From pv magazine Australia.

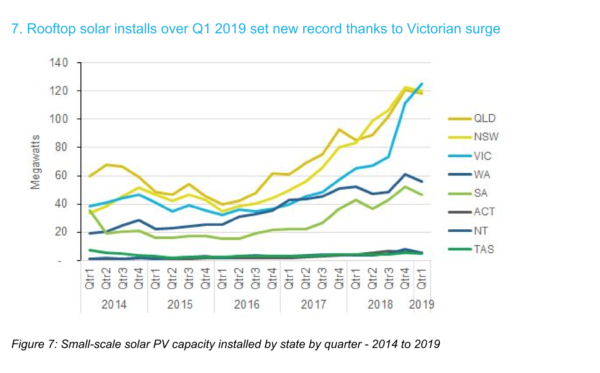

Green Energy Markets today released its Renewable Energy Index April update with data showing more than 480 MW of small-scale rooftop PV capacity was installed in Australia in the first three months of the year. That is an incredible 48% higher than the amount installed in Q1 last year, and 2.5 times greater than the Q1 average achieved over the past four years.

The surge has been largely driven by a blanketing of Victorian roofs in response to the state government’s Solar Homes program, under which 30,000 of an intended 700,000 residential properties have already signed up for rebates.

“The Victorian government rebate has really turbocharged sales in Victoria,” said Green Energy Markets’ Tristan Edis at the Smart Energy Conference (SEC) this month. “It’s also spectacular in that we’re seeing ongoing robust sales in other states as well, with perhaps the exception of Western Australia.”

Edis said consumers continue to install solar in an effort to reduce power bills blown out by high energy prices, which rose sharply in 2016 due to the combined effects of the closure of the Hazelwood Power station and a doubling – in some cases tripling – in the wholesale price of gas.

The Green Energy Markets report shows Australian rooftop solar installations in March alone gave 7,857 people meaningful employment – last month saw enough capacity installed to power 48,965 homes.

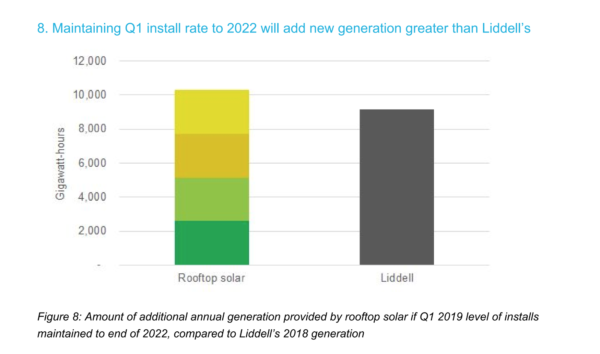

If the current rate of growth in rooftop PV is sustained until the end of 2022, the report says, “it would provide additional generation greater than that due to be lost from the closure of Liddell Power Station”. The 46-year-old coal-fired Liddell plant is scheduled to close in 2022, reducing generation capacity in the grid by 1,680 MW.

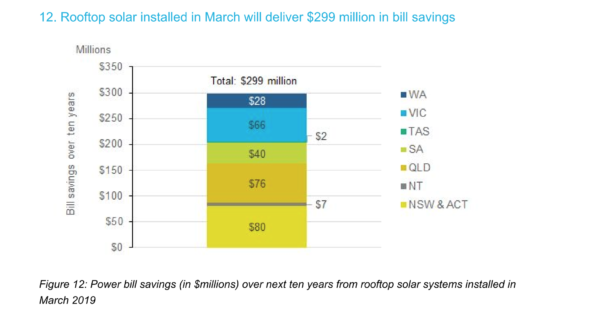

According to Green Energy Markets, new first-quarter rooftop capacity would deliver a reduction in power bills of more than $850 million (US$610 million) over 10 years, based on today’s electricity prices.

Popular content

And therein lies a conundrum, said Edis. In terms of time-of-day generation profile, he said, rooftop solar is currently “knocking a little off the top” of gas generation in the grid.

By 2020-2021 extrapolating the likely amount of rooftop generation, he says, would take out all the capacity currently supplied by gas during the middle of the day and also, “munch out a fair chunk of coal”.

The issue is that as rooftop PV reduces the energy demand profile from 9am to 3pm to a similar profile currently seen between 2am and 5am, wholesale electricity prices will decline, reducing costs for customers. “It’s great news for consumers,” said Edis. “It’s great for greenhouse gas emissions.” But part of the good-news gain – much lower wholesale electricity prices – poses a potential stumbling block for the solar industry.

Reduced power prices – the holy grail of residential and commercial consumers – could put a natural brake on rooftop installations and also change the economics of large scale renewable projects.

Edis said although Victoria’s Solar Homes program has fanned the installation of solar across the residential landscape, another factor boosting rooftop capacity is an increase in the size of systems installed. He said the average capacity of a residential solar installation is now above 6.6 kW. The Clean Energy Australia Report 2019 confirmed the average size of household systems has increased from 1.3 kW in 2009 to 7.13 kW in 2019.

That means, said Edis, because people don’t use all the solar energy they generate – mainly in the middle of the day – “the vast majority of generation is exported” and exporters make money based on the wholesale price of electricity, which generally sets the feed-in tariff. That means the economics of people upsizing systems also depends on the wholesale price of electricity.

Edis emphasised that would be great news. “It’s what we hoped would happen,” he told the renewable industry crowd at the SEC, “but we’re going to see a material reduction in the wholesale price of electricity when the sun is shining and the solar system is generating – and that’s not necessarily great news for ongoing growth in the sector. And it’s not necessarily great news for those who have invested in large solar systems.”

Australia’s energy system is still in transition, with the anticipated uptake of electric vehicles soon to influence supply and demand at a household level and electrification of other sectors of the economy adding load as renewable capacity expands. SEC speakers agreed the need for monitoring and planning the emerging renewables-based energy system has never been greater, to ensure abundant, clean, low-cost energy that fuels demand while substantially reducing the carbon load on the planet.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.