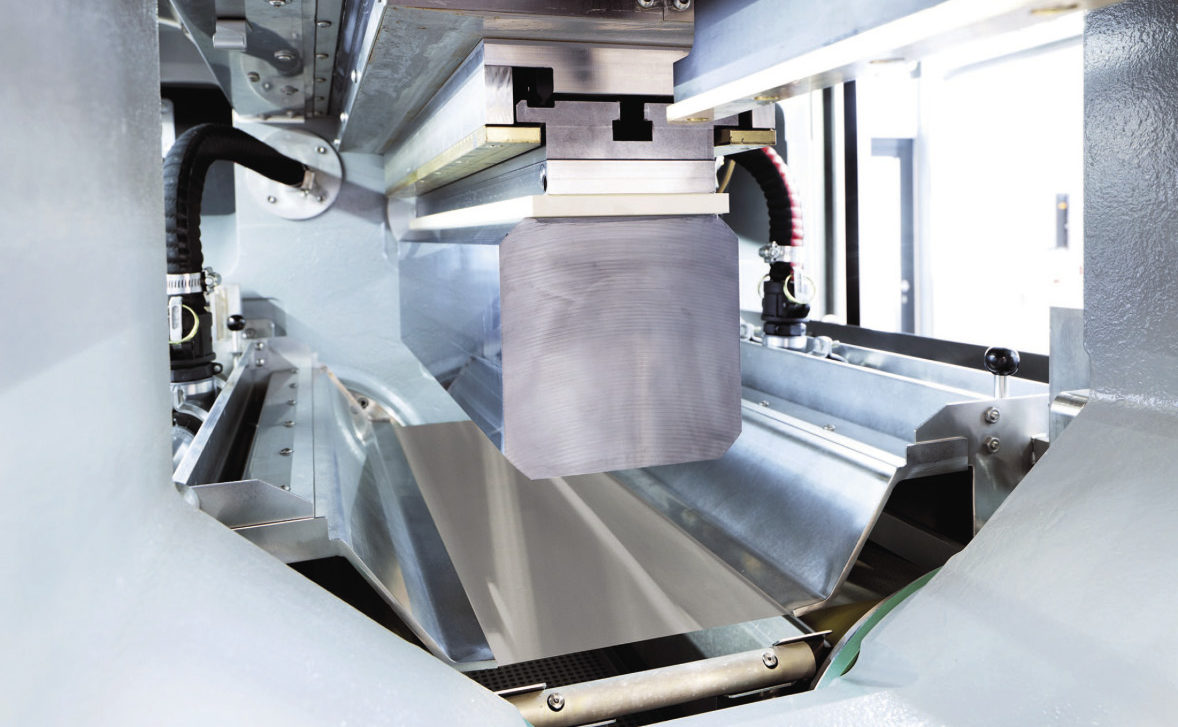

Chinese manufacturing giant Longi Green Energy Technology, which has led the rise of mono (See China’s monocrystalline boom, pv magazine 04/2018, p. 56), claims to have been the first company to widely deploy diamond wire sawing. These are more expensive than slurry saws but also more efficient, with no need for glycol slurry or grit, and less saw waste, meaning more wafers per kilogram of ingot.

Diamond wire sawing was pioneered by Switzerland’s Meyer Burger, but as has been the case with other equipment, Chinese manufacturing is bringing down the cost of these saws, making a further economic case. At first, multicrystalline wafer makers could not take advantage of diamond wire sawing, as the saw left too smooth of a texture, which did not work with existing wet processes.

However, with multicrystalline wafer and cell makers making modifications to their etching solutions, by the end of 2017, diamond wire had also become the dominant technology for multicrystalline silicon, often combined with black silicon surface treatments.

A potentially longer lasting technological driver to monocrystalline has come with passivated emitter rear contact (PERC) cell technology. PERC requires only a few process additions, and the machinery to do PERC is far less expensive and easier to integrate than switching over to heterojunction or interdigitated back contact (IBC) cell designs. PERC has been the high-efficiency design of choice for many manufacturers during the last six years.

PERC can give both multi and monocrystalline silicon a boost, but the advantage is greater for mono. Charts from the German Mechanical Engineering Industry Association’s (VDMA’s) latest International Technology Roadmap for PV (ITRPV) show the average efficiency of multicrystalline PERC cells at around 1% higher than standard multi, but for monocrystalline cells it is more like 1.7%.

This relative efficiency gain is not the only advantage of mono-PERC over multi-PERC. PERC cells are more susceptible to light-induced degradation (LID) and light and elevated temperature-induced degradation (LeTID), and analysts including IHS Markit Research Director for Solar, Energy Storage and Smart Utilities Edurne Zoco say this is a bigger problem for multi-PERC: “LID is the biggest problem,” notes Zoco.

RCz and CCz

While both PERC and diamond wire have been significant, another factor in the shift to mono is lower costs coming from dramatic improvements in casting monocrystalline ingots through the Czochralski process. This includes the ability to cast more monocrystalline silicon in a single crucible, through the rechargeable Czochralski (RCz) and continuous Czochralski (CCz) processes.

Longi, the world’s largest monocrystalline wafer maker, stresses the advantages of the RCz technology it has widely adopted. Various analysts estimate that the company is getting three ingot pulls from a single crucible; however Longi Chair Zhenguo Li tells pv magazine that his company is getting as many as five.

Not only does this extend the life of crucibles, but also saves energy and reduces downtime. And in the world of ingot casting as elsewhere, time is money. “The main driver is productivity, which leads to lower cost,” explains Simon Price, the CEO and head of research at U.K.-based analysts Exawatt. Price notes that RCz has also benefited from a move to larger crucibles, which means longer ingots and less time loading and unloading, as well as other advantages. “There are little bits of savings all along to doing RCz,” he says.

