Alongside ground-mounted and rooftop PV, floating solar PV (FPV) is often hailed as the future third pillar of the global solar PV market. At present, among the 60+ countries actively pursuing the deployment of FPV (see Map 1 below), more than 35 countries are home to an estimated 350 operational FPV systems, which up until the end of August 2020 had a cumulative capacity of approximately 2.6 GW. Although still considered a niche, FPV is projected to experience an average growth rate of above 20% in the coming five years.

In this context, Asia is expected to account for roughly two thirds of the global demand, mostly driven by China, India, South Korea, Taiwan, Thailand and Vietnam.

China: To date, China is the world’s largest market for FPV. Currently, FPV systems are either deployed as a result of a bidding scheme, thus eligible for a FIT granted over 20 years or as a so-called grid-parity project, i.e., without any form of subsidy support. To illustrate the on-going demand for FPV, in June this year, China’s Datang Power released a tender seeking several bids for a total capacity of 820 MW of FPV to be installed across China by December 2021.

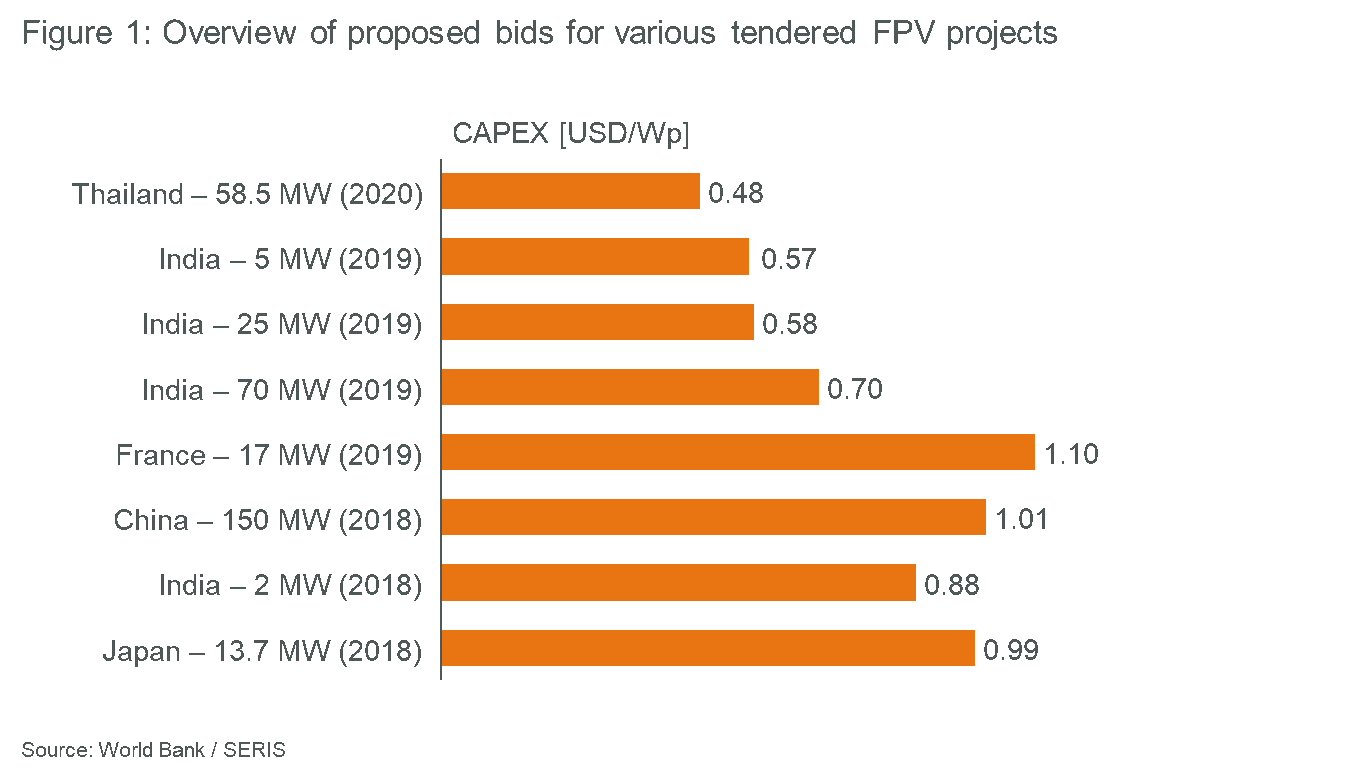

India: India’s domestic solar PV market, considered to be one of the most competitive in the world, witnessed a 45% drop in bid prices for FPV tenders from 2016–2018. For example, the lowest bid quoted by developers for a 70 MW FPV system earlier this year was as low as INR 35/W (EUR cents 4/W). The are several reasons for such a fairly low bid, e.g., improvement of manufacturing processes, reduction of material costs, reduction in thickness of floaters and aggressive bidding by developers in order to gain FPV related experience. The latter might be the main reason, given that between 2018 and the end of 2019, the government of India released a series of tenders for FPV systems amounting to approximately 2 GW. Presently, around 1.7 GW are in various stages of development.

