According to PV InfoLink’s supply/demand database, JinkoSolar’s shipments surpassed 11 GW in 2018, far higher than any other manufacturer. Astronergy (Chint) and Talesun both ranked 10th. This marked Astronergy’s first time ranked in the top 10.

Rapid growth of Chinese module manufacturers and Chinese domestic demand over the past two to three years led the top 10 module manufacturers to be all Chinese, except for Hanwha Q Cells. Looking ahead to this year, since the new capacities for First Solar’s factories in the USA, Malaysia, and Vietnam are climbing, the company is likely to be ranked in the top 10 again for 2019.

Consolidation

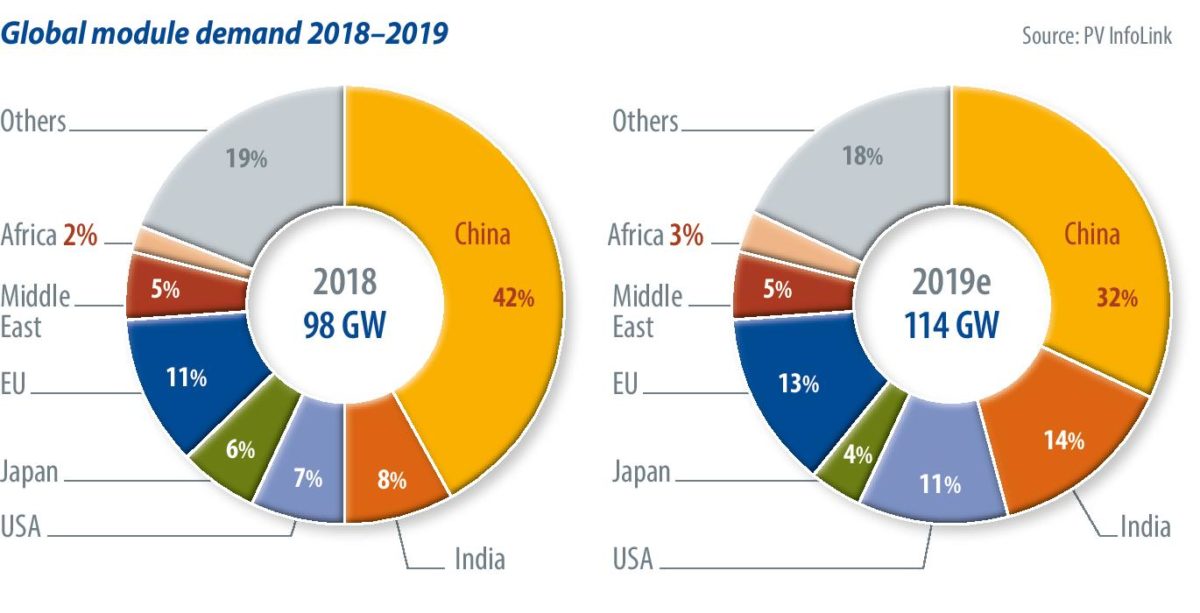

According to PV InfoLink’s database, although weak demand after China announced the 31/5 policy has led to lower total shipments in Q3 than in Q2, utilization rates for the top 10 manufacturers were maintained at a level higher than the industry average. Owing to demand rebounds both in China as well as overseas markets in Q4, the top 10 manufacturers’ utilization rates rebounded to over 90%, hitting a quarterly new high for many of them. The high utilization rate boosted the top 10 manufacturers’ total shipments to 66 GW in 2018, taking up nearly 67% of the total global shipments of 98 GW.

Looking back at H1 2018, more manufacturers were seen to have upgraded conventional cell production lines to PERC. The top 10 manufacturers have aggressively expanded capacities of new module technologies. By late 2018, top 10 manufacturers represent a PERC cell capacity of over 30 GW, and an additional 15 GW for half-cut modules.

