From pv magazine December 2018 issue

Benedikt Ortmann, Managing Director, BayWa r.e. Solar Projects GmbH sits behind the wheel. “I don’t think we can go there,” says his construction site manager, sitting in the passenger seat of the van. He points at a 10 meter wide, deep looking puddle in the middle of a solar park. It’s pouring cats and dogs outside. Ortmann is driving a small group of journalists through the company’s latest achievement. “But then we can’t see what is on the other side,” Ortmann says smiling. He pushes the accelerator and propels the van across the lake of mud, up a little hill, sliding his way to a halt adjacent to the substation. Ortmann appears to delight in pushing the van out of its comfort zone. And likewise, he is happy solar is pushed out of its comfort zone, into a subsidy-free future. And that surely is what lies behind the first stage of European PV projects, which were dependent on subsidies.

The reason the BayWa r.e. Managing Director was so excited to drive journalists through that muddy field was that it was the site of what the company calls Europe’s first utility-scale, subsidy-free solar plant. The Don Rodrigo solar park, just outside Sevilla, Spain with a system rating of175 MW, was first conceived in 2012 and is set for commissioning in Q2 2019.

Looking back on the Spanish solar market in 2012, the Don Rodrigo project was by no means an obvious move. The Spanish government infamously had retroactively applied policies to strip solar projects of their revenue streams. Ortmann says that he had much convincing to do, within BayWa r.e.’s board and with the investors, but he maintains, that because the plant is entirely independent of any government support it is also immune to policy backflips, or indeed policy vacuums. In southern Europe, including Italy, Portugal, and Spain, there are currently roughly a dozen projects claiming to be subsidy-free at various stages of completion, and there are several gigawatts in the pipeline and shovel-ready (see pp. 24-27).

The owners and developers of these new breed of projects routinely claim that they are the pioneers, setting out into new PV territory. Each measures its uniqueness by a different parameter – making each a first on its own terms. But beyond this first dash of vanity, much more unites them than sets them apart.

They tend to be located in areas of high solar irradiation, benefit from falling system costs, and above all, have gained the long-term trust of utilities, IPPs, or otherwise private off-takers who have come to attractive financial agreements – primarily, power purchase agreements (PPAs) running more than 15 years. Hitherto, planning periods longer than six years had been rare. However, as companies see PV as a secure and stable investment, and one that can deliver returns after a decade or more, they are increasingly willing to join the game.

Chop, chop costs…

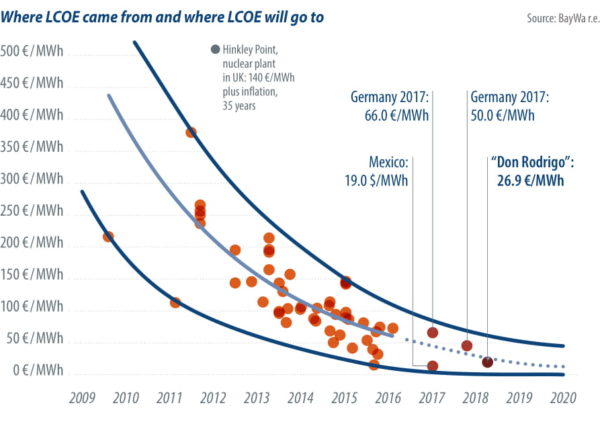

Two circumstances have laid the groundwork for this new game, according to BayWa r.e. One is the fact that system costs have fallen significantly in recent years. This year alone module prices decreased by more than 20%. And with modules comprising 50% of the overall system costs, if their prices are falling, tougher competition among other components ensues, to the effect that the whole system cost falls by a similar margin.

In this vein, BayWa’s Ortmann explains that he has to repeat time and again to himself, that solar is now the cheapest form of energy generation – below the costs for gas, wind, and coal. “For 15 years I had been working in the industry, and I thought that PV was the most expensive source of energy. But now we have a paradigm shift, and it is finally the cheapest source of energy,” he says pointing at a chart that shows new solar PV’s LCOE at €0.04/kWh, compared to new coal (€0.063/kWh) or new gas (€0.085/kWh), with the right settings in place.

For Ortmann, solar is now moving towards the next stage of its development, namely grid parity. The current trajectory of module prices and the different market scenarios will dictate the speed at which grid parity is moving further north.

Ortmann cites work from the Becquerel Institute as a basis by which European countries can be understood in terms of when they will arrive at subsidy-free utility-scale solar. The Becquerel map considers system price trajectories as well as national electricity price projections, but does not consider the cost of land or grid-connection.

From this alone it is clear that grid parity does not hinge solely on irradiation levels, with grid parity projects arriving earlier in the United Kingdom than in southern France, for example. Crucially, it shows that by 2021 grid parity is realistic everywhere, except in the Scandinavian countries.

The Don Rodrigo plant achieves an LCOE of €27/MWh. At this cost, the plant would be fully depreciated in 15 years. Ortmann explains that the same site in Germany would take about 20 years to depreciate, with current system costs and an assumed LCOE of €50/MWh, as was achieved in 2018 tender rounds. However, the trajectory of the cost development is clear, and he is adamant that he will be able to build a subsidy-free site in Germany by 2020. And determination is something Ortmann is not lacking.

In solar we trust

Another driver of grid parity in European PV is that investors and corporations are weaning themselves from their addiction to short-term planning, instead showing a willingness to issue long-term PPAs that ultimately enable the financial viability of subsidy-free solar plants. While governments or the public institutions in some markets have issued PPAs longer than 15 years, corporations are not used to operating procurement contracts longer than five to six years.

