PV projects in Cyprus may be installed under the following three policy schemes: net metering; government set feed-in tariffs; and feed-in tariffs via competitive tenders.

The current landscape

A 50 MW tender held in January 2013, which concerned the development of 23 PV parks, led to tariffs as low as €0.0741 per kWh.

The most crucial element of the tender was that the generated power was bought by the Electricity Authority of Cyprus (EAC) at prices most often lower than the amount paid to produce electricity from fossil fuels. Of the awarded capacity, around 35 MW have been installed to date.

In addition to tenders, for the past six years a net metering scheme for all residential, commercial and industrial PV consumers has been in place. It often hands cash out to vulnerable residential consumers to install PV systems on their rooftops.

All three policy schemes have led to approximately 120 MW of solar PV capacity being installed in the Republic of Cyprus.

120 MW of subsidy-free PV

Nevertheless, the current talk of the Cypriot PV community is a new wave of development set to arrive via a number of subsidy-free plants.

Specifically, in 2017, Cyprus’ Ministry of Energy, Commerce, Industry and Tourism announced a new plan to aid in the development of 212.5 MW of renewable energy, which would compete on the country’s wholesale electricity market.

Of this, 120 MW will comprise PV, while 50 MW will be for solar thermal plans with onsite storage, 20 MW wave energy plants, 17.5 MW wind energy plants and 5 MW biomass plants.

Developers who aim to build the new subsidy-free plants had to submit their applications by April 30, 2018. The only exception was for wave power plants, for which a later submission date will be announced.

The government has published a list of preliminarily approved projects, which include PV parks ranging between 100 KW to 8 MW. The aim is to have these projects installed and operational by December 31, 2019*, at the latest.

Revenue streams

An EAC spokesman told pv magazine the subsidy-free PV plants will only be paid the variable, so-called “avoidance cost”, which is currently €0.12 per kWh, although in the past it has reached down to €0.046 per kWh.

This equals the amount of money the EAC saves by not paying the fossil fuel power plants to generate the power that will be generated by the renewable energy plants. Therefore, added the spokesman, the avoidance cost is a market neutral arrangement.

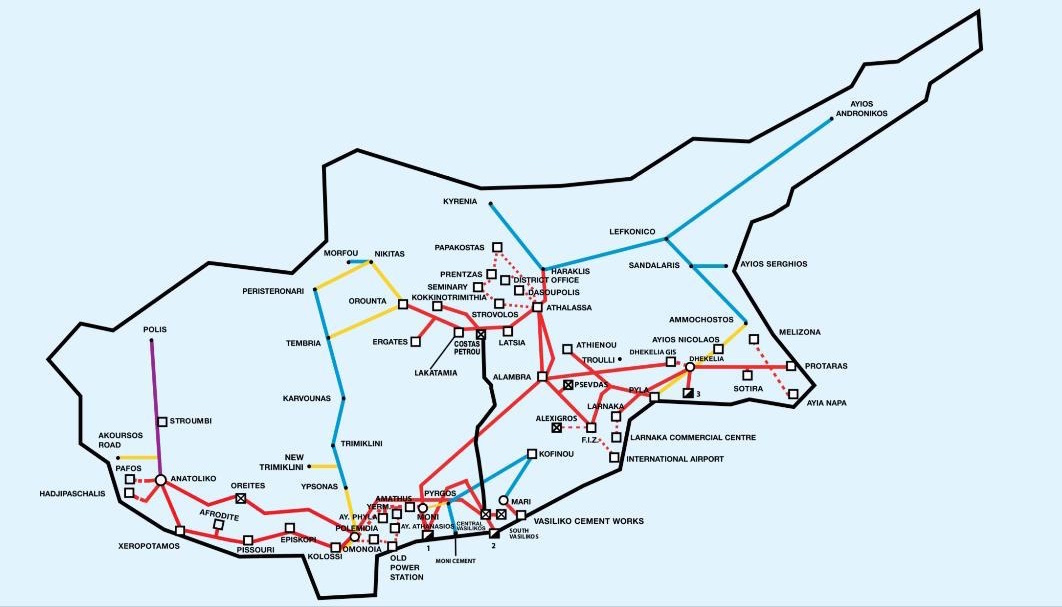

Image: EAC

According to information provided by the EAC, Cyprus’ electricity generation fleet includes 1,550 MW of fossil fuel-based plants, 175 MW of wind farms, about 120 MW of solar PV capacity, and around 8 to 10 MW of biogas units.

Tariffs vs. subsidy-free plants

While the new wave of installations is considered subsidy-free, the so-called avoidance cost revenue stream is controversial.

Indeed, Cyprus’ fossil-fuel electricity generators primarily include diesel and heavy fuel oil (HFO) machines. Some of these can operate with gas too, but this is an island country with no liquefied natural gas (LNG) terminals, meaning Cypriots currently burn diesel and oil to generate the majority of their electricity.

A solar PV tender held six years ago produced tariffs ranging between €0.0741 to €0.097 per kWh. A new tender held in 2019 would most certainly produce lower tariffs, which could outcompete the avoidance cost prices.

Therefore, even with a stable tariff mechanism set via a new tender, similar to that held in 2013, Cyprus could pay less for the new wave of PV plants than in the new policy scheme.

Moreover, the formula to calculate the avoidance cost is not very transparent, due to the use of a complicated way to reflect the cost of conventional power generation at any point in time (e.g. peak versus non-peak generation times).

2020 target

The Cypriot Government devised an energy master plan, which includes an updated goal of 360 MW* of installed solar PV capacity by 2020. It is accountable to the European Union for implementing it.

Perhaps it is because of this target that it last year implemented the subsidy-free renewable energy plants scheme based on the avoidance cost, to attract investors.

Nevertheless, the government and its institutions need to hurry. Developers of the preliminary approved subsidy-free PV parks still need to gather numerous licences, which allow them to start construction. However, based on research undertaken by pv magazine, cumbersome bureaucracy is the main problem for the development of the PV sector in Cyprus. The government needs to make sure its institutions deal with the license process efficiently.

On a positive note, Cyprus’ economy has left the economic doom of 2012 a long way back, scoring a 3.9% annual GDP growth in 2017. Forecasts for the years 2018 and 2019 also predict robust economic growth.

Overall, this year could be a pivotal year for the Cypriot PV sector, if the country plays its cards right.

* The article was amended on 10.1.2019 to include updated figures.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.