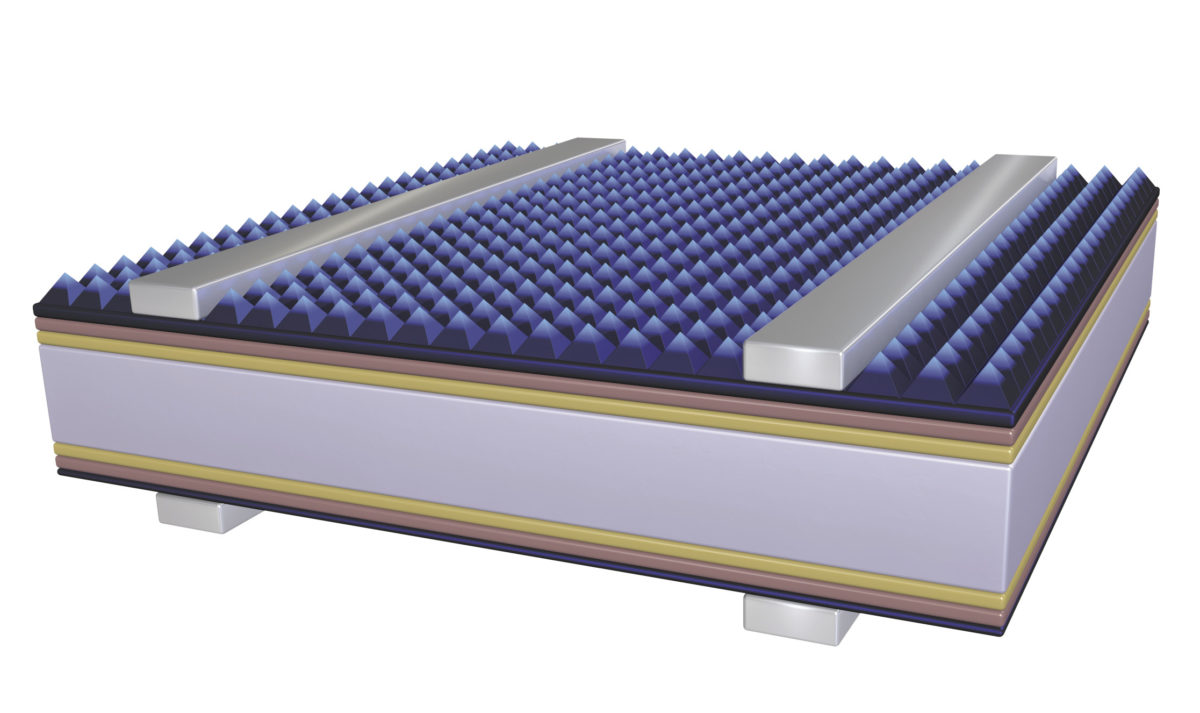

With continued performance improvements coming from PERC technology, heterojunction; the so called ‘next generation’ of silicon PV – which requires investment in a whole new set of processes and equipment, has been slower to get off the ground than many expected.

Analysts at PV InfoLink expect the market share of n-type technologies to grow at a steady rate over the next three years. However, they initially expect TOPCon rather than HJT to represent the largest share of this, with TOPCon capacity forecast to reach 4.9 GW by the end of this year, compared with 3.2 GW for HJT.

PV InfoLink also notes, however, that there are some opportunities for HJT, with manufacturers of both modules and factory equipment ramping up capacities that could potentially see the entry costs for HJT fall to more acceptable levels, as well as increases in performance that come with experience working with the technology at scale.

This viewpoint was evidenced by the Chinese solar module manufacturer Jinneng Clean Energy Technology Ltd (Jinergy). In a press statement released by the company, the company's general manager, Liyou Yang, noted some of the state-owned manufacturer’s achievements, including the completion of a 100 MW project using HJT modules in China earlier this year.

The Chinese state-owned manufacturer was among the first in China to offer HJT modules commercially, introducing a module back in 2017. Yang said the company currently achieves an average cell efficiency of 23.95% in production, and expects to boost this to 24.2% by the end of the year. Modules using this cell, in a half-cut M6 format, achieve 510 W power rating and 93% bifaciality.

Popular content

Jinergy appears convinced that HJT will be the next mainstream PV technology. “HJT cell has become one of the main competitors of the next-generation mainstream technologies due to its advantages of high photoelectric conversion efficiency, excellent performance, less technological processes and large room for cost reduction.” Stated a company representative earlier this year. “As a leading enterprise in promoting mass production of HJT technology, Jinergy has been increasing investment and efforts in R&D.”

The company currently operates 2 GW of production capacity in China, for multi and monocrystalline PERC products as well as HJT.

In yesterday’s presentation, Yang also noted that the company’s research is also looking beyond HJT alone, at possibilities of combining it in a tandem cell format or in back contact format to further boost performance. “Jinergy will continue to invest in R&D for cutting-edge technologies and contribute to the global renewable energy market with most advanced and reliable products,” he said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.