Profits may be squeezed

Although demand will remain strong during the off-peak season in Q1, the market should witness weak demand in H1 2019 and strong demand in H2 2019, owing to more concentrated demand from China and the overseas markets like Europe and the United States, in the second half of the year. It’s projected that demand will be the weakest in February, after the lunar new year. By then, from polysilicon down to the module sector, the supply chain will experience a drop in prices.

However, despite the higher demand in H2 2019, subsidies have been lowered every year for different countries. Therefore, even though module prices may rebound during the peak season, the range of price increase is not likely to be as significant as that for the mid-to-upstream sectors of the supply chain. This was also the greatest challenge faced by module manufacturers this year. That’s why all module makers are aggressively coming up with new technologies, for example, products with larger-sized wafers, full square wafer, or half-cut, multi-busbar (MBB), shingled, bifacial, etc. They did so to further increase the cost effectiveness of products, widening the gap of module power output with conventional modules to pursue greater profits.

Judging from module makers’ capacity plans this year, most manufacturers chose to expand machines that are compatible with half-cut and MBB technologies. A few chose to expand shingled module production lines. It’s very rare now to see conventional production line expansion. Also, some manufacturers have upgraded existing production lines to bifacial, or special production lines that can fit wafers with sizes of 158.75 mm, 161.7 mm, or

166 mm. All manufacturers are getting ready for a year with product variety and a surge in module wattage.

Looking ahead to 2019, global demand is expected to increase by 16 GW, from 98 GW in 2018 to 114 GW in 2019. The market share of the top 10 manufacturers will remain at about 70%, but we forecast that mono products will make up nearly 56% of the total. In addition, the actual shipment of special modules will rise substantially, and thus manufacturers with lower high efficiency or special module shipment ratios may see reduced profits this year.

Cell ranking

For cells, the top cell manufacturer in 2018 was Tongwei. Aiko and UNIEX ranked joint second, while URE and Motech ranked fourth and fifth respectively.

2018 could be seen as a turning point for the cell segment. With the large-scale and cost advantage of new capacities, top-tier manufacturers like Tongwei, Aiko, and UNIEX posted shipments of over

4 GW. Total shipments surpassed 6.5 GW for Tongwei, far higher than any other cell maker. It’s projected that Tongwei, Aiko, and UNIEX will continue to be the top three cell manufacturers in 2019. On the other hand, because the manufacturing costs are higher for Taiwanese companies, and Taiwan cell makers’ advantages in the European market were greatly affected after Europe terminated the minimum import price on mainland Chinese goods, Taiwan’s competitiveness immediately plummeted.

In addition, the most important events for the cell sector in 2018 were PERC capacity expansions and efficiency increases. According to PV InfoLink’s investigations, Aiko, Pingmei, and Tongwei were the manufacturers with the largest PERC cell shipments. It is noteworthy that the General Top Runner Program will bring a large amount of high-efficiency PERC cell demand in H2 2018. Also, due to the earlier production line transfer, Aiko became the biggest supplier for bifacial cells, with a shipment of 1.4 GW, much higher than other cell makers.

Major point for cell in 2019

Bifacial PERC and PERC cell markets have maintained high prices with abundant profits from January to February this year. But prices are likely to drop after February, as new capacities are released further and China’s General Top Runner Program comes to an end. In order to consolidate profits, cell makers must continue to increase their product competitiveness. After selective emitter (SE) also becomes standard equipment for mono PERC cell lines this year, it will be more difficult to increase cell efficiency further. However, many manufacturers still plan to expand PERC capacity, and thus cost reductions caused by equipment improvements and efficiency increases will continue.

Yet aside from cost reduction, the trend of ‘next-generation’ cell technology remains unclear. The mainstream trend this year will be continued lowering of the share of conventional cells. Judging from this year’s capacity plans, we can also see that more and more cell makers will prepare to give up on conventional multi cell manufacturing and upgrade multi cell production lines to mono or multi-PERC, with some likely to completely abandon multi cell capacities. Meanwhile, it’s projected that the shipment of bifacial modules and modules with larger-sized wafers will gradually rise. How cell makers adjust their production lines will be critical to whether they can get hold of the next opportunities.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.