Taken from the upcoming January pv magazine

Walking along Dubai’s Jumeirah Beach Residence area in 2013, there was a sign that read: “Keep Calm, We Still Have Oil.” Despite the United Arab Emirates (UAE) kick-starting the region’s first commercial solar power project only five years earlier, the country remained focused on its black gold – as did its neighbors.

Oil prices dipped in mid-2014, and while other oil producing regions suffered, the Middle East maintained its economic position. However, sustained oil market volatility lasting three years left the six-member Gulf Cooperation Council (GCC) scrambling to put into action new ways of revenue generation.

With smaller government coffers and electricity demand growing by more than 3% each year, countries began looking to economic reforms. The UAE started the movement by liberalizing its energy markets in 2015, followed by Saudi Arabia announcing its own path to market reforms by breaking up its utility Saudi Electric Company. Other countries are said to be at different stages of electricity market liberalization and reform.

In the meantime, there is a need to increase power generation capacity to meet the rise in demand. The GCC has planned and committed power investments over the next five years totaling nearly $140 billion, according to the multilateral development bank Arab Petroleum Investments Corporation (Apicorp). This makes up half of the capital planned for the power generation sector throughout the Middle East and North Africa region. Now the standard statement echoed throughout the Gulf is “energy diversification.”

Mustafa Ansari, a senior economist at Apicorp, says that nearly 30% of that capital is slated for renewable energy projects throughout the region. “Total planned and committed investment for solar and wind increased by 65% in our five-year outlook this year, compared with our outlook last year, meaning that renewable energy is featuring heavily in the investment plans of many MENA countries,” he notes.

The catalyst

Despite the fall in oil prices, the tipping point can be traced to the 2015 tender of the 200 MW second phase of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai, which saw Saudi Arabia’s Acwa Power win at a world record low bid price of $0.0584/kWh.

That number plummeted even further the next year with Abu Dhabi clean energy company Masdar winning the 800 MW third phase at $0.0299/kWh, and then the 1.17 GW Noor Abu Dhabi (previously known as Sweihan) at a weighted bid price of $0.0294/kWh.

Paddy Padmanathan, Chief Executive of Acwa Power, says that regionally, power today predominantly means renewables, and that of course includes a great deal of solar PV. “When solar PV is nearly three cents everywhere and even below in some places, why wouldn’t everyone rush to install more solar PV? After all, in the GCC, over half of the electricity consumed is when the sun is shining,” he says.

One of the other major policy shifts in the region has been the various country commitments to add clean energy to the total energy mix. French power utility Engie says that it has a multi-gigawatt pipeline thanks to the large-scale nature of solar projects in the GCC, though these policies also indicate a potential for small-scale and C&I solutions. “We recently submitted the lowest bid for the first corporate PPA in the region – a 30 MW PV project for NADEC, one of the largest dairy farms in Saudi Arabia. And Engie plans to expand its corporate PPA portfolio in the GCC where regulation allows,” an Engie spokesperson says.

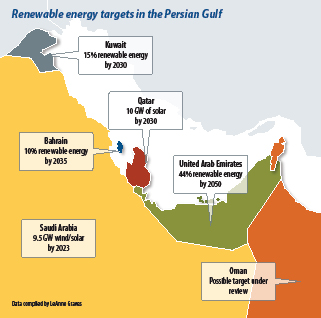

UAE has taken a lead here, pledging to procure 44% of its energy from renewables by 2050. Saudi Arabia has a target of

9.45 GW of renewable capacity by 2023, while Qatar plans to install 10 GW by 2030. Bahrain is also targeting 10% renewables in its energy mix by 2035, behind Kuwait which targets 15% by 2030. Oman is also said to be reviewing a possible nationally mandated target.

Another less publicized change is an increased willingness by transmission system operators to integrate renewables, according to Mohammed Atif, Middle East and Africa Regional Manager for Energy Consultancy at DNV GL. “This means we can see the upgrade of control centers in the region and widespread feasibility studies for integrating battery storage,” he says.