“Private PPAs are by nature risky, given the duration of the investment, and require adequate market conditions to develop. A PPA is a contract, but the nature of the contract remains the provision of electricity during many years,” Gaëtan Masson, cofounder and Managing Director of the Becquerel Institute, said in a statement to pv magazine.

For the Don Rodrigo plant, a 15 year PPA was signed with Norwegian utility Statkraft, for an undisclosed price. Over the first five years, Statkraft will pay a fixed rate: important for investors’ IRR calculations and the overall bankability of the project. For the 10 years thereafter, the tariff is market-oriented, but Statkraft will pay a minimum floor price, to make sure that the plant can pay its bank loan is still possible even when spot market prices are too low. By BayWa r.e.’s own account, such a variable price scheme also secures the off-taker against future spot market developments, over time, as well as protecting the solar asset owner. If prices climb, both parties benefit: The offtaker by purchasing on a discount and the generator by realizing higher revunues. Given this, there is some flexibility built into the PPA.

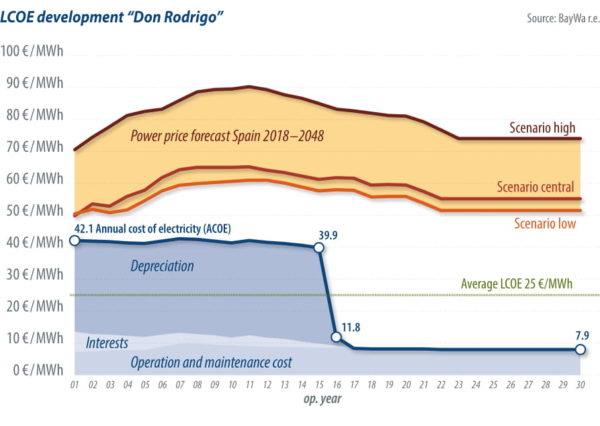

Assuming a lifespan of around 30 years for the plant, BayWa r.e. calculates that it can achieve an annual cost of electricity of just over €40/MWh for the first 15 years after commissioning. After this point, and with a fully amortized asset, electricity cost from the asset falls to around

€8/MWh – the magic of zero marginal cost generation. When measured against Spanish power price projections, which range between €50/MWh and just over €70/MWh, this is exceedingly attractive. Ortmann says that he does not plan to construct any more solar plants under FITs and tenders anywhere in Europe. He sees the future clearly in private PPAs, and also believes that he will be able to do so on the rest of the continent soon. Local power prices, land costs, and permitting regimes play a role in making grid parity, large-scale solar a reality. BayWa r.e. had considered Italy for its first such project, but because subsidy-free plants need economies of scale, suitable sites would exceed the easy permitting regime in Italy, which applies to sites up to 50 MW. Solar parks above that rating have to undergo an alternative development process – for Ortmann simply not an option. Another reason was that electricity prices were coming down in Italy, which further jeopardized plans.

Road to grid parity

Europe’s road to grid parity is still muddy. Currently, there is a big push towards corporate PPAs especially through the group of corporations under the RE100 program. These companies have pledged to power themselves with 100% renewables in the foreseeable future. However, Ortmann cautions that corporate PPAs alone are unlikely to be the key instrument for the realization of subsidy-free utility-scale solar parks. The reason for this is that corporate offtakers are rarely in need of more than 50 MW of generation capacity. Below 50 MW is too little to benefit from economies of scale which are critical for grid parity projects. Following this logic, a plant developer would need to close three or more corporate PPAs for one solar park. Also, while energy companies have begun to calculate in 15 year terms, manufacturing industries or other potential off-takers, are not – at least not with their power bills at this stage.Therefore, private PPAs are going to be essential to enable this development, not just in Spain but across the EU. Merchant models, on the other hand, are unlikely to get a foothold, as they are connected to incrementally higher IRR in the two-digit percentage region, whereas PPA models can achieve IRR of about 6.5%. Taking FITs and other subsidy schemes out of the equation allows power producers to work with more security, free from sudden policy changes, and without burdening taxpayers through surcharges or other forms of extraordinary payment.

Ortmann says it also allows IPPs to build solar farms outside of tenders or government schemes and largely free of politicians likely to drag their heels regarding the energy transition. If the trick can be pulled off convincingly, others might follow suit, and considerably more solar PV can be developed in Europe than its governments had initially anticipated. Based on this, Ortmann wants to push solar out of its comfort zone. “I’m not so sure this will be acceptable so easily for policymakers. Energy, and especially electricity, has always been under the control of authorities, given the importance of energy in the economy in general,” says Masson. For him the issue is that energy regulators will continue to heavily regulate the market, to provide system and price stability. Regional ceilings for PV development are still not off the table.The way through the muddy solar farm was not easy and neither was solar’s adolescence. But it does appear that where there is a will, there is a way. And having travelled the path, the destination beyond subsidies becomes clear.

The author travelled to the Don Rodrigo solar park in Spain, for the purposes of this article, as a guest of BayWa r.e.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Some correction to the claim in the news piece: The first European Utility Scale subsidy free solar park was Ourika, a 46 MW park in Ourique, PortugL, that is operating since July 2018 and was recently bought by Allianz.

This one would be the second one, if it starts now.

Hi Joao M,

thanks for engaging with our content. There would be several other “subsidy-free” solar plants already in operation in Europe, in fact. There are many ways to define subsidy-free and utility-scale which makes it a contentious topic. Therefore the article reads: “The reason the BayWa r.e. Managing Director was so excited to drive journalists through that muddy field was that it was the site of what the company calls Europe’s first utility-scale, subsidy-free solar plant. ”

The emphasis is on ….what the company calls….

I hope this helped and thank you for your interest in our content.

Marian Willuhn