RCz is not the only technology to get more monocrystalline silicon out of a single crucible. In 2016 GCL-Poly, which has managed to stay just ahead of Longi as the world’s largest wafer maker overall (including both mono and multicrystalline silicon wafers), bought the intellectual property behind SunEdison’s continuous Czochralski process, and in April of this year established a joint venture to build 20 GW of monocrystalline ingot capacity using this technology.

GCL also acquired SunEdison’s fluidized bed reactor (FBR) polysilicon technology, which it says produces the best material for making CCz mono. GCL is currently the only company in the world to own viable versions of both of these technologies. Exawatt’s Price notes that there are some advantages to CCz “in principle,” including the ability to run at a lower temperature, reducing wear on crucibles and extending crucible lifetimes. More significantly, he says that the process allows for better control of doping. Not only does this mean easier production of n-type silicon, but allows for gallium-doped wafers.

Longi agrees, stating that the “CCz process produces a narrower longitudinal resistivity distribution of silicon ingots that is suited in high-efficiency p-type PERC and high-efficiency n-type cells.” But while GCL claims that CCz can greatly improve efficiency and reduce overall production costs, the jury is still out on this question.

As opposed to RCz, which uses equipment similar to previous processes, CCz technology requires modifying pullers to allow for two feeders, both of which need to be continuously working. “There are loads of little wrinkles that need to be ironed out,” states Exawatt’s Price.

Price further notes that the development of the technology may be slower due to the limited number of companies working with CCz, as opposed to many other processes in the solar industry where dozens of companies are working on parallel paths. Longi has a less optimistic view of CCz and is informed by extensive experience – the company started an R&D project using CCz in 2011 and closed it in 2015. Among other concerns, Longi notes that CCz requires a double crucible, which drives up prices. “The reason that we have not used it for mass production is that we believe that RCz is more competitive,” Longi Chair Zhenguo Li explains. Li has also expressed concerns over powder and hydrogen issues in FBR polysilicon.

However, Longi is still involved with CCz, as in August the company returned to limited CCz production through a joint development agreement with Aiko Solar. Longi says that this is to find out if CCz can bring more value to end-customers, and if they will bear the higher costs.

“Hundreds” of improvements

Whether through RCz or CCz, monocrystalline silicon is advancing. Every expert who pv magazine spoke with stated that the speed of ingot pulls is the biggest driver for reducing costs, and these are moving quickly. Exawatt’s Price estimates that ingots are being pulled at roughly twice the speed they were only four years ago. “I don’t know what the ceiling is,” he admits.

Along with this, both crucibles and ingots are getting bigger, which also leads to greater productivity. Ingots up to five meters long are now being pulled, and monocrystalline ingot technology company Linton Crystal Technologies notes that the main limit so far has been the infrastructure to move the final product.

The progress does not stop there. Longi Chair Li has explained that there have been “hundreds” of improvements to the process of casting monocrystalline silicon ingots over the past few years.

Simon Price expressed a similar sentiment, noting that there are “a lot of little iterative processes” that have made mono cheaper, including improvements in hot zones.

It is worth noting that Longi may be responsible for a fair amount of the overall progress. At present, Longi spends more money on research and development than any other large PV maker, both as a portion of its revenues and in raw dollars, and roughly half of this goes to the ingot and wafer process.

The future

It is obvious that mono is gaining on multi and becoming the more widely used technology, but analysts and market participants are divided as to how far this will go. “We are not so bullish as the other voices in the market,” states IHS Markit’s Edurne Zoco. “The market is not going to be 80% mono in two years.”

However, Zoco also notes that at present utilization rates are higher for mono producers than multi, and this is already having market impacts. “We might see some exits,” warns Zoco, noting that Daqo New Energy has already pulled out from multicrystalline wafer production.

Downstream, companies are voting with their feet. Even REC Solar, which was deeply invested in multicrystalline technology and has long championed multi-PERC, is now also producing mono-PERC products, including a line of mono-PERC modules for residential solar customers.

This shift is particularly pressing for GCL-Poly, which despite its inroads into mono remains the world’s largest producer of multicrystalline silicon ingots and wafers.

GCL is feeling the heat financially, and in the first six months of 2018, its profit fell 68% compared to the prior year – a decline likely exacerbated by mono’s growth.

But this may only be the beginning. GCL has a massive stock of directional solidification system (DSS) furnaces to make multicrystalline ingots, and if multi loses too much market share, they could become stranded assets. One solution for GCL has been to grow single-crystal ingots in its existing DSS furnaces to create “mono-like” wafers. However researchers note that it is challenging to keep the monocrystalline structure as the ingot grows, resulting in more waste and less efficiency. GCL states that it is pursuing a “dual-track” strategy of both mono and multi, the former in collaboration with Zhonghuan Semiconductor, which has been the second-largest mono ingot and wafer maker and which, like Longi, has grown rapidly over the past few years.

This may be its best move in a market increasingly dominated by mono. “The fundamental thesis is that absent some kind of real technological innovation, it’s kind of the beginning of the end for multi,” notes Exawatt’s Simon Price. “Broadly speaking, we don’t really see anything that gets multi back ahead at this point.”

Correction: This article was corrected at 16:25 CET on November 26. An earlier version stated that Longi was gaining on GCL as the world's largest polysilicon maker, and this was incorrect. Longi is gaining on GCL as the world's largest wafer maker, and the text has been updated to show this. We regret the error.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.