Lack of forward planning

Popular content

However, Atif notes that other problems may be on the horizon for the Gulf’s renewable energy plans if the region only focuses on these mega-projects. “The only issue I have is how a secondary market might or might not evolve.” This is due to the gigantic 1 GW type projects, though he says that if policy changes in the future allowed for portions of the plant to be sold off in a secondary market – then this could add liquidity and attract capital in the future.

The view of the Gulf region’s market as limited is not uncommon. Belén Gallego, chief executive of market intelligence firm ATA Insights, believes the solar market in the Gulf will continue to thrive in the future. However, a major obstacle is the scale of the projects with only one or two developers taking the lion’s share of capacity offered, serving as a disincentive to others. “This will limit innovation in the medium term,” she says.

The two main developers are Acwa Power and Masdar, with solar power projects (PV and CSP) in operation or under construction in the UAE and Saudi Arabia with a combined total of more than 2 GW.

Engie has been bidding for many of the major solar PV projects in the region; however, the company says that while competitive LCOEs are beneficial to driving higher solar penetration, recent solar PV auctions have seen aggressive bids. “The risk is that the bidders would sometimes see past the details to achieve a competitive [price], which may impact the projects during the execution phase,” an Engie spokesperson says. “The challenge is as tenders get more aggressive, risks are overlooked and the value creation to all parties becomes very minimal if not unachievable.”

The other issue is that while centralized government tenders have been the impetus in many ways to help markets develop quickly, the lack of clarity over the next few years limits companies’ abilities to plan and invest for the long term. Gallego says: “Solar developers need more visibility over future opportunities for the market to continue developing.”

The future conundrum

The problem is that while regional governments understand that there is a very real rise in electricity demand, particularly during peak times, the problem cannot simply be combated by adding more solar power capacity. Eventually, other components, such as scaling up the grid infrastructure, become necessary.

Jonathan Walters, independent energy economist and former World Bank Director, says that managing the intermittency of solar PV is on the horizon. As incomes rise, the use of more energy-intensive items such as air conditioners and large data centers will emerge. “It’s a huge driver for finding a way to make renewable energy 24 hours. But in the Gulf, so far that hasn’t been a huge necessity,” he says.

It is unclear if utilities and regulatory bodies have begun to reliably predict how to match supply to demand over the next 5, 10, or even 15 years. “In the power sector, many of your investments are long-term. You need to have a clear prediction, even if it’s multiple scenarios, to make investment decisions – and I’m not sure that the Gulf planning systems have really adapted,” Walters adds. “Sooner or later, you’ll hit a wall and you need to know when that wall is coming several years in advance, because you can’t build new generation plants with a snap of your finger.”

However, Walters says that he believes there is a “quiet revolution coming out of the Gulf,” but while only some of the world is taking notice, many haven’t been following closely enough. “I often speak to energy colleagues from all over the world who are simply unaware of the Gulf region’s solar tender results and don’t understand why. They think it’s just very sunny.”

The centralized systems under the government umbrella have procurement processes that allow very competitive bidding. In addition, huge swaths of land are on offer that reside near demand centers, which cuts the cost for transmission and distribution networks followed by huge economies of scale.

“Often economies of scale [emerge] because you’re out in the market buying 300 MW of PV panels – that’s some pretty important purchasing power – which further drives down the price,” he says. “Not many other countries in the world have that sort of configuration. And the effect of the tenders coming out of the Gulf over the past three years is revolutionary.”

LeAnne Graves

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The off-the-shelf technology for firming large-scale renewables on most of the world is pumped hydro, as recently demonstrated by Andrew Blaker’s team for arid Australia. (You don’t need a big river, the system can be closed-cycle.) But the Gulf is even drier and flatter, with no usable mountains until you get to war-torn Yemen. P2X is probably their best bet. Inter-connectors to Turkey and Iran would be technically possible, but not politically.