South Korea: Located on South Korea’s southwest coast, the tidal flats of Saemangeum have been identified as the site for the world’s largest FPV installation of 2.1 GW by 2025, requiring an investment of approximately US$4 billion. South Korea’s third largest conglomerate, SK Group, has been selected as a preferred bidder to build 200 MW as part of Phase 1 with 1.2 GW, scheduled to begin in the latter half of 2020. These nearshore/maritime and coastal or offshore floating PV undertakings are in addition to South Korea’s estimated onshore FPV market potential of around 9.7 GW, which depending on the body of water (reservoirs, freshwater lakes, dams, irrigation & drain channels), would see between 2–20% of the water surface covered by FPV.

Taiwan: The Taiwanese government has offered FITs specifically for FPV systems since 2017. Accordingly, FPV systems coming online in the second half of 2020 are eligible to receive a FIT of NTD 4.2709–4.7067/kWh (EUR cents 12–14/kWh) for 20 years. Local developer Chenya Energy, owned by Marubeni, is constructing what will be the world’s largest FPV with a capacity of 180 MW scheduled to be grid-connected by the end of 2020 (and as mentioned above, the title of the “world’s largest FPV” will then go to the planned South Korean installation of 2.1 GW in 2025).

Thailand: A national FPV target is favoured for example, by the Electricity Generation Authority of Thailand (EGAT), which announced in March 2019 that it aims to build a total of 16 FPV systems on dams with a combined capacity of 2.7 GW by 2037. Individual capacities of the envisaged FPV systems range from 24 MW up to 325 MW. In June 2019, EGAT released a tender for a 58.5 MW FPV project, which will be financed by its own fund to the tune of around EUR 51M. According to the World Bank, the CAPEX of this 58.5 MW FPV project amounts to USD 0.48/Wp (EUR cents 0.41/Wp). In November 2019, the Bangkok-based BCPG company commissioned a 200 kW FPV on a private Power Purchasing Agreement (PPA) basis signed with the local Bangchak Biofuel Company.

Vietnam: In order to de-risk investments in FPV, the Asian Development Bank in cooperation with the Canadian Climate Fund, provided a $37 million concessional loan in autumn last year for a 47.5 MW FPV to be built in southern Vietnam. The project is planned to be built on a man-made reservoir co-located with an existing 175 MW hydro-power plant. In April, the government of Vietnam announced its plan to hold two auctions, one aiming at a 50–100 MW capacity planned for 2020 and the second for a 300 MW FPV project in 2021. On May 22, the government announced a FIT for FPVs. Accordingly, a tariff of VND 1,783/kWh, equivalent to EUR cents 0,65/kWh will be applied from the commercial operation date onwards for 20 years.

Early beginnings and motivations

Floating PV systems are not new, given that the first system (for R&D) was already installed in Aichi, Japan in 2007. The following year, the first FPV-related patent was officially registered and the world’s first commercial installation, a 175 kWp system built at the Far Niente Winery in Napa Valley, California, became operational. The owner’s primary motivation to deploy a FPV system was to avoid occupying land and to reduce water evaporation.

Geographical considerations are naturally a key driver for FPV. Countries subject to high population density, low percentage of flat terrain, competing use for available land, etc., but at the same time, home to a significant number of available water bodies, both often in proximity to load centers and existing grid infrastructures, were among the first to consider FPV systems as a way to further scale-up solar power generation capacities. Land scarcity is an ever pressing issue, as illustrated by South Korea, where 70% of the land is mountainous. During the early years, commissioned FPV systems were of a smaller scale and primarily designed for research and development purposes. Today, located in the Province of Anhui, China, the world’s largest installed FPV system currently has a capacity of 150 MW and has been in operation since November 2017.

