Spanish researchers develop materials to obtain hydrogen from water via microwave radiation

The developed process allows green hydrogen to be obtained from renewable electrical energy due to the design and use of materials that have redox properties and that respond to microwave radiation.

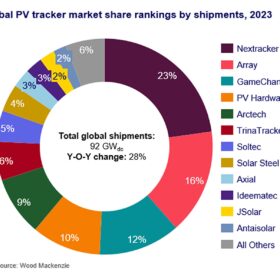

WoodMac says global solar tracker shipments grew by 28% in 2023

Global tracker shipments reached 92 GWdc last year, according to WoodMackenzies’ latest report. The US accounted for the majority of the global market, with three US-based manufacturers, Nextracker, Array Technologies and GameChange Solar, ranking as the three largest shippers in the world.

Optimizing grid-scale battery placement via quantum computing

A computing pilot program, housed within Europe’s largest electricity utility, Iberdrola, found that some quantum and quantum-inspired algorithms matched or outperformed existing benchmarks for optimal placement of grid batteries.

Portugal, Spain set records for daily solar energy production

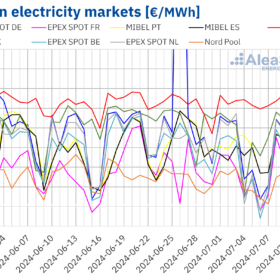

AleaSoft Energy Forecasting says average electricity prices rose in all major European markets during the second week of July, with Spain and Portugal breaking their daily solar production records.

Residential PV power forecasting method based uniquely on direct radiation

Researchers in Spain have created a novel PV forecasting method that uses only direct radiation as a parameter. They found it to be “comparable, if not superior” to four established forecasting techniques. The method could help homeowners with PV systems decide when to use electricity-intensive appliances and cleaning systems.

The Hydrogen Stream: Hydrogen power plants feasible but inefficient, says CATF

The Clean Air Task Force (CATF) says in a new report that dedicated clean hydrogen production and use is often a costly, inefficient decarbonization strategy for the power sector, while American Airlines says it has signed a deal with ZeroAvia for 100 hydrogen-electric engines.

Solar for small-scale brewing

Researchers in Spain have investigated the potential of using photovoltaic (PV) or photovoltaic-thermal (PVT) systems in microbreweries and have found that PVT systems can cover more energy demand but have a longer payback time.

Solar carports on the rise in Europe thanks to mandates

GoodWe has cut in half the time necessary to install a waterproof solar carport, according to the company’s Senior International Business Development Director of BIPV, Apollo Chai. He notes that the manufacturer has also already launched vertical and horizontal solar shades to address current gaps in the European market.

Cegasa presents new modular, scalable battery for C&I applications

The new EScal HV offers installations of between 17 kWh and 350 kWh using a stackable system that allows up to 15 modules to be placed in series, and four strings in parallel.

Spain authorizes 7.2 GW of new PV projects

The Spanish authorities have approved 7.2 GW of new PV projects so far this year, with 3.1 GW authorized in the second quarter alone.