From pv magazine 04/2020

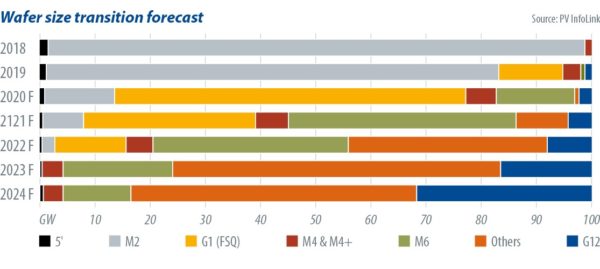

Despite the ongoing pandemic, advancement in technology has not slowed down one bit. Many Chinese manufacturers announced new capacity expansion plans after the traditional Lunar New Year break, while some have moved online to introduce new products and technology roadmaps. The change in wafer size is a common theme, and remains one of the hot issues of the year.

Projects secured under China’s 2019 tender scheme are expected to sustain demand throughout the first half. However, the timing has been delayed to the second to third quarters due to the virus outbreak. As most of these projects were designed to use modules based on M2 (156.75mm) wafers, suppliers of M2-sized mono cells are suffering a lack of demand, thereby accelerating cell manufacturers’ switch to G1 (158.75mm).

In the module sector, only a few manufacturers adopted the M6 (166mm) format in the first quarter. A large volume of M6 cell capacity added since the second half of 2019 has been left underbooked as a result. Some cell makers that produced M6-sized cells therefore reverted to G1 size earlier this year. That increased the share of the G1 format to more than 60%, making it the mainstream format of the year.

Quite a few module makers plan to start producing M6-cell modules in the second and third quarters, as the enlarged wafer helps improve the module power output and brings down the cost per watt. It’s expected that the market share of the M6 format will start to grow in the second half, and level with G1 as two mainstream products in the market by the end of the year.

500 W modules

Zhonghuan Solar and Trina Solar are promoting the G12 (210mm) format. Risen announced that it will start producing some G12-cell modules in the second half of the year. With manufacturers introducing G12-cell modules in online conferences held after the Lunar New Year and the ability of this product to bring module power output to 500 W, there is a growing interest in G12 in global markets.

pv magazine webinar

As many ingot pulling furnaces have been installed since last year, wafer manufacturers can produce larger wafers without having to deal with problems such as insufficient capacity, yield rates, and breakage rates. However, cell and module manufacturers need to take several issues into consideration, from breakage rates and module weight limits to the possibility of upgrading older production lines, as well as price/performance and end market acceptance. These issues create uncertainty around larger wafers and the progress and direction of development.

The shift to larger wafers is expected to take place during the second half of this year and will continue into 2021. It is not likely to be achieved all at once, like the earlier shifts from slurry to diamond wire saws or from M0 to M1 to M2. There might be two or three mainstream formats on the market by the end of 2022.

Equipment selection is another challenge facing manufacturers, and now with the Covid-19 pandemic disturbing the industry, this year’s capacity expansion becomes even more unclear. On the cell side, if cell manufacturers adopt 210mm for new lines, reverting to smaller sizes will incur extra expenses and may affect production efficiency. So, many manufacturers with plans to expand capacity haven’t named a format. Moreover, it’s uncertain which equipment these manufacturers will use, as their schedule for bringing new capacity online has been delayed by the pandemic.

Popular content

On the module side, many manufacturers are opting for equipment that is compatible with dimensions up to 210mm, given that wafer sizes are changing rapidly and 166mm and 180mm+ formats might be used during the two-year transition period.

Overall, vertically integrated companies have turned to compete on wafer size. During the 2020-21 period, the top five module manufacturers will form alliances and develop wafer sizes of their own. These developments will determine the mainstream wafer size in the future.

Ripple effects

Most Chinese manufacturers shut production down or lowered utilization rates in early February in response to the coronavirus outbreak, wrecking the solar supply chain. As operations started returning to normal from the end of February onward, capacity utilization across the supply chain rose to 80% in March, stabilizing the supply of modules gradually. However, the continued spread of coronavirus threatens an economic crisis, and the impacts will ripple through the manufacturing sector and out to global demand in March through April.

On March 10, China’s National Energy Administration (NEA) released “Notice on the Measures related to Wind and Solar Power Generation in 2020,” which outlines a clear regulatory framework for PV development this year. It states that the solar subsidy for this year totals RMB1.5 billion ($211.4 million) and the submission deadlines for projects under the auction regime have been postponed until the middle of June. This suggests that end-market demand in China will turn pessimistic.

At the time of writing, the Chinese government had yet to decide whether grid-connection deadlines should be extended beyond March 31, June 30, and December 31. However, it has been said that the March 31 and June 30 deadlines might be extended for another quarter. Against this backdrop, anticipated demand won’t pick up the slack until Q2-Q3 in China, and any jump in demand will depend on China’s decision on the December 31 deadline extension. For now, Chinese demand is predicted to fall slightly lower than 40 GW this year.

As the coronavirus crisis worsens in Europe and the United States, knock-on effects on overseas demand will begin to emerge, but to what extent demand will be affected depends on when the outbreak can be contained.

Please note, there is an error in the bar chart used above. “G2 (FSQ)”, on the bottom axis of the graphic, should read “G1”.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The bar chart includes G2 but the article does not mention how big G2 wafers are. Please clarify.

Hi Eddy,

You’ve got us bang to rights here. The “G2” you mention on the bar chart should actually read “G1” and the person responsible for the error is being tarred and feathered as we speak. Unfortunately, amending a graphic is something that’s way above my pay grade so I will have to settle for adding a note at the foot of the copy but thanks for keeping us on our toes.

Hello Max, Is there a difference between the M12 and the G12?