Advantages and benefits of floating solar PV

Floating solar PV systems have certain advantages and benefits when compared with traditional ground-mounted solar PV systems. Below in Table 1 is a non-exhaustive list:

| Advantage / Benefit | Evidence / Verification |

| Higher land use efficiency | Yes, approx. 1.33 MW / hectare vs. approx. 1.6 MW / hectare on land (note: site-specific) |

| Increased energy yield | Yes, due to the cooling effect of water & wind, in a low(er) single-digit range (note: site-specific) |

| Higher yield with bifacial modules | No, due to the low albedo of water, but glass-glass modules will offer a longer durability |

| Lower module degradation

| Initial data suggests that the lower operating temperature leads to a slower degradation, however more research is considered necessary |

| Reduced water evaporation | Potentially yes, but it depends on technology, water body coverage and characteristics, applied calculation methodology, etc. |

| Improved water quality | In theory yes, but it requires more long-term environmental impact studies |

| Reduced algae growth | Yes, in theory, but needs more long-term environmental impact monitoring |

| Less prone to dust pollution | Yes, but possibly more prone to other forms of soiling, such as bird droppings |

| Hydro-FPV-Hybrid has a lower CAPEX | Yes, due to the existing grid infrastructure, but subject to specific site characteristics |

| Ease of installation | Yes, e.g., 30 MW can be installed in only 8 weeks, due to high degree of modularity, no land levelling/elimination of surroundings causing shading needed, etc. (note: site-specific) |

| Simple(r) decommissioning | Yes, in theory, but lacks sufficient verified data |

To date, the global track record of operational FPV is limited. Therefore, a number of the above stated performance advantages have yet to be confirmed by larger installations, ideally over longer time periods and across varies geographies. However, first monitoring findings indicate that in many cases such benefits may outweigh the increased capital cost.

What are the costs of FPV systems?

Overall, costs incurred for developing a FPV system, not only vary from project to project, but are as well highly site-specific. Factors influencing the cost structure include water level variation, depth, quality and salinity. The bathymetry of the water body determines the design layout of the anchoring and mooring system. Depending on the locally prevailing wind regime, the FPV plant design requires the ability to withstand stronger wind loads.

As well the overall logistics, other factors to consider include distance to the shore, site accessibility, local infrastructure, and vicinity to the grid. Moreover, water-based electrical infrastructure not only causes higher O&M costs, but also for example, installed cabling may require a higher moisture resistance. Furthermore, due to the lack of empirical data, projects tend to require a more comprehensive technical due diligence.

Usually water bodies are subject to increased scrutiny measures imposed by relevant governmental authorities, hence developers might be required to regularly conduct comprehensive environmental impact assessments (EIA), which might be an additional cost driver. In general, the CAPEX of FPV systems are currently around 5–15% higher compared to a ground-mounted PV system, but in some European countries, a 20+ MW system is already considered competitive. Below in Figure 1 is an overview of proposed bids for various tendered FPV projects.

State of FPV related knowledge and overall risk perception

Despite the fact that FPV systems have been deployed for more than a decade, and while the vast majority of today’s 2.6 GW was only built during the last five to six years, the current state of knowledge regarding FPV systems varies considerably. Certain areas, such as PV modules, cabling, materials & components are well understood. In contrast, knowledge is still lacking in areas such as O&M procedures, long-term environmental impact, as well regulations and permitting. Other areas, however, are better understood, such as floats, mooring and anchoring, electrical layout, long-term energy yield forecasting and safety issues, thanks to extensive experience gained particularly in the maritime sector (see Figure 2 for an overview of some of the current players active in the FPV sector).

Against this background, it is not surprising that FPV systems are perceived as relatively high risk. However, work is currently being done, for example, by the International Electrotechnical Commission via its Technical Committee 82 for Solar PV Systems to define a relevant standard. Also, several national research entities and industry initiatives are actively engaged in formulating recommended best practice and guidelines regarding floats, sites, permitting, energy yield estimations, anchoring and mooring, and technical requirements, among others, for both onshore and nearshore/maritime offshore FPV.

Additionally, in recent months several multi-year long research projects have been launched, involving numerous companies representing almost a dozen countries. Below in Table 2 is an overview regarding FPV systems related research & development currently being undertaken.

| Subject | Research activities |

| Durability of materials | Fatigue, wear and tear, corrosion, bio-fouling, ensuring environmental friendliness |

| System durability | Determine reliability / degradation rates in a harsher environment |

| Performance / energy yield | Comparison with land-based PV systems, assessing the cooling effect, lower operating temperatures may slow down module degradation process, minimize mismatch loss, etc. |

| Optimize floats/modules | CFD based designs, anti-bird-dropping coatings, east-west orientation vs. south-facing, etc. |

| Water bathymetry | Optimized solutions for anchoring / mooring technologies for both land-based and nearshore / maritime water bodies |

| Anchoring & mooring | Solutions securing the mooring system, anchors that keep the FPV in position |

| Water quality impact | Reduced growth of both algae, giardia and cryptosporidium bacteria |

| Biodiversity interaction | Impact of aquatic flora & fauna, understanding heat transfer between panels and water surface |

| Hydro-FPV hybrid-system | Developing a methodology to assess the technical potential / operational benefits |

| Off-shore FPV | Understanding the hydrodynamic interaction btw. elastic bodies and flexibility of systems |

Current and emerging business models

The early batch of commercial FPV systems were installed onshore, as stand-alone on ponds, in reservoirs and pit mine lakes, etc. The initial business model, FPV 1.0, was to generate power, usually fed into the nearby grid.

