From pv magazine 07/2020

For many tracker suppliers active in the U.S. market, the stepdown in the investment tax credit (ITC) and the willingness of developers to safe harbor for projects yet to be built has meant that 2020 started very strongly.

New markets

The supplier landscape continued to be extremely competitive as leading suppliers expanded into new markets globally, with solar tracker technology becoming increasingly accepted by developers, EPCs and the financial community. Leading suppliers such as Nextracker and Array Technologies accounted for almost half of global shipments in 2019. Both of them enjoyed a strong year due to booming utility-scale solar PV markets, and as developers in the United States safe harbored trackers in order to safeguard a higher ITC rate.

Solar trackers are uniquely positioned to assist with safe harbor as they do not degrade compared to solar modules. Additionally, prices are less likely to decrease relative to other balance-of-systems components and by their nature, the components are relatively robust for storage while waiting to be installed. Other suppliers such as GameChange Solar, Soltec, Nclave, Convert Italia and PVH were all active in the United States and some suppliers received significant orders to safe harbor in 2019.

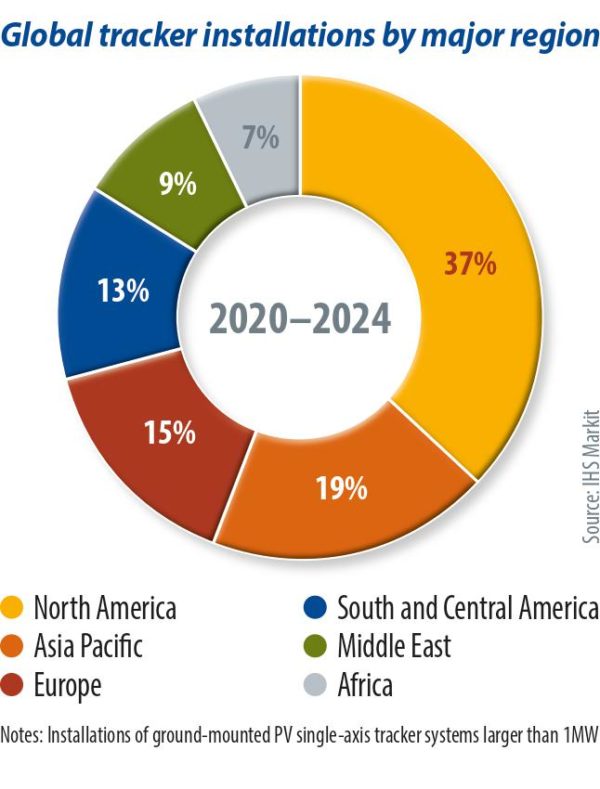

The top 10 supplier rankings continued to be dominated by suppliers from United States, Spain, Italy, Germany and China as a result of strong domestic demand and willingness to expand abroad. Demand for trackers in mature markets such as the United States, Spain and Australia continued to be strong. But in recent years, demand has also grown in emerging markets such as Brazil, Mexico, Chile, Argentina, South Africa, Saudi Arabia and United Arab Emirates.

However, IHS Markit expects volatile demand for solar trackers in these emerging markets in the next one to two years due to the impact of Covid-19 globally. PV projects in the pipeline in some of these markets that are not at an advanced stage are expected to be delayed over the next year or two. Overall though, these markets will remain attractive due to the higher irradiation and the fact that most have big targets for large utility-scale PV projects.

Next phase

Latin America has been one of the key emerging markets for solar trackers in recent years, but the Middle East and Africa (MEA) region is expected to be increasingly attractive in the next five years. Egypt and South Africa have already embraced solar tracker technology along with markets such as Saudi Arabia and the UAE. Nascent markets such as Oman are expected to begin installing trackers, while markets such as Jordan – which already has a substantial installed base of tracker projects – are expected to keep utilizing the technology.

A plethora of African countries with large utility-scale projects are providing a testbed to showcase the added benefits of trackers to a solar project. IHS Markit predicts that there will be a mix of suppliers active in these markets. Some suppliers, such as Pia Solar, have been very active in South Africa and are well placed to expand into other African markets as they open up. Other suppliers – such as Arctech, Soltec, Convert Italia, Nextracker, PVH and Ideematec, who have all installed trackers in specific markets across the MEA region – can leverage these real-world examples to showcase to partners the benefits of their offerings.

Despite Asia being the largest region for solar installations over the next five years, it will be a challenging market for tracker suppliers. Overall, many of the largest markets – such as India, China and Japan – still prefer fixed-tilt structures due to climatic conditions, site limitations, the availability of cheap labor, and sensitivity to higher upfront capital expenditure. Australia continues to be the most attractive market, as customers are already very comfortable with the technology and its added benefits.

Cost competitiveness

Single-axis tracker suppliers are riding the waves of rapid innovation underway in the solar module market. Next-generation solar PV modules are increasingly being released that are much larger both in size and in wattage terms, and are expected to have higher efficiencies as well. Module suppliers are also ramping up production of bifacial solar modules so that they can facilitate an additional energy gain of up to 20%, subject to ground conditions that govern the albedo effect.

Given that solar PV trackers benefit massively from PV module innovation, suppliers continue to invest in research and development on their own in order to more effectively take advantage of the benefits of new module innovation. Tracker suppliers often quickly redesign torque tubes and clamps, while also conducting in-depth wind tests and structural assessments of all new tracker redesigns when new solar PV modules are released on the market.

Overall, solar tracker prices are expected to continue to decline on a dollar cost per watt basis as energy production per module continues to increase. The major benefits for developers and EPCs here will be the improved energy yield of using higher-powered bifacial solar PV modules along with solar trackers, which is expected to greatly improve the levelized cost of electricity for utility-scale solar projects and make the tech more cost competitive with other forms of energy generation.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“Solar trackers are uniquely positioned to assist with safe harbor as they do not degrade compared to solar modules.”

This is incomprehensible as written. Solar modules are encapsulated solid-state devices with no moving parts, and known to last 30 years. Trackers are mechanical devices with moving parts, exposed to the elements (rain, dust, sand, snow, frost). You would expect them to break down in service far more often without regular preventive maintenance. If it’s all about buying early to get the tax break, both types of equipment can sit quietly in a box doing nothing.

Hi James,

Thanks for your comment, Cormac has responded with the following explanation:

IHS Markit is referring to the storage of components for 1-2 years in warehouses or on-site for safe harbor purposes, in order to take advantage of a higher ITC, rather than referring to the long term O&M requirements of solar trackers or modules.

It is known that modules have an assumed yearly degradation over their operational lifetime. However, if they are stored correctly and according to manufacturers’ advice, degradation may not be an issue.

As a result, IHS Markit noted, some developers chose to procure large quantities of solar trackers in 2019 and in Q1 2020 rather than purchase PV modules.