From pv magazine 08/2021

Tier-1 energy storage system integrators all participated in the SNEC PV Power Expo 2021, including Sungrow and Hyper Strong, China’s two largest integrators, according to 2020 statistics from the China Energy Storage Alliance (CNESA). Well-known players – including Huawei, Goodwe, Shanghai Electric, CLOU Electronics, and Cubenergy Technology – were also visible at the exhibition. These manufacturers mostly utilize China-made lithium-iron-phosphate (LFP) batteries. Huawei uses LFP from BYD and Eve Energy. GoodWe, Cubenergy and Sinexcel use LFP from Eve Energy. Hyper Strong uses LFP from CATL, while CLOU Electronics uses batteries from Higee Energy.

The standardization of battery cells is now underway. At present, the most common cell capacities are 90 Ah and 280 Ah, while 90Ah batteries are primarily applied to stationary energy storage systems in the tens to hundreds of kilowatt-hours range. Stationary storage systems at the megawatt-hours scale use 280 Ah batteries.

At present, front-of-the-meter batteries are leading China’s energy storage deployments, with C&I storage accounting for a small share. Therefore, companies focus on utility-scale stationary storage, with capacity ranging from hundreds of kilowatt-hours to 6 MWh and beyond for a single unit.

Primary focus

A massive surge in the market and favorable EV battery prices make EV battery manufacturing the Chinese industry’s primary focus. Rising demand for energy storage has led to short supplies of lithium-ion batteries, with delivery extending to more than six months. This may provide opportunities for more manufacturers to develop their storage business. Samsung SDI, for instance, has significantly lower cell capacity than CATL and LG, but it controls the largest share of the stationary energy storage market. In addition to CATL and BYD, this year’s SNEC saw applications of cells from Eve Energy in products across companies.

Competition in the EV battery market is intense. Stationary storage may provide some room for more manufacturers to get a slice of the pie.

Storage products

Sungrow’s latest “1+X” modular inverter, unveiled at SNEC 2021, is a breakthrough that can fulfill demand beyond traditional centralized solar applications and cover all scenarios. The device features 1,500 V LFP batteries, in a minimum unit of 1.1 MW, ranging up to 8.8 MW when connected in parallel. Its reverse-charging feature also enables the system to provide ancillary services, optimizing application scenarios and economic benefits of solar+storage projects.

Hyper Strong, one of China’s leading energy storage integration and service suppliers, provides liquid cooling solutions to replace the conventional air cooling. The HyperL1 solution claims several technical innovations, including 80% higher power density than air cooling, 20% higher lifecycles (up to 15 years), 20% less power consumption, high-efficiency thermal management, and an IP67 protection rating. The company also provides high-pressure air cooling with 45% higher power density and up to 5.5 MWh of system energy density.

CLOU Electronics launched E30, its fifth-generation integrated liquid- cooled ESS. This is a brand-new solution for applications spanning generation, grid ancillary services, regulation, and peak shaving. The device comes in a 2.5 MW/2.5 MWh capacity, and supports voltages ranging from 1,000 V to 1,500 V. The company’s patented thermal solution can run at high power efficiency throughout a 24-hour cycle.

GoodWe, one of the world’s largest ESS inverter suppliers, unveiled the high-voltage Lynx Home S and low-voltage Lynx Home U battery series, which can couple with its power conversion systems to achieve solar+storage self-generation and self-consumption. The Lynx Home S series features a 1C charge rate, meaning that it has high efficiency that can be fully charged within an hour. Both models of the Lynx Home series use LFP batteries from Eve Energy. Moreover, the systems incorporate module auto recognition for more flexible installation.

Battery trends

The rising standardization of cells at 90 Ah and 280 Ah, along with modular lithium battery system technology, indicates that the energy storage industry is gradually reaching maturity. These solutions offer flexible applications and product selection. Regarding safety and power density, LFP has been widely adopted by Chinese manufacturers, given their faith in domestic-made cells and concerns over safety issues that rose from a series of ESS fires in South Korea that occurred in 2018 and 2019. As energy storage systems could be tens to hundreds of times bigger than EVs in scale, they require much stricter thermal management and sophisticated cooling. This provides an opportunity for liquid-cooled systems, which offer higher efficiency and take up less space compared with air cooling. In light of this, liquid cooling is expected to become mainstream in the future.

On the product strategy side, there are mature products available for both front-of-the-meter and behind-the-meter battery storage. Sungrow, outside of the Chinese market, is actively expanding into utility-scale energy storage in the United States and India. GoodWe, on the other hand, is focused on the residential energy storage sectors in Europe and Australia.

Potential growth

Although China’s ESS market lags behind Europe and the United States in terms of maturity, pace, and market share, the government’s supportive polices are spurring development.

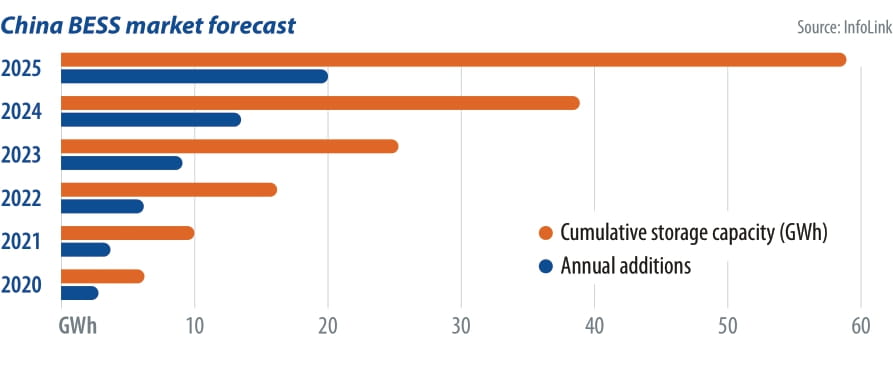

InfoLink forecasts that, under an optimistic scenario, China’s cumulative installed electrochemical energy storage capacity will reach 60 GWh by 2025, reaching the global market share taken by the United States, and likely to surpass the U.S. market by 2030. China, having dominated the battery and PV manufacturing sectors, will see the birth of more large businesses related to ESS, as the industry grows alongside.

About the author

Fang-Wei Yuan has more than six years of experience in R&D in lithium-ion batteries and related materials. As a senior analyst at InfoLink, Yuan provides expertise in battery storage development, material and product trends, pricing, and market forecasting. He holds a doctorate in chemical engineering from National Tsing Hua University in Taiwan.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.