Today, FPV 2.0, involving the co-location of a FPV system with an existing hydropower plant is gaining traction, in particular, if combined with larger hydropower sites that can be flexibly operated. The benefits of such hybrid systems are manifold, e.g., the FPV system increases the overall energy yield of the asset, it may facilitate the management of seasonal periods of low(er) water availability, thus compensating a reduced power output of the hydropower plant. Additionally, the reduced amount of evaporated water could be used for irrigation purposes, instead of being lost. Moreover, a FPV system can support daytime peak loads, allowing more hydropower to be reserved for an increased load during evening times. The most significant benefit, however, is that such a FPV system would utilize the existing electricity transmission infrastructure of the hydropower plant, consequently lowering the overall CAPEX of the FPV system.

Currently, the World Bank is actively involved in exploring potential sites and conducting mapping and technical feasibility activities in countries like Myanmar, Pakistan, Turkey, Ukraine, Mali and the Ivory Coast for such hydropower-FPV hybrid power plants. In addition, the Global Solar Atlas has identified 1889 such potential global sites in February this year.

A report, jointly published by the World Bank Group, the Energy Sector Management Assistance Programme and the Solar Energy Research Institute of Singapore in autumn 2018, states that the most conservative estimate of the global FPV potential based on available man-made water surfaces exceeds 400 GWp, which corresponds roughly to 65% of the global cumulative installed solar PV capacity in 2019.

Recently, developers started exploring new potential business models, let us call it “FPV 3.0”. Here, the power generated by a floating PV system is to be consumed onsite, in order to support the so-called “blue economy”. This is divided into “power at sea”, i.e. offshore marine aquaculture, sea water mining, ocean observation, underwater vehicle charging or seaweed farm operations and “coastal communities”, where FPV generated power would be used for e.g., for water desalination or resiliency and disaster recoveries. In Thailand, various developers are evaluating project proposals to combine nearshore/coastal maritime fish/shrimp farms with FPV systems. Traditionally, such offshore “blue economy” operations are mainly powered by diesel generators. The potential of replacing such diesel gensets with FPV systems is estimated to be in the multiple GW range annually.

In the context of food supply, one consequence of the continued global urbanization is the shrinking area per capita available for agricultural purposes. In order to compensate a potential future food supply constraint, nearshore/coastal maritime agri-farming powered by floating PV systems could be another business model we will see emerging in a few years.

Today, more than 40% of the global population lives within 100 km of the coast. In light of an increasingly connected and digitalized world, cloud servers near where people live facilitate the short travel distance of data, hence, submerged data centres, already a reality off the coast of Scotland since June 2018, powered by FPV systems could be the norm in future. As an example, Singapore, a country facing land constraints, but whose data centres consume roughly 12% of the nation’s electrical power today, will need to add more data centres to meet future demand, is thus actively looking into FPV powered data centres. The global data centre market has been estimated to grow to a value of $58 billion by 2025.

Outlook

Today, a number of companies are pushing the boundaries of FPV, i.e., to operate offshore FPV systems in areas with water depths of less than 100 m. One favoured concept is to combine existing and future offshore wind parks with FPV. The basic idea is to cover the open space between the individual offshore wind turbines with FPV, thus increasing the land use efficiency and contributing to the overall energy output, while using the same grid infrastructure. The Italian company Saipem through its Norwegian subsidiary Moss Maritime in collaboration with Equinor is currently designing a potential project, however, it may take another two to three years until proof of concept has been established.

In the meantime, FPV 2.0 as discussed above is anticipated to experience the strongest growth in the near to midterm. A larger share of the global project pipeline does favour the co-location of a FPV system with an existing hydropower plant, due to the obvious advantages.

Once international best practice, guidelines and even standards will be available, certification, inspection, acceptance procedures established and warranties and performance guarantees offered, and the environmental sustainability of FPV systems ensured among other issues, floating PV has the potential to become the third pillar of the global solar PV market.

By Frank Haugwitz, senior advisor at Apricum – The Cleantech Advisory

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

24 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.